[Archive] From Recession to Growth: The Story Of Nigeria’s Recovery from the 2016 Economic Recession

Being a Paper presented by Godwin I. Emefiele, Governor, Central Bank of Nigeria at the Special Convocation of the University of Nigeria, Nsukka, on Friday, May 17, 2019 at the Princess Alexandra Auditorium, University of Nigeria, Nsukka, Enugu State

It is an honour and a privilege to be given the opportunity to deliver this special convocation lecture at a renowned institution that has indeed played a formidable role in my personal development, as well as in the advancement of my career. In this regard, I will like to thank the Chancellor, His Royal Majesty the Ooni of Ife, Oba Enintan Ogunwusi II, the Vice Chancellor, Prof. Benjamin Ozumba, along with the faculty and staff of the University of Nigeria Nsukka, for the honor granted to me today. Looking back at the period I spent at the University of Nigeria Nsukka, both as a student and as a lecturer, the University was known for its commitment to driving research and development, as well as in imparting to its students, knowledge that can be applied for the betterment of society. Over thirty years later, I am aware that this commitment to fostering knowledge that can be used for the benefit of society has not waned, even in the midst of difficult challenges. As policy makers work to harness the huge potentials of the Nigerian economy, Universities like the University of Nigeria Nsukka will play a critical role in not only supporting research and development of ideas that will support the growth of our country, but in also ensuring that the skill sets obtained by its graduating students, can be utilized to meet the growing needs of the Nigerian economy.

In my paper today, I will like to share my thoughts on some of the factors that led to the economic recession between 2016 – 2017; the policy measures implemented by both the monetary and fiscal authorities, and some of the measures we ought to consider in our efforts to build an economy that will support improved wealth and job creation for a majority of Nigerians.

On assumption of office as Governor of the Central Bank of Nigeria in June 2014, one of my cardinal objectives was to create a people focused Central Bank. A Central Bank that will promote macro-economic objectives such as low inflation and a stable exchange rate, along with a focus on promoting inclusive growth and reducing unemployment in the country. I believed that these objectives were necessary in Nigeria given the constraints faced by rural dwellers, as well as small and medium scale businesses in the country. The economic recession between 2016 – 2017 provided additional impetus on the need to promote a pro-growth strategy, that will reduce our reliance on earnings from the sale of crude oil, as well as our dependence on the importation of items that can be produced in Nigeria.

Factors that Triggered the Economic Recession

Between 2014 – 2017, the global economy witnessed several adverse shocks, three of which were simultaneous and significant in shaping the trajectory of the Nigerian Economy, namely:

I. Widespread and rising geopolitical tensions along critical trading routes in the world – Beginning in March 2014 with the United States’-led sanctions on Russia for its annexation of Cremia and alleged role in precipitating the crisis/conflict in Ukraine. Other areas include Britain’s desire to pull out from the European Union, and rising trade tensions between the United States and China, with its attendant implications on global trade and capital flows.

II. Crude Oil Prices – The 60 percent drop in oil prices between 2014 – 2016 exposed the structural vulnerabilities of oil dependent economies like ours. In July 2014, global crude oil prices began a sharp descent. The price of Bonny light, Nigeria’s crude, plunged from about US$115 per barrel in June 2014 to as low as US$31 per barrel by January 2016; and

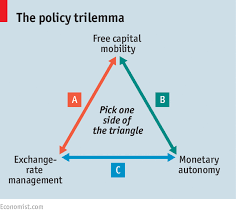

III. Normalization of Monetary Policy by the United States’ Federal Reserve System – This measure led to an acute capital flow reversals especially in emerging markets and increased financial fragilities in these countries. In October 2014 the US Federal Reserve commenced the tapering of its quantitative easing in preparation for a more conventional monetary tightening cycle. In an effort to contain rising inflation, the Fed fund rate was raised steadily to 2.25 percent in December 2018.

Domestic Economy

Whereas these three factors had adverse consequences on the Nigerian economy, the most important factor was the drop-in commodity prices. The country’s overdependence on crude oil for over 60 percent of government revenue and for 90 percent of its foreign exchange inflows, meant that shocks in the oil market were transmitted entirely to the economy via the FX markets as manufacturers and traders who required forex to purchase their inputs as well as goods, were faced with a depleting supply of foreign exchange in the country.

For example, average monthly inflows of foreign exchange into the CBN fell from over US$3.4 billion in June 2014 to as low as US$500 million in October 2016. The decline in foreign exchange earnings was further complicated by the foreign capital flow reversals from emerging markets due to the interest rate hike in the USA. The impact of this decline on our economy was evident in the rise in the value of the US Dollar relative to the Naira; and a rise in the Consumer Price Index due to the increase in the cost of imported inputs, food items, petroleum price, transportation costs, as well as goods and services.

