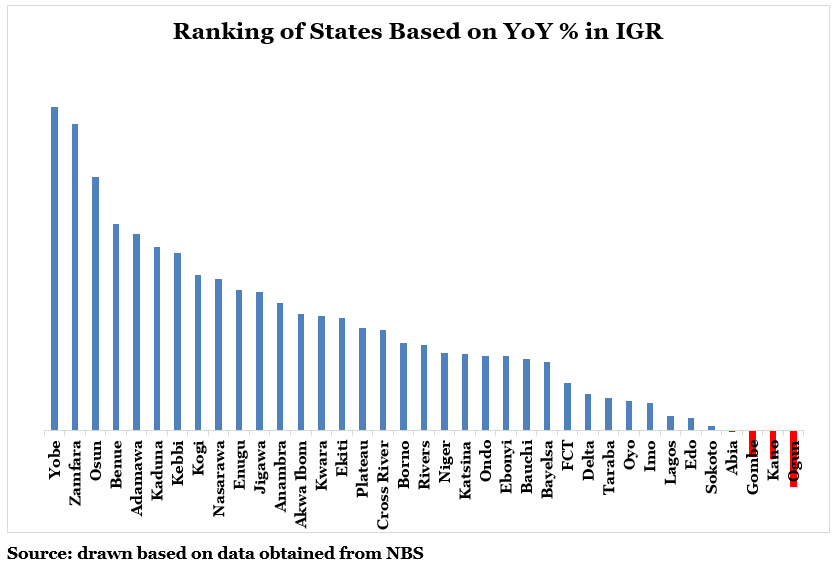

Fiscal Stability – A Need for States to Look Inward

The existing revenue-sharing structure of the government stifles innovation and prevents the state from looking inward to improve revenue since the Federal Allocation remains intact. The major source of revenue for most States is the funding from FAAC, with many contributing little to the pool. Oil revenues which make up more than 42% of government income are generated from activities in oil-producing states, mainly in the South-South region, a fraction of the nation.

![[ANALYTICS] Domestic Debt Profile by Geo-Political Zone](https://giftedanalysts.com/wp-content/uploads/2020/07/Debt-by-Geo-1.png)

![[ANALYTICS] States with the Highest Debt Profile as at Q1’20](https://giftedanalysts.com/wp-content/uploads/2020/07/Top-10-Highest-1.png)