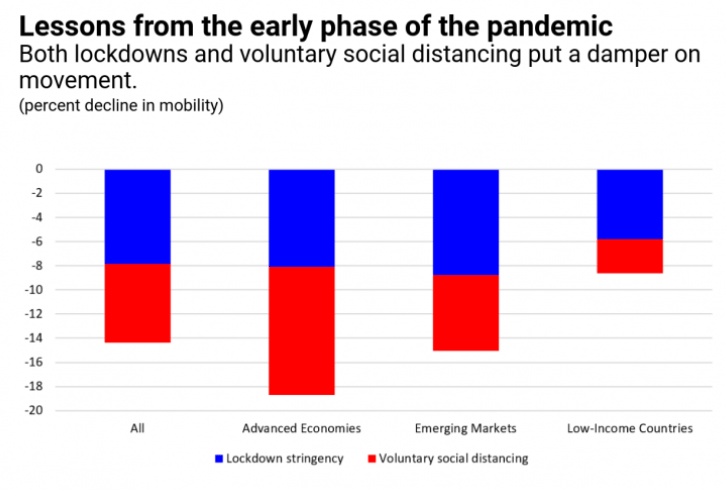

It is one year into the COVID-19 pandemic and the global community still confronts extreme social and economic strain as the human toll rises and millions remain unemployed. Yet, even with high uncertainty about the path of the pandemic, a way out of this health and economic crisis is increasingly visible. Thanks to the ingenuity of the scientific community hundreds of millions of people are being vaccinated and this is expected to power recoveries in many countries later this year. Economies also continue to adapt to new ways of working despite reduced mobility, leading to a stronger than anticipated rebound across regions. Additional fiscal support in large economies, particularly the United States, has further improved the outlook.

In our latest World Economic Outlook, We are now projecting a stronger recovery for the global economy compared with our January forecast, with growth projected to be 6 percent in 2021 (0.5 percentage point upgrade) and 4.4 percent in 2022 (0.2 percentage point upgrade), after an estimated historic contraction of -3.3 percent in 2020.