With the drop in foreign exchange inflows, the exchange rate at the parallel market rose from N200/$ in August 2015 to N525/$ in January 2017. Inflation also rose from 9% in January 2016 to over 18% in January 2017. Our external reserves fell from about $31bn in April 2015 to $23bn in October 2016, and activities in the Manufacturing sector witnessed a lull as manufacturers struggled to get access to key inputs needed in the production process.

Other vulnerabilities include, slowdown in government spending following the drop in government revenue, build up in the demand for foreign exchange, and high exposure of the banking sector to the oil and gas sector.

Driven largely by the downside effects of these shocks, real GDP growth plunged sharply from 6.2 percent in 2014 to a 1.6 percent contraction in 2016. Nigeria effectively slipped into a technical recession in the second quarter of 2016 and maintained negative growths in all quarters of that year. Quarterly disaggregation of the 2016 outcomes showed the worst contraction of 2.4 percent and a turning point thereafter.

Addressing the Recession: The Monetary and Fiscal Policy Mix

In a bid to contain rising inflation and to cushion the impact of the drop in FX supply on the Nigerian economy, the monetary and fiscal authorities took extraordinary measures to meet these extraordinary challenges. Some of the measures we took include;

1. Monetary Policy – Over the intervening period of the slowdown in the economy, the CBN embarked on a cycle of tightening which culminated in a July 2016 hike in the Monetary Policy Rate from 12 percent to 14 percent. This decision was expected to rein in expected inflationary pressures that may result from exchange rate pass-through to domestic prices, and ensure that inflation expectations are well anchored. It was also expected to set off increased capital inflows to the country, which should improve accretion to reserves.

2. Conserving our Foreign Exchange – We introduced a demand management approach in order to conserve our reserves and support domestic production of items that can be produced in Nigeria. In this regard, we analyzed our import bill, and encouraged manufacturers to consider local options in sourcing their raw materials, by restricting access to foreign exchange on 43 items. Four of these items alone constituted over N1 trillion of our import bill.

3. Risk Based Supervision – The weakening of the Naira, following the shift to a more flexible foreign exchange mechanism along with the exposure of several banks to the oil and gas sector, impacted somewhat on the balance sheets of domestic banks. To support the health of the banking system, the CBN took a number of steps, including:

i.Monitoring compliance of supervised institutions with the foreign exchange management framework issued in June 2016 through our risk-based supervision methodology, which also involved reviewing international trade and foreign exchange operations of local banks;

ii.Monitoring the financial position and performance of supervised institutions;

iii.Assessment of the risk profile and governance management practices of banks In the event of major deteriorations on any key risk indicator, we engaged with the affected bank in order to mitigate concerns and shore-up their capital base.

1. Foreign Exchange Market – In April 2017 we introduced an Investors and Exporters FX(I&E), which allowed investors and exporters to purchase and sell foreign exchange at the prevailing market rate. In addition, exchange rate management was further liberalized following the approval of the “Revised Guidelines for the Operation of the Nigerian Inter-bank Foreign Exchange Market” on June 15, 2016 and its operationalization on June 20, 2016. The commencement of this policy guideline introduced the Naira Settled Foreign Exchange Futures Market.

2. Growth-enhancing Fiscal Policy – The Fiscal authorities concentrated on examining ways in which fiscal policy could support household consumption and business investments, as these two factors make up more than 85 percent of Nigeria’s GDP by expenditure. In this regard, the Federal Government budgets were readjusted to adequately address priority infrastructure needs that would support improved investments by the private sector. This was complemented by various Presidential initiatives on improving the ease of doing business in Nigeria, dismantling regulatory bottlenecks, enhancing competitiveness and industrialization

3. Development Finance Intervention – The CBN increased its lending to the agricultural and manufacturing sectors, through targeted intervention schemes such as the Anchor Borrowers Program, Commercial Agricultural Credit Scheme and the Real Sector Support Facility. In particular the CBN sought to improve domestic supply of four commodities (rice, fish, sugar, and wheat), which consume about N1.3 trillion annually in our nation’s import bill. The Anchor Borrowers Programme (ABP) which was launched in November 2015 by President Muhammadu Buhari, was designed to build partnerships between small holder farmers and reliable large-scale agro processors, with a view to increasing agricultural output, while improving access to credit for farmers.

