Introduction

Nigeria stands out among its peers in the African continent. From an economy that accounts for 65% of West African GDP ($605.06 billion as at 2018) and 17% of African economy ($2.34 trillion in 2018), to an estimated population of more than 190 million citizens, the country is indeed a force to reckon with when talks about Africa and its economy ensue. The country is relied upon when it comes to market for goods and services, military power (largely influenced by its population), production and export of goods and services to other countries in Africa as well as providing financial support to other countries. As such, it is called the Giant of Africa.

In spite of this, the Nigerian economy was not rosy in 2019, as major economic events occurred in the year which shaped the economy and thus provides an outlook into the future years. Major broad highlights of the year range from the country’s general elections February, to the world credit rating agencies downgrading Nigeria in December. This research report therefore provides a broad assessment into Nigeria’s economic performance in 2019.

The Nigerian Economy Grew by 2.28% in real terms YoY

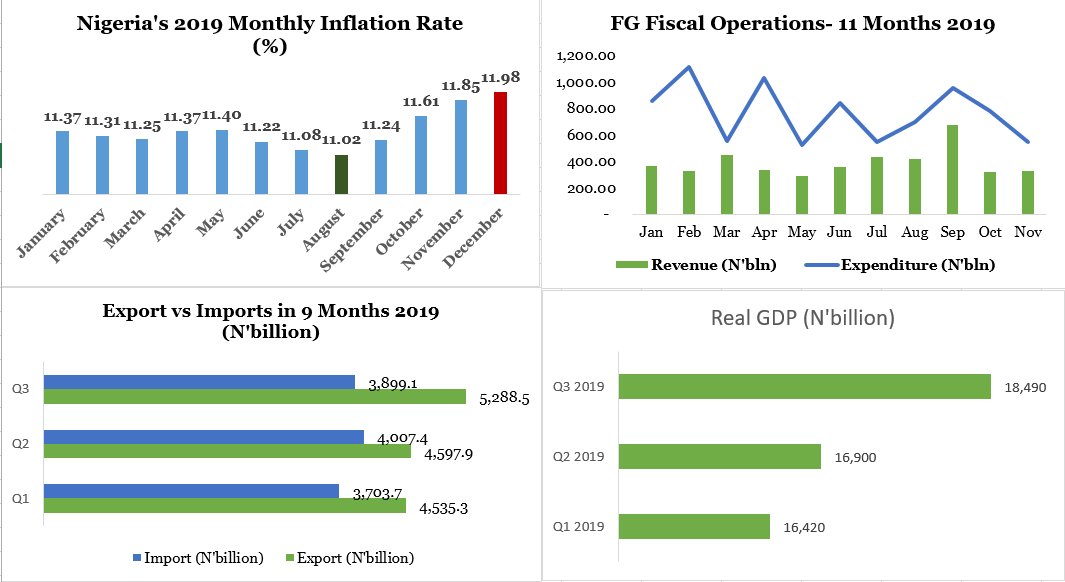

According to the data obtained from the National Bureau of Statistics (NBS), total nominal GDP for the first nine months of the year stood at N104.55 billion while real GDP stood at N51.81 billion. Nominal GDP grew by 13.3% YoY while real GDP grew by 2.28%, representing the second highest real GDP growth rate since 2016 when the nation’s economy was in a recession.

The Nigerian economy is expected to grow to $446.54 billion in 2019 up from a nominal Gross Domestic Product (GDP) of $398.19 billion in 2018 according to the data obtained from the International Monetary Fund (IMF).

In terms of real GDP, the IMF projected that the Nigerian economy will expand by 2.28% to N72.15 trillion in 2019 and by 2.52% in 2020. Apparently, the Q3 economic performance of the country as shown in the table above, is in line with the projections of IMF for the full year.

In terms of growth, the industrial sector recorded the highest growth with 3.20% increase in contribution from N3.97 trillion in real terms in Q3 2018 to N4.09 trillion in Q3 2019. The agriculture sector also increased by 2.27% YoY. The service sector however, recorded the lowest expansion of 1.85% from N8.8 trillion in Q3 2018 to N8.98 trillion in Q3 2019. Despite recording the weakest growth, the service sector is the largest contributor to the Nigerian economy. The sector contributed 48.59% to the Nigerian economy in Q3 2019, followed by the agricultural sector which contributed 29.25%; and the industrial sector which contributed the remaining 22.17%.

The FG Records N4.14 Trillion Fiscal Deficit in 11 Months

According to the data obtained from the Central Bank of Nigeria (CBN), the Federal Government (FG) of Nigeria spent N8.41 trillion while it received N4.26 trillion in the first 11 months of the year. This translates to fiscal deficit of N4.14 trillion during the period.

Source: Based on the Data Obtained from the CBN

The chart above shows that within the first 11 months of 2019, the FG’s revenue fell short of its expenditure. Over the period, the FG’s highest revenue came in September 2019 at N668.60 billion, while its expenditure exceeded one trillion naira in February 2019 as the government spent N1.11 trillion. This is reflected in the debt profile of the country as total public debt rose by 2.02% from N25.70 trillion in Q2 2019 to N26.22 trillion in Q3 2019.

