Implication of the Forex Ban on Food Items

“In God we trust“

The above motto is embedded in the United States (U.S.) currency denominations. Is this true?? In reality it’s not in God the U.S. trusts, the trust lies with the Federal Reserve (Fed). Americans trust the Fed to ensure stability in the value of US dollars making it generally accepted as a means of exchange and further store of wealth.

The same narrative plays out in Nigeria. Nigerians trust in the Central Bank of Nigeria (CBN), Nigerians will willingly give up their goods or services for the legal tender “Naira” backed by the CBN hoping that its worth will not diminish as they expect to exchange it in the future.

The beauty of capitalism is embodied in its mechanisms to ensure wealth redistribution and propel economic stability. The Fiscal authority (Federal Government of Nigeria) and the Monetary Authority (CBN) are fundamental mechanisms of any functioning capitalist state which are supposed to be independent albeit complementary.

The mandate of the CBN is written on the home page of its website – “…delivering price and financial system stability and promoting sustainable economic development.”

The Federal Government (FG) on the other hand is largely tasked with carrying out fiscal activities (Taxes, budget, and debt) to influence economic activities.

On the 10th September 2020, the President through his official Twitter handle @MBuhari tweeted; “I am restating it that nobody importing food or fertilizer should be given foreign exchange from the Central Bank. We will not pay a kobo of our foreign reserves to import food or fertilizer.”

This statement doesn’t only ridicule the CBN as an independent institution, but also shows the influence the fiscal authority has exerted on the monetary authority in recent times.

Dwelling into the nitty-gritty of the presidential tweet, will banning sales of forex to foods importers solve the food crisis at hand?

History is a better teacher of what is to come. On July 13th, 2020, the CBN announced a ban of forex to maize importers. 54 days later (4th September 2020) it reversed its decision granting access to some maize importers. This is one of the inconsistencies in policies in the system, as the CBN failed to take into cognizance the domestic demand for maize as both a food item and a source of poultry feeds.

Rice is perhaps the most consumed food in Nigeria, with a consumption per capita of 32kg. In the past decade, consumption has increased by 4.7%, almost four times the global consumption growth, and reached 7.9 million tonnes in 2017. According to the President of Rice farmers in Nigeria, Nigeria currently produces 5.8million tonnes of rice per annum compared to 7.9 million tonnes that are being consumed. The supply gap of 2.1 million tonnes has been complimented with imports.

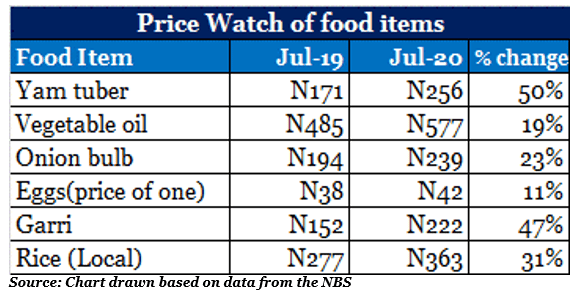

The border closure has already worsened food prices across the country, utterly banning forex sales for food importation is fueling a burning fire. The $1.8 billion food import bill cannot be compared to the amount of foreign exchange that goes into services such as medical tourism and holidays abroad.

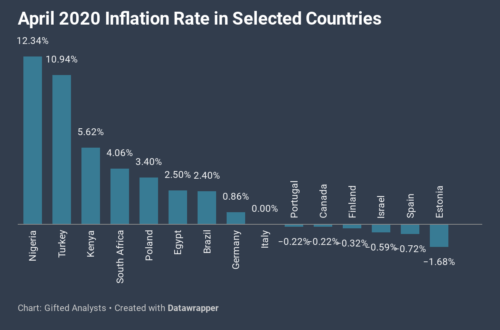

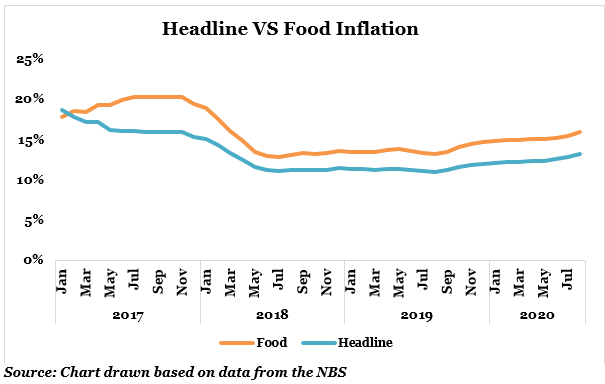

If inevitably, the CBN ostracizes food importers, this will only exacerbate the rising inflation (13.22% as of August 2020) currently experienced. With the underlying economic situation, banning of food importers from accessing forex at the official rate does imply that they will now access forex from BDCs or other unofficial windows at ridiculously high rates. This will also further put pressure on the Naira and lead to wide margin between the official and parallel market rate. The pass down effect of this will be high food prices which are at 30-Months high (August 2020: 16.00% y/y). The corresponding effect will be felt on headline inflation (Consumer Price Index) which has been fueled by increased food inflation for a while now.

Insecurity unrest in the Northern part of the country and flooding experienced in food-producing states are already threats to Nigeria’s food production. For instance, the recent flooding in rice-producing Kebbi State has destroyed over 2 million tons of rice harvests this year. Do not also forget that high cost of transportation, poor storage facilities and inadequate road networks are still a huge part of the problems faced by food producers and distributors.

With 84% of Nigeria’s export (as at Q2’2020) as oil products, we reiterate that Nigeria does not really have an import problem. Nigeria has an export problem and until that problem is solved, average Nigerians will always suffer higher commodity prices due to the demand management strategy of the CBN anytime external shocks occur in the oil market.

For questions, opinions, corrections and contributions, please drop them in the comment section. You can as well contact the writer on Twitter @SheriffHolla

Additionally, should you need data backed research and analysis for your business or research needs, you can contact us by sending a mail to info@giftedanalysts.com