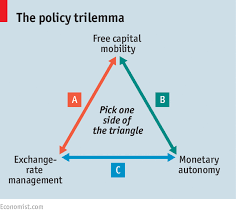

Policy Trilemma and Interest Rate Behaviour in Nigeria

Policy makers face trade-off in dealing with exchange rate management, monetary independence and concerns about capital mobility simultaneously. This

study empirically examines the effects of Nigeria’s trilemma policy path on

interest rate using data spanning from 1997:Q1 to 2017:Q3. It equally incorporates the role of external reserves in buffering these effects.

![[Archive] From Recession to Growth: The Story Of Nigeria’s Recovery from the 2016 Economic Recession](https://giftedanalysts.com/wp-content/uploads/2020/08/pexels-mcbarth™-obeya-3172830-scaled-e1627122592571.jpg)