Persistent rise in the general price of goods within an economy is acclaimed inflation. Increasing prices could signal consumption spending by economic agents within the economy, however persistent rise makes fixed income earners and fixed securities like bonds worse off. A healthy level of inflation (1-3%) is acceptable to propel economic growth. If consumption spending increases, there’s tendency for aggregate demand to follow suit. Manufacturers (suppliers) tend to match the increased demand by employing more labour to the production process hereby increasing employment. This illustration espouses the relationship between inflation, economic growth, demand and employment (unemployment).

The renowned British economist, Arthur Philips in the 19th century conducted an empirical study and was able to establish a relationship between inflation and unemployment. According to him, a trade-off exist between inflation and unemployment. If employment was to improve, there would be a rise in inflation and vice versa. Economist today refer to the then novel study as “Philips curve”. Today’s Nigeria is however one characterized with soaring inflation rate and massive job loss.

Rising Inflation in Nigeria

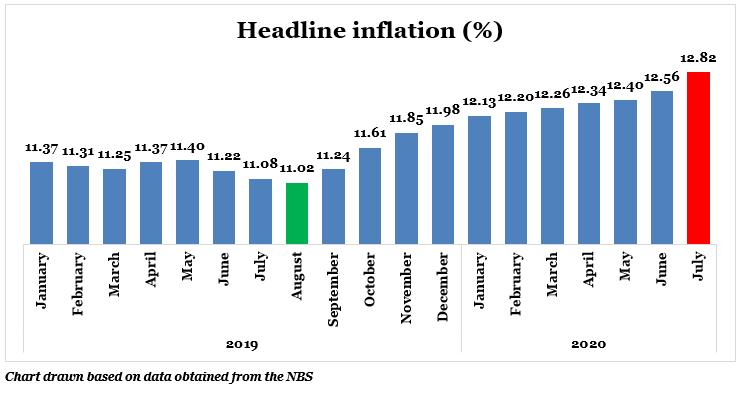

The recent publication by the National Bureau of Statistics (NBS) showed that consumer price index (CPI) stood at 12.82% as at July 2020, which is 26bps points greater than the previous month (12.56%).

This index used in tracking the average price of goods has been on a persistent rise, rising for its 11th straight month reaching 17 months high. The passed down effect of this rising prices could range from high cost of living, decreased standard of living, pressure to implement raised minimum wage, loss of purchasing power, and many more.

Composite food index which tracks the average prices of food items also rose to 15.48% in July 2020 compared to 15.18% in June 2020. The rise was attributed to increase in prices of bread and cereals, potatoes, yam and other essential food items. Glean from the data also shows that headline inflation was fuelled mainly by rising food prices, transportation (air and road) and health services.

It has been almost a year now since the president directed the closure of Nigeria’s land borders specifically Nigeria-Benin border shutting out regional trade activities. This move has since then contributed to rising prices. Most producing firms have since then been forced to buy into backward integration.

Adding to the 41-item ban list, the CBN announced suspension of forex sales to maize importers (20th July, 2020). This directive was geared towards improving domestic cultivation and production of maize. However, prices of maize and its processed form has since skyrocketed.

Forex illiquidity at forex market has also contributed to inflation. Since suspension of forex sales in mid-March, the CBN is yet to fully resume its operation of providing forex to importers, exporters and investors. Falling foreign earnings due to low crude oil prices has contributed to scarcity of dollars with continued pressure on the Naira. This underlying situation has led to continued devaluation of the Naira rendering the currency worse off with skyrocketing prices to match the value of goods and services.

With the virus still at large, economic activities are still in low ebb and measures taken to curb its spread are very much still in vogue. The cost of social distancing in public transportation as well as the other situations described above, have played a leading role in fuelling inflation.

Worsening unemployment rate

After six quarters of wait, the National Bureau of Statistics (NBS) finally released the quarterly unemployment report for the country. The report showed that Nigeria’s unemployment rate stood at 27.1% for the second quarter (Q2) of 2020, which represents a 4% points increase when compared to 23.1% recorded in Q3, 2018. The only good news from the report is Nigeria’s unemployment rate still falls below some African countries like South Africa 30% and Angola 32%.

The Q2 2020 unemployment rate of 27.1% also showed that about 21.7million Nigerians are currently unemployed, and compound to these already high numbers, Nigeria’s under-employment rate also stands at 28.6%. This signifies that a staggering 55.7% of the Nigerian labour force are either unemployed or under-employed.

Under-employment as defined by the NBS is a situation when a worker works between 20-29 hours per week while fully employed is working in excess of 40 hours per week i.e skills are fully utilised. Interestingly, the total number of Nigerians fully employed as at Q2’20 is 35.6 million (30% of active working population) while 22.9million are under-employed. The full employment figure is 15.8% less than the people in employment in Q3’2018, with the 2020 estimates showing how much the labour market has collapsed.

