-

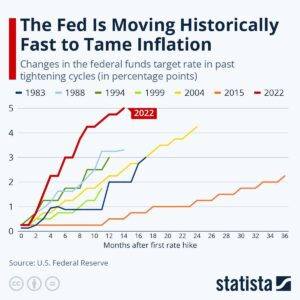

Why U.S. Monetary Policy Objectives are Unrealistic and How it Chokes the Global Economy in a Post-Pandemic World (PART TWO)

In the second part of two articles, Abdulmajid discusses the global effects of aggressive monetary policy, in Africa, the EU, and the United States. In addition, He highlights a few analyst recommendations and…

-

Why U.S. Monetary Policy Objectives Are Unrealistic and How it Chokes the Global Economy in a Post-Pandemic World (PART ONE)

The Federal Reserve Bank of the United States of America, also referred to as “The Federal Reserve” or “The Fed” or “The U.S. Fed,” has an almost monopolistic influence on the functioning and…

-

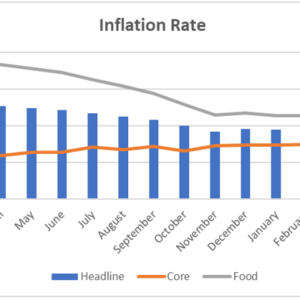

Nigeria’s Inflation Rate rose to an 8-month High of 16.82% in April 2022

We expect headline inflation to continue its upward trend in the coming months due to the supply disruptions that have ensued from the conflict in Eastern Europe which has left a mark on…

-

Taming Market Power Could (also) help Monetary Policy

Some central banks are currently debating whether to tighten monetary policy to fight inflationary pressures, after having eased decisively in response to the COVID-19 shock. In making such decisions, central bankers have to…

-

Understanding the Rise in US Long-Term Rates

The rise in long-term US interest rates has become a focus of global macro-financial concerns. The nominal yield on the benchmark 10-year Treasury has increased about 70 basis points since the beginning of…

-

A Future with High Public Debt: Low-for-Long Is Not Low Forever

Many countries are experiencing a combination of high public debt and low interest rates. This was already the case in advanced economies even prior to the pandemic but has become even starker in…

-

Monetary Policy at a Crossroad: Policymakers Need to Break Promise of Easy Money to Avoid Boom-Bust

The Federal Reserve's new policy approach is that policymakers want to see "actual progress, not forecast progress" before deciding to change its policy stance. Substantial actual progress is occurring in the economy, some…

-

A Long, Uneven and Uncertain Ascent

This crisis is far from over. Employment remains well below pre-pandemic levels and the labor market has become more polarized with low-income workers, youth, and women being harder hit. The poor are getting…

-

Monetary Policy for all? Inequality and the Conduct of Monetary Policy

nequality in both advanced economies and emerging markets has been on the rise in recent decades. The COVID-19 pandemic has exacerbated and raised awareness of disparities between the rich and poor.

-

Emerging Stronger From the Great Lockdown

The managing director and the chief economist of the International Monetary Fund lay out a strategy for sustained recovery.