Performance Review of Nigeria’s Vision 20: 2020 (2009- 2020)

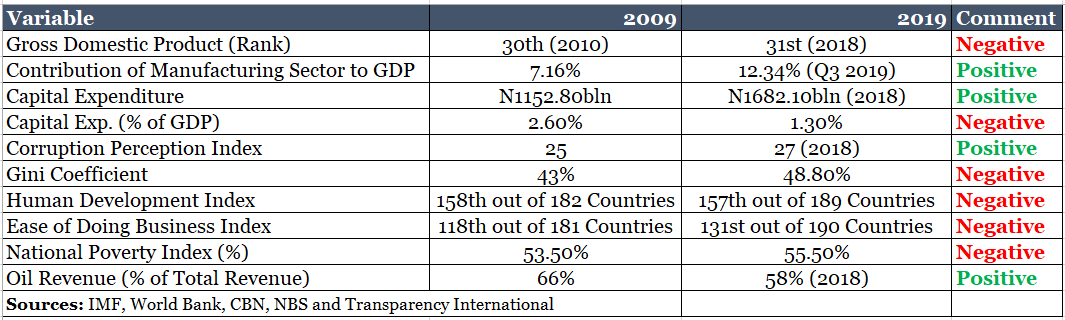

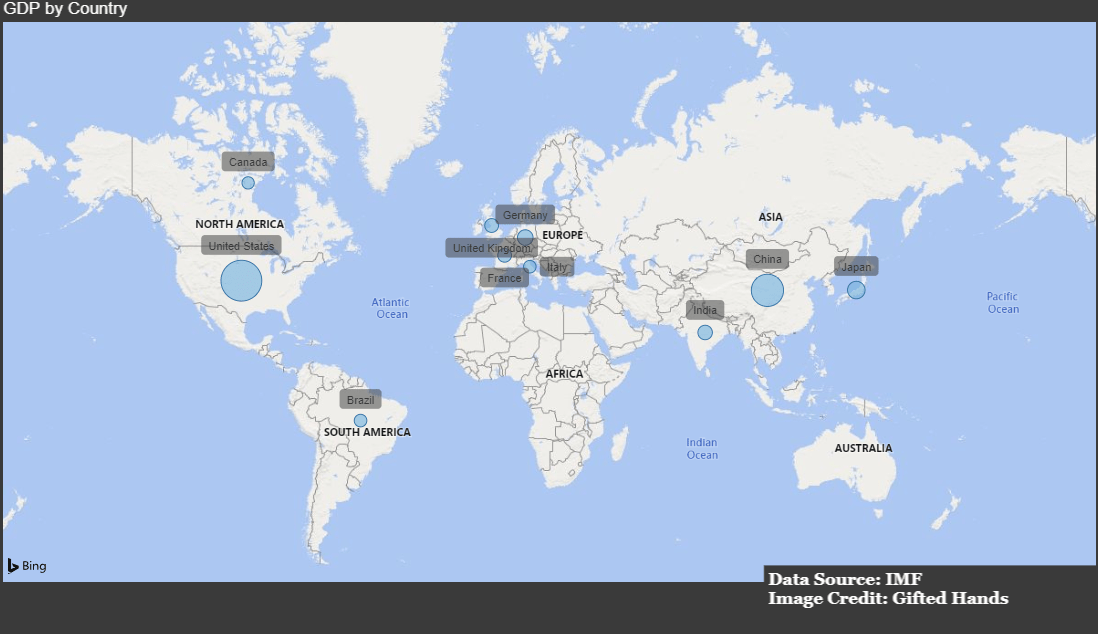

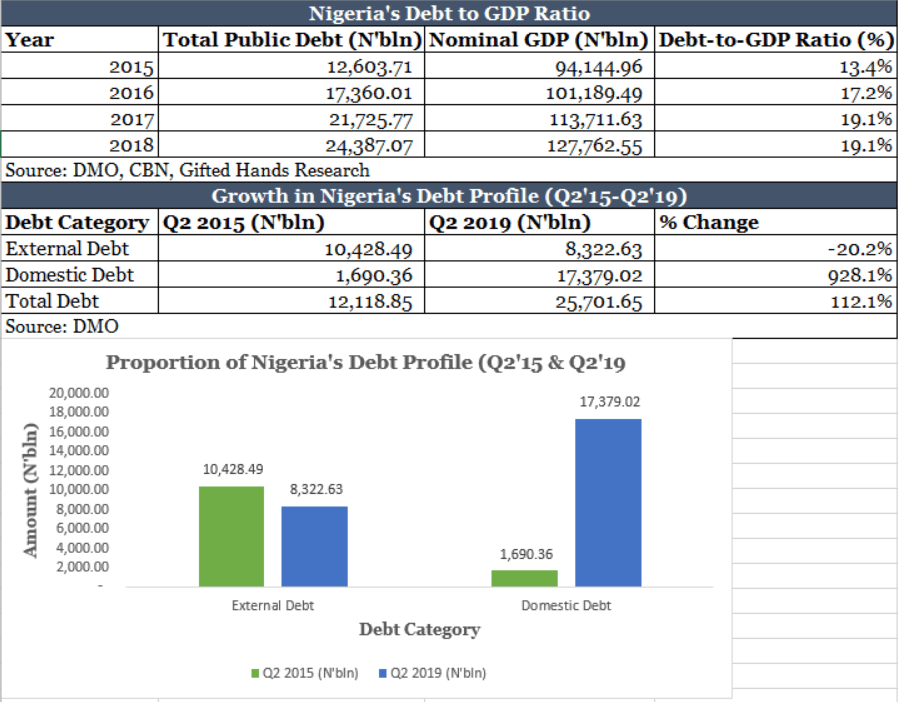

This article is inspired by the column which appeared on Punch Newspaper titled: “Vision 2020: Momento of a Failed Project”. It therefore aims to give a detailed report card of how Nigeria has performed under the three pillars while comparing the key data in 2009 with the ones in 2018 and 2019 as the need be.