COVID-19 Response in Emerging Market Economies: Conventional Policies and Beyond

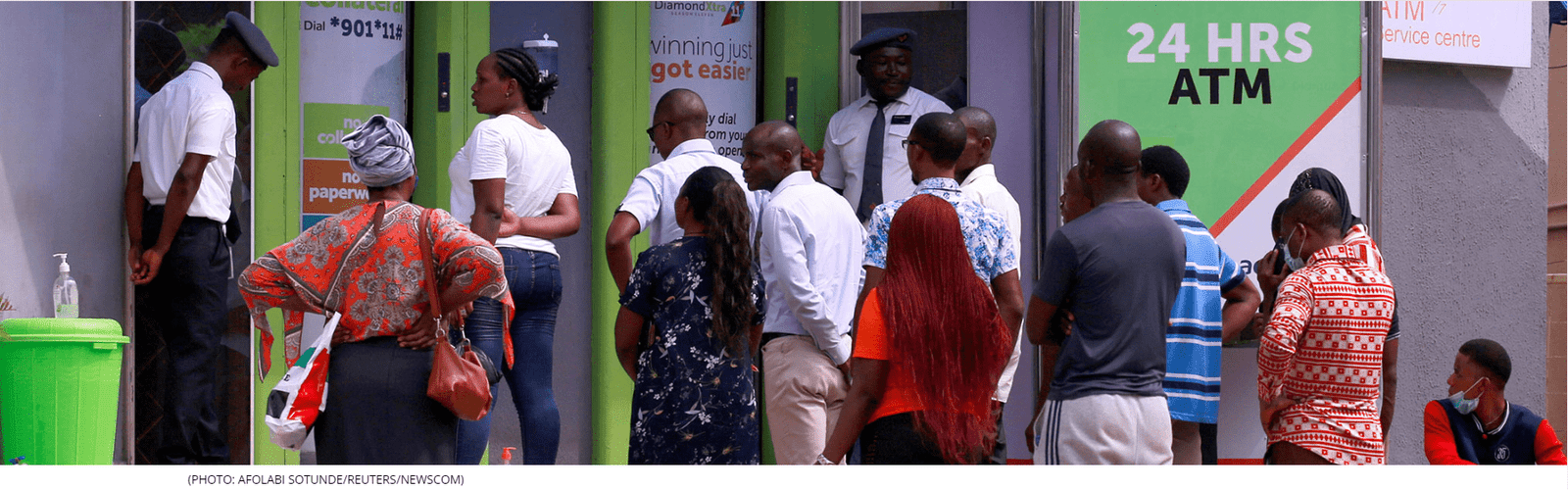

The economic impact of the COVID-19 pandemic on emerging market economies far exceeded that of the global financial crisis. Unlike previous crises, the response has been decisive just like in advanced economies. Yet, conventional policies are reaching their limit and unorthodox policies are not without risks.