Our targeted focus on the agricultural and industrial sectors were driven by the vast opportunities for growth, given our high population. These sectors were instrumental in taking Nigeria out of the recession; In 2017, over 50% of the contributions to GDP growth came from the agriculture and industrial sectors. These sectors have the ability to absorb the growing labor pool of eligible workers, and can help meet the household consumption needs of the Nigerian market. If efforts are made to improve productivity gains in these sectors, it will reduce our dependence on imported items that can be produced in Nigeria.Furthermore, improved productivity in the agriculture and industrial sectors could also help in diversifying the wealth base of our country. In 2017, Nigeria’s total revenue from exports of crude oil was $23 billion, relative to Indonesia, which earned close to $22bn from the export of palm oil in 2017. Nigeria has vast amounts of arable land that can be utilized to cultivate not only palm oil, but also cotton, tomatoes and rice. Supporting growth in the agriculture and industrial sector is critical in our efforts to wean our nation from its reliance on proceeds from crude oil. Other growth-support interventions initiated by the Bank include; the N222 billion Micro, Small and Medium Enterprise Development Fund (MSMEDF); N300 billion Real Sector Support Facility (RSSF); N213 billion Nigeria Electricity Market Stabilization Facility (NEMSF); N200 billion Commercial Agriculture Credit Scheme (CACS);); and the N300 billion Non-oil Export Support Fund. In most of these interventions, loans were granted at a concessionary rate of 9.0 per cent.

4. Financial Inclusion – The CBN also embarked on several financial inclusion strategies to counter the effects of recession and ensure stability in the financial sector. One of such measures, includes the launch of the National Collateral Registry, which enable SMES’ to provide movable assets as collateral in order to obtain loans from financial institutions, rather than providing fixed assets as collateral. In addition, we developed policy guidelines for the issuance of a Payment Service Bank license. Under this policy regime, Fintechs, Fast Moving Consumer Goods and Telecommunication firms with the permission of the Central Bank of Nigeria can set up entities that will provide limited financial services to individuals in underserved parts of the country.

5. Bailout Programme – The CBN intervened with a bailout to sub-national governments who could not pay their workers for several months. This measure was intended to provide temporary support to states grappling with dwindling finances, while they embarked on measures to improve Internally Generated Revenue in their respective states.

Policy Outcomes and Exit from Recession

GDP – After 5 consecutive quarters of negative growth beginning in the 1st Quarter of 2016, a coordinated approach by the fiscal and monetary authorities supported a rebound in the nation’s economy during the second quarter of 2017. The recovery has been driven largely by improved non-oil activities especially the agriculture sector which expanded consistently by about 3.5–4.3 percent reflecting government’s efforts at diversifying the economy. This was nonetheless, reinforced by the pickup in the oil sector as oil prices rallied in 2017. The gradual re-orientation of the economic structure towards the agriculture sector reflects the diversification drive of the government which was supported by the development finance initiatives of the CBN.

The recovery has been sustained for seven consecutive quarters. The pace of quarterly GDP growth has improved from .5 percent in the second quarter of 2017 to 2.38 percent in the fourth quarter of 2018. The short-term outlook continued to strengthen with average growth projections of about 2.8 percent for 2019, up from 1.81 percent in 2018.

Inflation – As a result of the implementation of a tighter monetary policy regime and improved FX inflows, inflation began to decline, from its peak of 18.7 percent in January 2017; it currently stands at 11.25 percent as at March 2019. Interestingly for the first time during a general election cycle, our inflation rate declined from 11.37 percent in January 2019 to 11.25 percent in March 2019, due to our measures aimed at containing liquidity and supporting improved production of staple food items.

Reserves – The introduction of the Investors and Exporters Window also helped in shoring up our external reserves. Transactions in the I&E FX window has reached over $48 billion since the inception of the window and our foreign exchange reserves has risen to $45bn in April 2019 from $23bn in October 2016. Nigeria’s current stock of external reserves is now able to finance 9 months of current import commitments. With improved availability of foreign exchange, the exchange rate at the I&E FX window has remained stable over the past 24 months at an average N360/$, and the parallel market exchange rate has appreciated from N525/$ in February 2017 to N360/$ today.

Anchor Borrowers Program – The program has helped to bolster agricultural production by removing obstacles faced by small holder farmers. We have also improved access to markets for farmers by facilitating greater partnership with agro-processors and manufacturing firms in the sourcing of raw materials. So far the program has supported more than 1,059,604 small holder farmers across all the 36 states of Nigeria, in cultivating 16 different commodities over 1.114 million hectares of farmland. It has also supported the creation of over 2.5m jobs across the agricultural value chain.

A key emphasis was placed on improving rice production, given the considerable weight importation of rice had on Nigeria’s import bill. This focus has enabled increased production of rice in the country, which has led to net savings of $800 million in our import bill as a result of drastic declines in rice importation.

Manufacturing Sector – Activities in the manufacturing sector also witnessed significant improvement between August 2016 and February 2019, as the Primary Manufacturing Index rose from a low of 42% in August 2016 to 57% in February 2019. This development was attributed to sustained supply of foreign exchange and the dogged implementation of our FX restriction on certain items. As a result, we have recorded spectacular improvements in domestic production of most of these items. Local manufacturers are reporting major boosts to their revenue and profit due to this policy.

