-

COVID-19 Crushes Global Economy but Emerging Markets are in Bigger Troubles

By 2021, it is of high expectation that the world will return to normalcy, and economies around the world should recover from the adverse effect of coronavirus spread. However, emerging markets may continue…

-

The Great Lockdown Through a Global Lens

The Great Lockdown is expected to play out in three phases, first as countries enter the lockdown, then as they exit, and finally as they escape the lockdown when there is a medical…

-

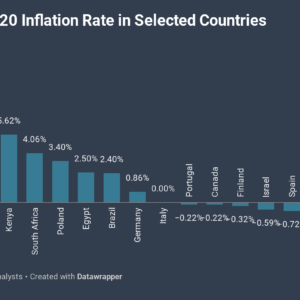

Global economy on a Tripod: Deflation, Inflation and Recession in 2020

From economic theories, one characteristics of a recession is that price level of goods and services will become low. If this should go by and considering that economic theories are in favour of…