-

Aftereffect of the festive season Leads to a Marginal Slowdown in Inflationary Pressure

Looking further into the year, we recognize the possibility of upside inflation surprises, as the sub-par food harvests of last year could cause food supply to be slim during this year’s planting season,…

-

Legally Speaking, is Digital Money Really Money?

Countries are moving fast toward creating digital currencies. Or, so we hear from various surveys showing an increasing number of central banks making substantial progress towards having an official digital currency. But, in…

-

Dominant Currencies and the Limits of Exchange Rate Flexibility

Faced with an unprecedented shock of collapsing global demand and commodity prices, capital outflows, major supply chain disruptions and a generalized drop in global trade, many emerging markets and developing economies’ (EMDEs) currencies…

-

Why the Central Bank of Nigeria will Devalue the Currency in 2020

With the Coronavirus outbreak having its toll on business and economic activities, recently released trade figures as well as policies not having their desired effects, we believe that there will be an unexpected…

-

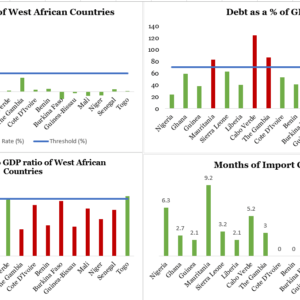

Empirical Analysis of the Criteria for the Adoption of “Eco” Currency

This research work concentrates on analyzing how each of the West African Countries have performed in terms of meeting the inflation target, fiscal deficit, debt as a percentage of GDP, import cover as…