Peer Review – in assessing Nigeria’s recovery efforts and performance, it is essential to conduct a comparative assessment of our peers. Strikingly, it will be discovered that Nigeria did not fare badly vis-à-vis other emerging market economies like Brazil, South Africa, Turkey, and Argentina, that had similar economic experiences. Amidst the growing challenges, Nigeria has managed to keep real GDP growth positive and has avoided a double-dip recession in contrast to some other emerging markets economies.

In comparison and following its 2016 contractions, the South African economy recorded a double-dip recession with renewed contractions of 2.6 and 0.7 percent in the first and second quarters of 2018, respectively. Its economy grew by .8 percent in 2018. In Argentina, though the economy was in recession throughout 2016, moderate upticks which peaked at 1.9 percent quarter two of 2017 ended that recession. However, the Argentinian economy fell back into a recession as GDP growth declined by 1 percent in 2018.

The Brazilian economy had been in recession since 2015 and only emerged from it the first quarter of 2017 with a growth rate of 1.0 percent. Since then the growth has slowed progressively until the last quarter of 2017 when growth remained flat. Economic recovery still remains tepid with a GDP growth rate of 1.1 percent in 2018.

Outlook

Global growth momentum continued to weaken in the light of ongoing geopolitical and trade tensions. This is aggravated by weakening demand in many advanced economies and financial market fragilities in many emerging markets and developing economies. Accordingly, global growth projections are estimated at 3.5 percent (in 2019) and 3.6 percent (in 2020) lower than a growth of 3.9 percent estimated for 2018. Medium-term outlook are lowered for advance economies generally as the prevailing trade war with China is expected to dampen growth impetus in the USA. In emerging markets, the slowdown of the Chinese economy is expected to continue into the medium-term.

In addition, developments in the exploration of shale oil have led to the emergence of the United States as the world’s biggest crude oil producer, ahead of Saudi Arabia and Russia. Overall crude production in the United States has climbed to a weekly record of 12 million bbl/d, up from 9.3m barrels in 2017, and production is expected to exceed 20m barrels by 2025, according to information from the EIA. Output from the US will continue to put downward pressures on oil prices, notwithstanding the output cut by OPEC members in order to shore up oil prices. As a result, it is important to note that the associated headwinds which led to the economic crisis between 2015 – 2017 still remain.

Road to Sustainable Growth

Have these unconventional tools employed by the Central Bank been effective? Skeptics have pointed out that the pace of recovery has been slow, with GDP growth averaging only slightly higher than a 2 percent annual rate over the past few years and inflation remains above the CBN 6 – 9 percent threshold. What the critics fail to note is that our economic recovery has faced powerful headwinds, as oil revenues constitute over 90% of our export earnings. Notwithstanding the fact that oil prices are yet to return to their pre-2015 levels, the CBN has been able to reduce inflation, build our FX reserves, while maintaining stability in the foreign exchange market.

Challenges still remain such as ensuring that the pace of GDP growth remains well ahead of our annual population growth at 2.7 percent. But this can only be achieved if we continue to support efforts aimed at improving domestic production of goods in Nigeria.

As a result, the recommended steps below may be required in order to promote sustainable growth of the Nigerian economy:

i. Significantly increase the country’s policy buffers, including fiscal measures to increase the external reserve;

ii. Diversify the revenue structure of the Federal government in

order to rely much less on direct proceeds from sale of crude oil;

iii. Proactive fiscal actions, specifically, infrastructure investment is required to enhance economic growth

iv. Provision of cheap financing to boost local production of priority goods in critical sectors of the economy in order to reduce reliance on foreign imports.

v. Universities have a considerable role to play in working with the private and public sector in supporting research and development of solutions that can be applied to enhance the growth of the Nigerian Economy. In addition, they will also have to enhance their curriculum, so students are well equipped with the skill sets that are required to support Nigeria’s growth in this digital era.

Conclusion

In concluding, I have examined various developments, principally, activities in the domestic and global economies that led Nigeria’s economy into the recession in 2016 and its eventual recovery in 2017. Building on measures implemented by the fiscal and monetary authorities towards addressing the constraints of farmers, SMEs and manufacturers will be critical in order to drive sustainable growth of the Nigerian economy and reduce our reliance on proceeds from the sale of crude oil. In addition, forging partnerships between Universities, Research Institutions, the Private sector and Public sector institutions in developing and implementing solutions that aid productivity in the agriculture and manufacturing sectors, will be important in order to build a sustainable productive base for the nation.

I thank you very much for your attention. And thank you once again, for being here today.

GODWIN I. EMEFIELE, CON

Governor, Central Bank of Nigeria

17th May 2019

Credit: The Post From Recession to Growth: The Story of Nigeria’s Recovery from the 2016 Economic Recession first appeared in Proshare on 17th May 2019.