Inflation Rate Moderation was Cut Short by Border Closure

12-Month average inflation rate during the year was 11.39% and this is 71 basis points less than the 2018 12-month average inflation rate. During the year, Nigeria recorded four consecutive months of disinflation from May to August. Consumer prices rose to the slowest pace of 11.22% in June; that marked its weakest increase in the preceding 11 months.

Source: Based on the Data Obtained from the NBS

The slowest inflation rate in the year occurred in August at 11.02%. Subsequently, the moderation in the headline inflation reversed when the Nigerian government closed its land borders in August, resulting into a consecutive increase in inflation rate from 11.24% in September to 11.98% in December, the highest in 2019.

Nigeria’s Trade Balance Hit N2.81 trillion Thanks to Crude Oil Export

During the first nine months of 2019, Nigeria’s total trade was valued at N26.03 trillion of which imports amount to N11.61 trillion while the value of total exports was N14.42 trillion. This means that Nigeria recorded a trade surplus for the period as more than half of the country’s trade was exported within the nine-month period, while import took a lower chunk.

Consequently, total trade balance stood at N2.81 trillion largely driven by N1.39 trade surplus recorded in Q3 2019, thanks to a decline in total import in the quarter to N3.90 trillion from N4.01 trillion recorded in the preceding quarter.

On the other hand, export grew by 15% to N5.29 trillion from N4.60 trillion recorded in the second quarter of the year.

Source: NBS

A further analysis of the data obtained from the NBS showed that Nigeria’s export is still dependent on the sales of crude oil. The export of the commodity accounts for more than three-quarters of Nigeria’s total export in the period under review, while non-crude export struggled to constitute a quarter.

Non-oil sector’s contribution to Nigeria’s export is still abysmally low. In fact, the sector’s highest of N1.54 trillion was recorded in Q3 2019 mainly due to the re-exports of high value cable sheaths of iron to Ghana during the period.

The Nigerian Stock Exchange was the Second Worst Performing in Africa in 2019

We sought data from 16 major stock exchanges in Africa and found that the Nigerian bourse lost the most value among the selected African stock markets after Lusaka Stock Exchange. The Nigerian Stock Exchange fell by -14.6%, placing it only ahead of the Lusaka Stock Exchange which shed -18.75%.

The key performance indicator of the NSE, the All-Share Index (ASI), which stood at 30,619.53 points at the end of the first month of 2019, grew by 4.45% to 31,981.18 points at the end of February 2019. In March 2019, the index level dipped by -1.89% following the country’s general elections. In April 2019, the NSE index level went below 30,000 points psychological level for the first time of the year as it declined by -5.42% (when compared to its performance in March) to 29,675.89 points.

In the second half of 2019, the ASI began with a 5% decline to 28,517.22 points as at the end of July 2019 and further declined to 27,388.70 points at the end of August. At the end of October 2019, the ASI was 26,562.90 points which shows it fell by 3% when compared with the index level of October 2019. By November, the ASI was 26,689.41 points and was 26,603.39 points as at December 2019.

During the year, three companies listed on the NSE while seven companies delisted either voluntarily, or for regulatory reasons. There was a merger and acquisition deal as well.

MTN Nigeria listed on the NSE by introduction while Airtel Africa conducted an Initial Public Offering (IPO) to list its shares. Skyway Aviation also finalized its IPO listing early in the year.

Great Nigeria Insurance was delisted from the NSE for not giving value to its shareholders. As such, it got approval of the shareholders to delist from the NSE. Skye Bank and Fortis Microfinance bank were delisted as a result of not meeting regulations while Diamond Bank got delisted as a result of merging with Access Bank.

Conclusion

The year 2019 was characterized by different fiscal and monetary policies which shaped the economy. One of such was the border closure which had effect on the inflation rate, but still led to an increase in total export while increasing the revenue base of the country. The Nigerian economy however did not perform very well as its growth rate was below the African growth rate and its inflation rate is among the highest in the region. Also, poverty and unemployment remain a challenge for the Nigerian economy that continued to grow at a pace lower than its estimated annual population growth rate of 2.6%.

In spite of this, there are glaring signs that some of the policies will yield good results entering into 2020. Notable among this policies is the ban of non-bank and local individual investors from participating in OMO auctions, a development that pushes yields on the apex bank’s liquidity management tool at attractive rates, while those on Nigerian government short-term debt instruments continue to plummet following increased demands for the fixed income instruments. Furthermore, the year 2020 will likely see major mergers and acquisitions in the insurance sector due to the CBN directive of new minimum capital requirement for insurance companies in the country. This will give the insurance sector a solid capital base, deepen their operation and increase their contribution to the economy.

A special recognition to Segun Olakoyenikan of AFP news agency for his support and contribution towards ensuring the article communicates in the right manner.

Please drop your comments as well as suggestions in the comment section. You can also contact the writer on 08098374664.

This is great…

Thank you Iblajo…