-

UNITED CAPITAL PLC: 9 MONTHS-2022 PERFORMANCE REVIEW AND STOCK RECOMMENDATION

United Capital Plc has seen steady growth in both top and bottom lines over the years, and we expect both to continue to grow at double digits over the next five years. The…

-

BUACEMENT: A Dive into Company Performance and Financial Analysis

We issue a sell recommendation on BUA Cement PLC(BUACEMENT.NSE) Based on a target price of ₦58.6k representing a 13% downside on the closing price of ₦70.75 as of march 30th, 2022. Our valuation…

-

[Infographics] Financial Performance Summary of Selected Companies in Nigeria (2020)

Get the 2020 financial performance summary of some of the big names listed on the Nigerian Stock Exchange.

-

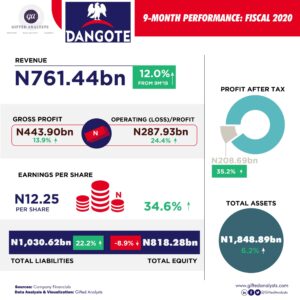

Financial Performance of Dangote Cement Plc in the First 9 Months of 2020

In the first 9 months of 2020, Dangote Cement (DANGCEM) plc was able to grow its revenue by 12% on the basis of solid production volume (+5.6% y/y to 18.40 million tonnes) with…

-

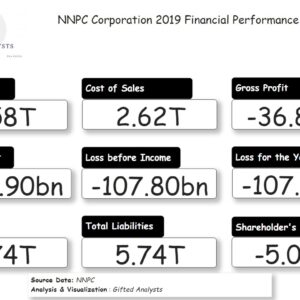

NNPC 2019 Financial Performance in Four Visuals

A simple analysis of the 2019 NNPC Group and NNPC Corporation Financial Performance

-

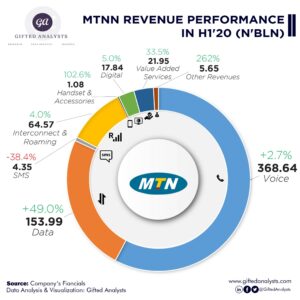

Analysis of the Financial Performance of MTN Nigeria Communications Plc in Half Year 2020

MTN Nigeria increased its subscribers base by adding 6.8m to its network totaling 71.1m mobile subscribers as of June 2020. Total revenue generated was up by 12.5% (y/y) to ₦638.08bn for the first…

-

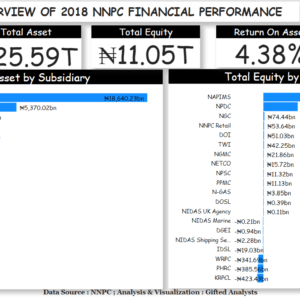

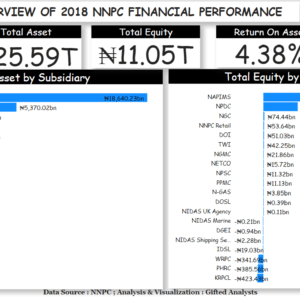

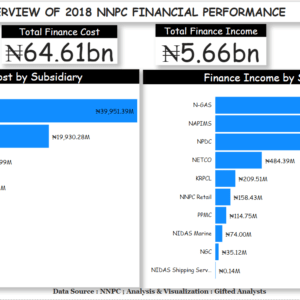

[ANALYTICS] 2018 Financial Summary of the Subsidiaries of NNPC

Analytics showing the financial summary of the 20 subsidiaries under the NNPC Group.

-

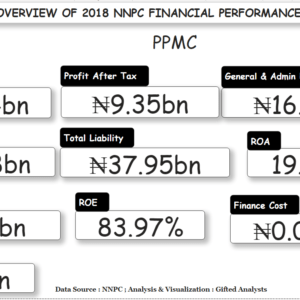

[ANALYTICS] Overview of 2018 NNPC Financial Performance

Here is Analytics showing the aggregate financial performance of NNPC in 2018 based on the results of its 20 subsidiaries.

-

NNPC: Inefficient in its Core Business, Excelling in Non-Core Areas (3)

This article provides a critical review of the financial performance of the 20 subsidiaries of the NNPC for the 2018 financial year. We also provide an aggregate figure for the Group based on…

-

NNPC: Inefficient in its Core Business, Excelling in Non-Core Areas (2)

This article provides a critical review of the financial performance of the 20 subsidiaries of the NNPC for the 2018 financial year. We also provide an aggregate figure for the Group based on…