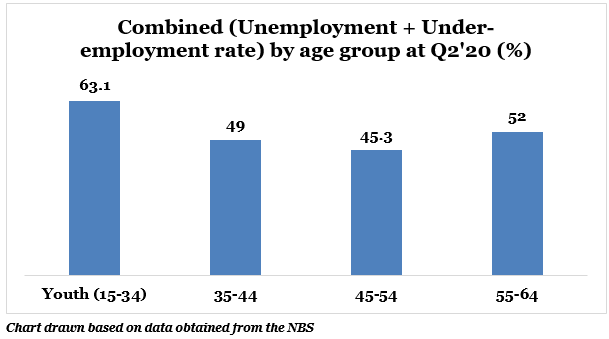

The unemployment rate amongst young people (15-34years) in Q2 2020 printed at 34.9%, higher than 29.7% recorded in 2018. Also, the rate of underemployment for the same age group rose to 28.2% from 25.7% in Q3, 2018.

Unemployment rate stood at 20.4% for 35-44years age group while under-employment was 28.6% bringing a combined rate of 49%. 45-54years age group unemployment rate stood at 17.1% and under-employment was 28.2% a combined 45.3%. 55-64years age group unemployment rate stood at 20.4% and under-employment 31.6%, leading to a combined rate of 52% just behind 53.1% of young (15-34years) age group.

This shows that Nigeria’s youth remain the hardest hit by unemployment with over 13.9 million people aged between 15 and 34 years unemployed. The data further shows that 7.6 million of this age group do not involve themselves in any productive economic activity, succinctly explaining the high rate of social unrest, betting and insecurity currently experienced across the country.

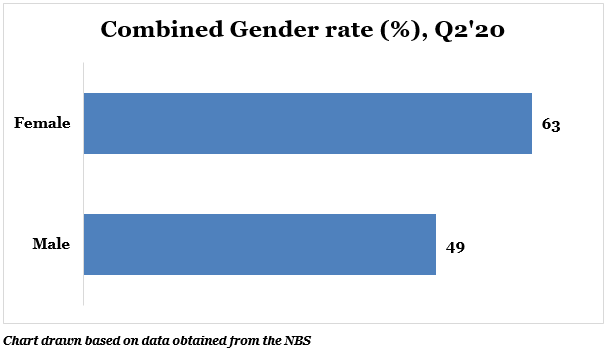

Gender disparity in employment also exist with women bearing the brunch of bad labour market. Female unemployment rate stood at 31.6% and under-employment 31% translating to 13.6 million women who are either unemployed or under-employed. In states like Imo where combine rate is at the highest (75.1%), you hardly come by a woman who is fully employed. Male unemployment rate stood at 22.9% and under-employment 26.3% making a combine 49.2%.

60% of rural inhabitants, or about 13million are either unemployed or under-employed when compared to 48.6% combine rate in urban cities (10.5million people).

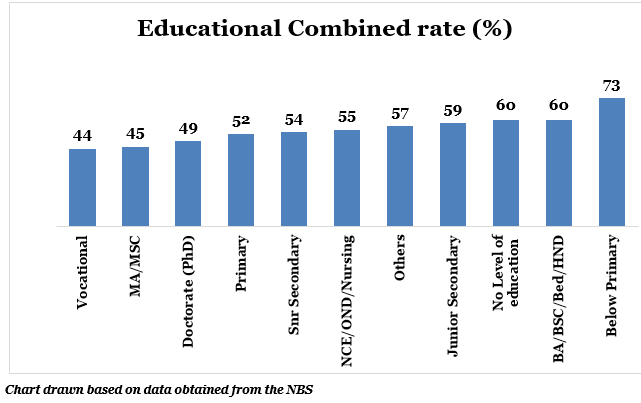

Further scrutiny the data showed that combined graduates and postgraduates made up about 2.9 million (41%) of the total Nigerians that are unemployed. This is expected given thousands of graduates from various tertiary institutions coming into an already overwhelmed job market. Interestingly, Vocational certificate holders are better off compared to Bachelor degree holders. The lowest unemployment rate is within the vocational certificate holders’ stratum (17.9%) although under-employment within the group is still relatively high (26.2%). Interesting figure and a representation of reality currently in play. Vocational certificate holders have a ready skill set that they can monetize immediately. If unemployment is that low at the vocational level, then it suggests that it could be a path solving the unemployment problem

Thus, it can be seen that Nigeria is currently battling with stagflation which is an economic phenomenon for high inflation in conjunction with high unemployment. We believe the first macroeconomic problem to tackle is the level of inflation as other factors tend to hover around it. As such, issues such as persistent structural problems in food production should be addressed in order to reduce the inflationary pressure in the food segment. This in conjunction with addressing the forex illiquidity will bring down the headline inflationary pressure. With low inflation, growth will be unlocked in other areas such as the domestic & foreign investment segment which will boost employment and as such, increases economic growth.

For questions, opinions, corrections and contributions, please drop them in the comment section. You can as well contact the writer on Twitter @SheriffHolla

Additionally, should you need data backed research and analysis for your business or research needs, you can contact us by sending a mail to info@giftedanalysts.com