-

DANGCEM Stock Pitch – by Fatai Aminat Ajiun

All forecasted indices highlighted on Dangote Cement Plc. pointed towards growth as it had been since its commencement of business. Though the major risk the company is exposed to are exchange rate fluctuations…

-

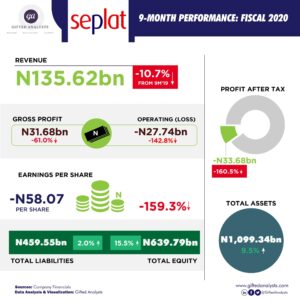

Financial Highlights of SEPLAT in the first 9 months of 2020

Although revenue declined, we note that the cost of sales surged during the period. Specifically, cost of sales was N103.94 billion compared to N70.65 billion recorded in the corresponding period of 2019. This…

-

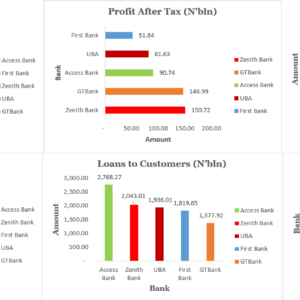

Nigeria’s Tier-1 Banks Made Interest Income of N1.52 trillion and PAT of N521.92 billion in Q3 2019

The Q3 financial statement of the five banks reveal they earned N1.52 trillion on charging interest in the first 9 months of 2019 and they made a Profit After Tax of N521.92bln in…