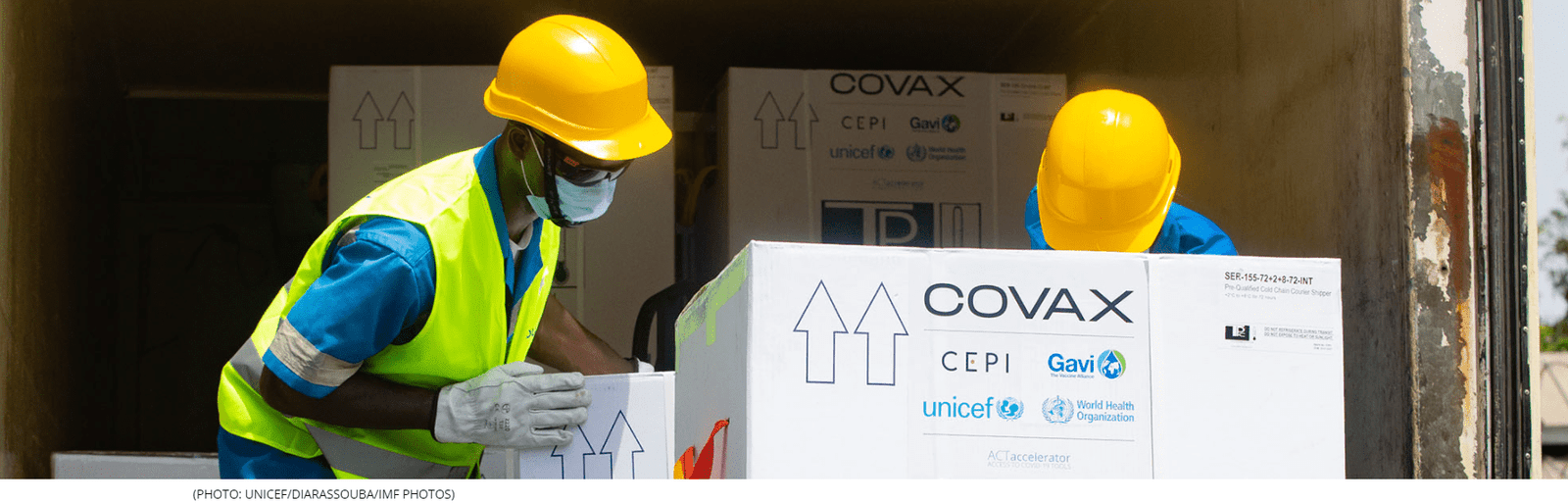

Imagine you’re a policymaker in sub-Saharan Africa. You’ve been charged with lifting your country out of the worst health crisis in living memory, and nobody around you knows when it will end—the second wave that gripped the region earlier in the year has eased, but many countries are nonetheless bracing for further waves as winter approaches.

One piece of good news is that a global recovery is well underway. Key economies are rebounding sharply, global trade has improved, commodity prices are higher, and investment flows have resumed.

The bad news is that, for sub-Saharan Africa, at least, near-term growth prospects are somewhat more subdued. And as long as widespread vaccination remains out of reach, you will face the unenviable task of trying to boost your economy while simultaneously dealing with repeated COVID-19 outbreaks as they arise.

![[INFOGRAPHICS] Countries with the Cheapest Electricity Tariff in Africa](https://giftedanalysts.com/wp-content/uploads/2020/07/Oil-companies-01-scaled.jpg)

![[INFOGRAPHICS] Biggest Banks in Africa by Tier-1 Capital](https://giftedanalysts.com/wp-content/uploads/2020/07/Banks-02-2.jpg)