COVID-19 & Cheap Oil: An SSA Market Update

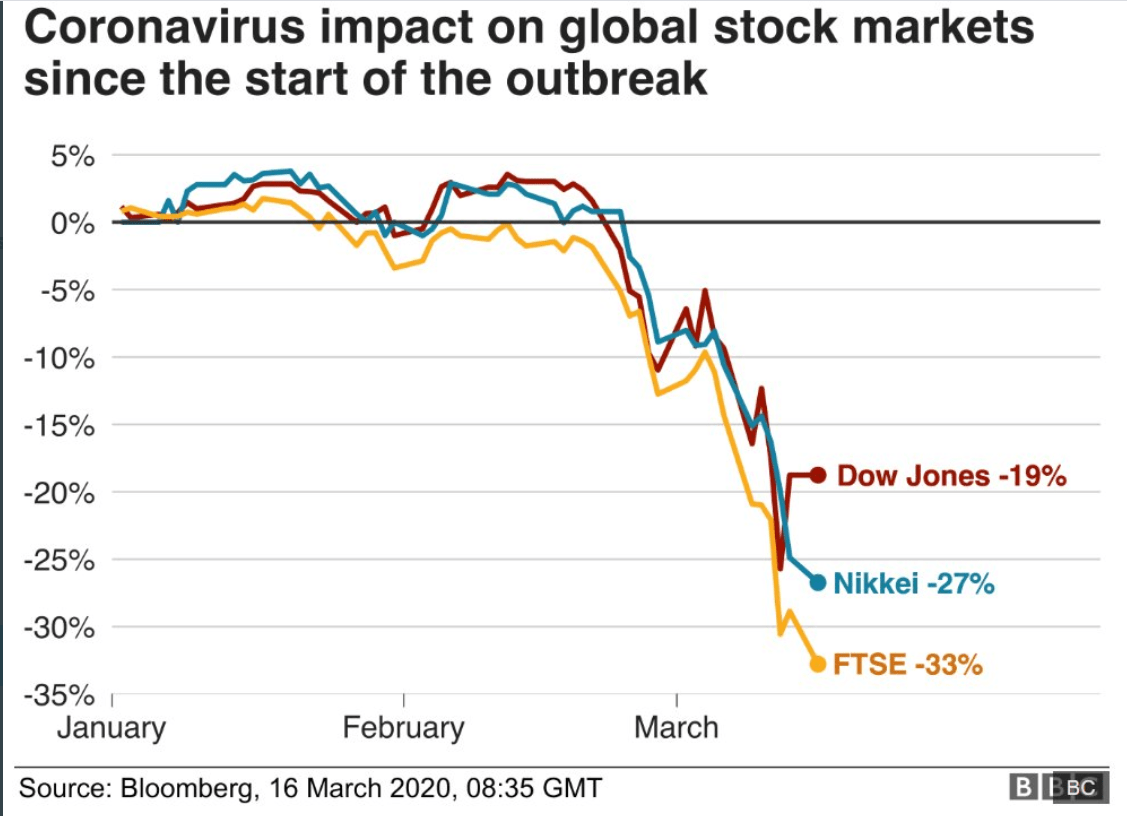

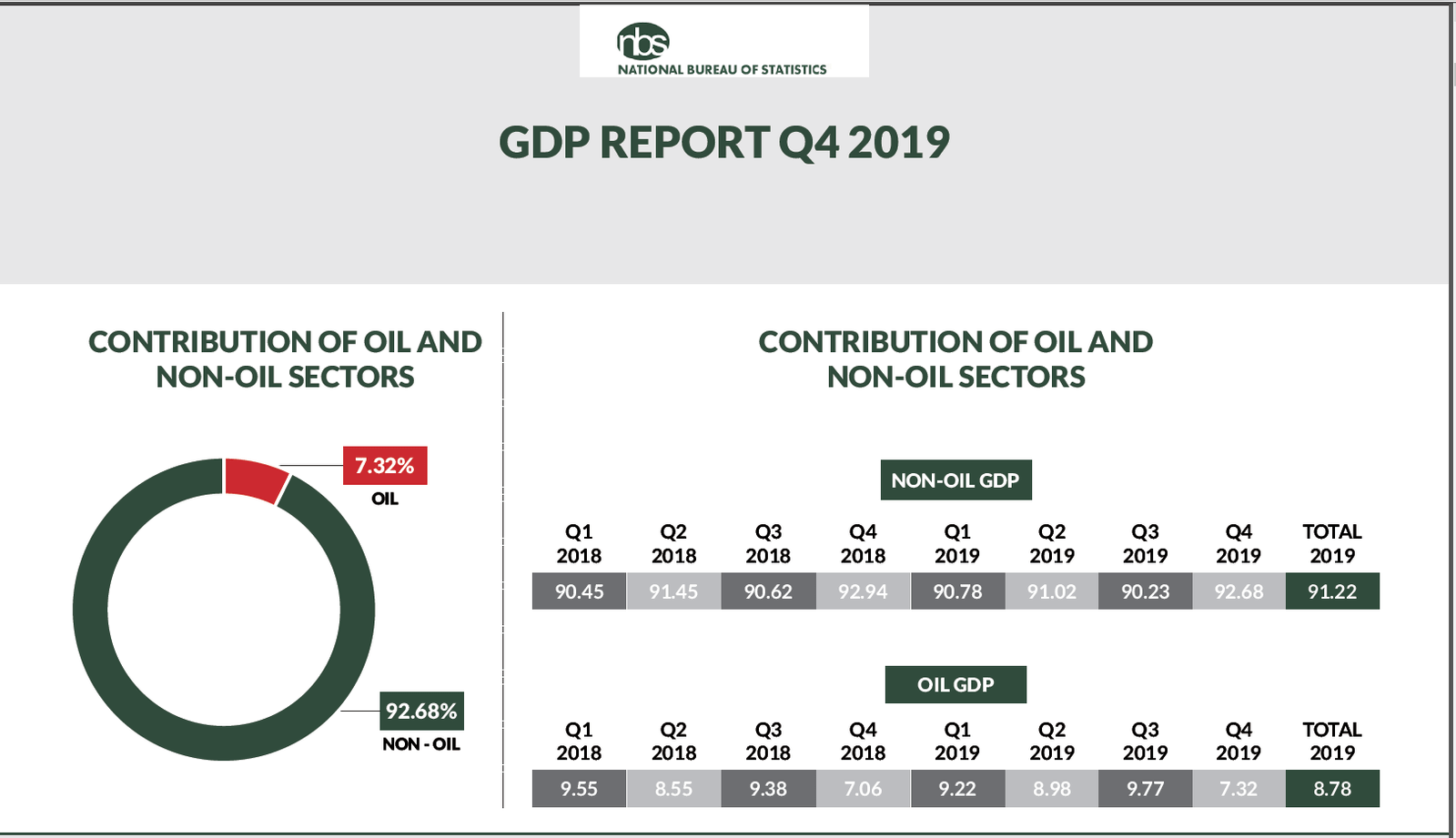

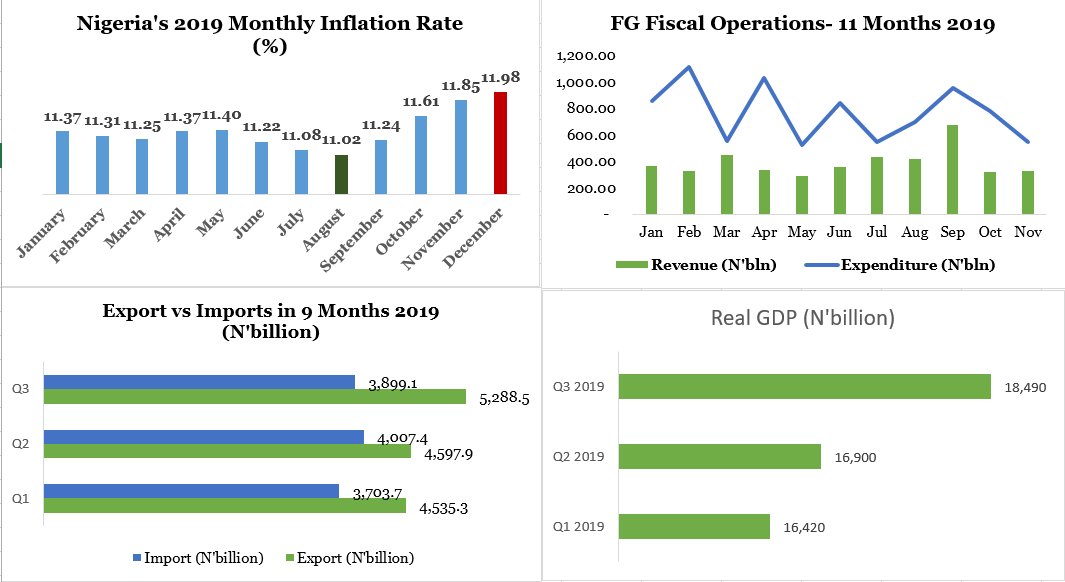

Being what we learnt from the RenCap Securities Conference Call held on 25th March 2020 According to the global chief economist of RenCap, Charles Robertson, the COVID-19 outbreak in Italy shows that the 12 days lag before the virus infection rate goes up, is valid. As such, New York is expected to experience a peak […]