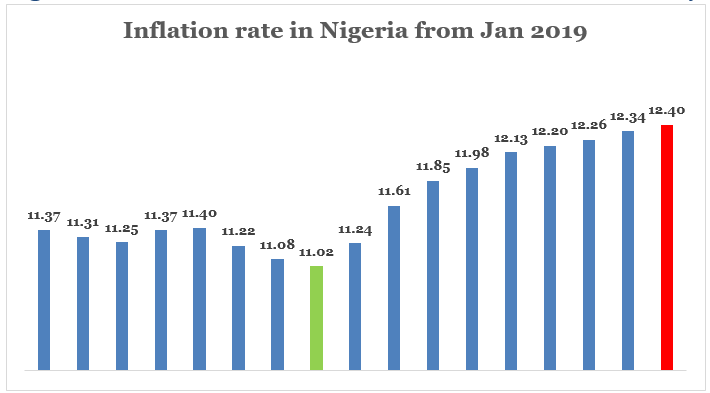

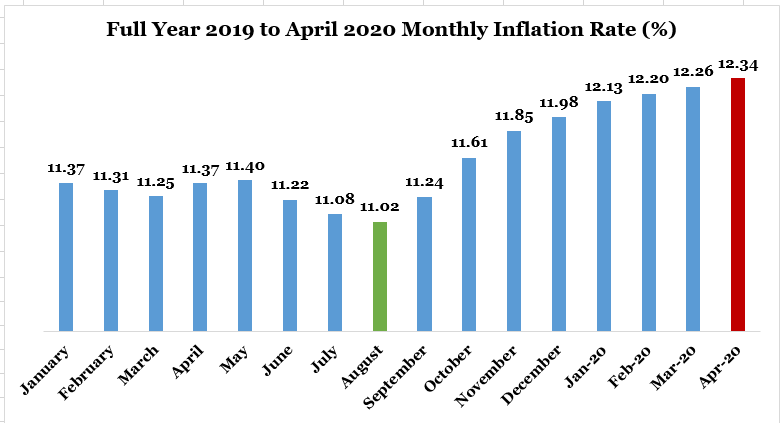

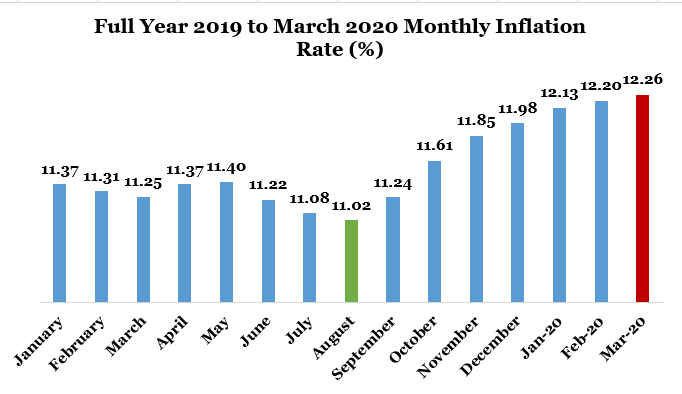

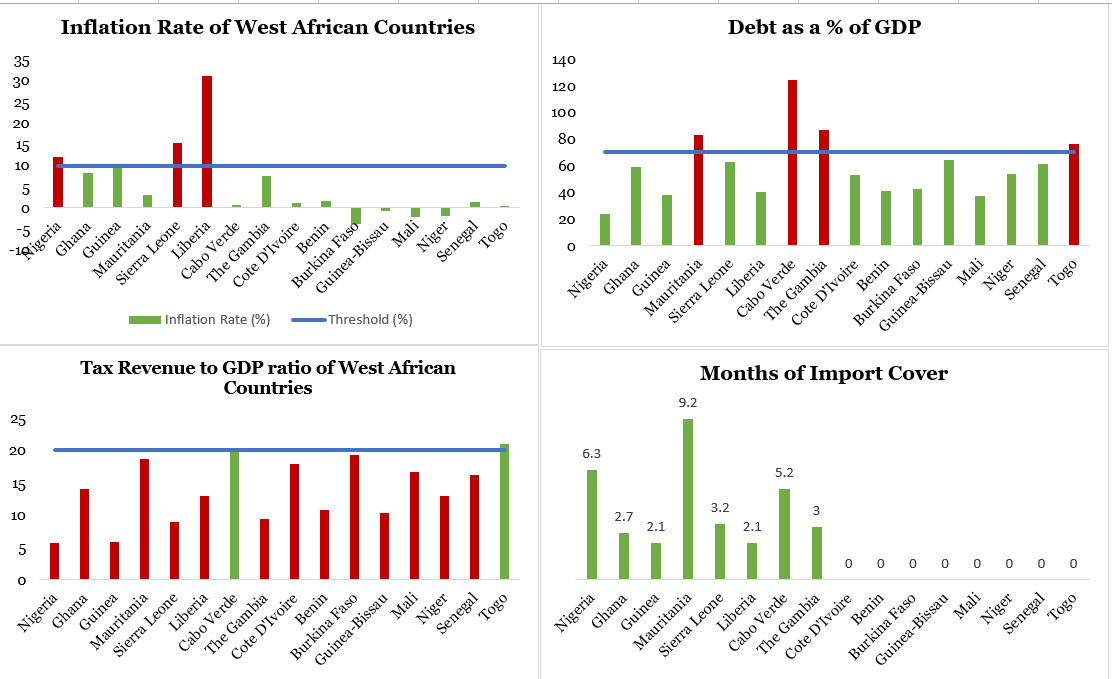

Nigeria’s Double Whammy of Inflation and Unemployment Increases

Persistent rise in the general price of goods within an economy is acclaimed inflation. Increasing prices could signal consumption spending by economic agents within the economy, however persistent rise makes fixed income earners and fixed securities like bonds worse off. A healthy level of inflation (1-3%) is acceptable to propel economic growth. If consumption spending […]