Nigeria’s Northern Region Records 49% Financial Inclusion Rate as Opposed to 77% Inclusion Rate in the South

Introduction

According to Enhancing Financial Innovation and Access (EFInA), financial inclusion is the provision of a broad range of high quality financial products such as savings, credit, insurance, payments and pensions, which are relevant, appropriate and affordable for the entire adult population, especially the low income and rural segment of the population.

In a glance, there are 99.6 million citizens above the age of 18 years in Nigeria in 2018. They are called the adult population. According to the CBN, of this 99.6 million adult population, 56.9% are less than and equal to 35 years, that is, are 35 years and younger as 50.1% are female while 49.9% are male.

In terms of mobile usage, the EFInA report of 2018 shows that 3.08 million (representing 3.1% of the adult population) have both mobile money and bank account while 0.3% adults have only mobile money account. Also, 82% of the adult population receive their income in cash while 10% receive their income into bank accounts or mobile money.

It is on the basis of the above background that this research aims to look into the financial inclusion statistics of Nigeria between 2008 and 2018 with much focus on 2018. This study therefore breaks down the figures into regions and geopolitical regions while giving further insights into the financial service channels as a proportion of the total adult population of the country in 2018.

Breaking down the Figures

The total adult population in Nigeria between 2008 and 2018 grew by 15% and by 13 million in nominal terms. This means that 13 million people moved into the age bracket of 18 years and above within the last 10 years in Nigeria. Of this adult population, 60.3% do not have access to or use a deposit money bank and also do not have any of the traditional banking product such as ATM card and the likes. This means that only 39.7% of the adult population are banked as at 2018. Furthermore, 14.6% of the adult population only have access to informal services and products such as esusu, ajo, etc and they do not have any formal bank account as at 2018.

From the table above also, it can be seen that the percentage of adults who have access to or use other financial institutions grew by 304.5% over 10 years to 8.9 million adults in 2018 from 2.2 million adults in 2008. The total number of those financially excluded however declined by 19.4% to 36.6 million adult population in 2018 and this is a positive result of the financial inclusion strategy of the Central Bank of Nigeria.

Financial Inclusion by Region

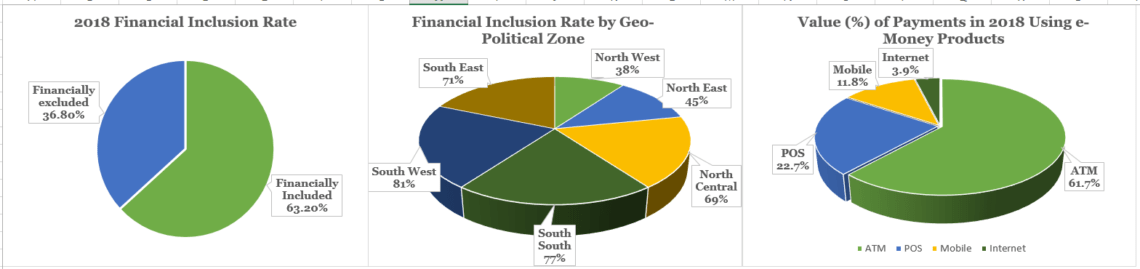

In Nigeria, 36.8% of the population are excluded from financial services. However, the total number of adults that are not banked is 60.1 million (60.3%). This therefore puts the National financial inclusion rate in 2018 at 63.2%. By region, 49% of the northern adult population are financially included while the financial inclusion rate in the southern region is 77%.

Data Source: CBN Annual Report 2018

The Northern Region

In terms of population, 23.8 million adults of the total 49 million adults in the north are financially included while the remaining 25.2 million are financially excluded. This means that there is 49% financial inclusion rate in the northern region, and this resulted from the high financial inclusion rate in the north central region. Taking the north-east and north-west region alone, their combined financial inclusion rate in 2018 was 33% while the remaining 67% of the adult population are financially excluded.

According to the 2018 Biennial Access to Financial Services in Nigeria Survey, Gombe (76%), Kano (75%) and Jigawa State (65%) are the most financially excluded states in Nigeria as their financial inclusion rates are the top three highest in the northern region of the country.

The Southern Region

The financial inclusion rate in the southern region is relatively higher than that in the northern region. In 2018, the totality of the southern region recorded a financial inclusion rate of 77% as 39.09 million adults of the 50.6 million total adults are said to be financially included while the remaining 23% are not in the financial inclusion zone.

The top three most financially excluded states in the southern part of Nigeria in 2018 according to the Biennial Access to Financial Services in Nigeria Survey, are Ebonyi (44%), Bayelsea (35%) and Akwa-Ibom (29%) which are all above the average exclusion rate of 24% in the region in 2018.

Financial Inclusion by Geo-Political Zone

It has been established earlier on that the financial inclusion rate is higher in the south than it is in the north, with the north central region pushing the financial inclusion rate high in the northern region of the country. The south western region remains the most financially included region in the country at 81% of adult population while the north western region is the most financially excluded region in the country with financial inclusion rate of 38% in 2018.

In 2018 however, the south west and the south east recorded marginal decline in their financial inclusion rate to 81% and 71% respectively from 82% and 72% recorded in 2017. The remaining four geopolitical zones recorded marginal increase in financial inclusion rates when compared with the 2017 figures. The north-west and south-south region recorded the most improvement in financial inclusion rate in 2018; Financial inclusion rate in the northern region moved from 30% in 2017 to 38% in 2018. For the south-south region, the financial inclusion rate also increased by 8% from 69% in 2017 to 77% in 2018.

Data Sources: National Financial Inclusion Annual Report, CBN 2018 Annual Report

In the north-west, the most excluded states are Kano (75%), Jigawa (65%), and Katsina (64%). Kano state with a population of about 18 million therefore has about 13.5 million people that are financially excluded.

In the north-eastern part of the country, the most excluded states are Gombe (76%), Bauchi (61%), and Yobe state (60%).

The most financially excluded states in the north central region are Nasarawa (40%), Niger (38%), and Plateau state (38%).

In the south-western part of Nigeria, Ondo (29%), Oyo (23%), and Ogun state (22%) are the most financially excluded as they record financial inclusion rates of 71%, 77% and 78% respectively.

In the south-eastern part of the country, Ebonyi state is the most excluded state with a financial exclusion rate of 44%.

Lastly, Bayelsa, Akwa-Ibom and Edo state are the most excluded states in the south-south region as they recorded financial exclusion rate of 35%, 29% and 25% respectively in 2018.

Channels for Financial Services: The backbones to Financial Inclusion

As at 2018, there were 27 licensed banks in Nigeria and they comprise of 21 commercial banks, five merchant banks, and 1 non-interest bank. Furthermore, the total number of Payment Service Banks in the country in 2018 was 35 as the number of Microfinance banks and Bureau De Change (BDCs) were 885 and 4,492 respectively.

The table shows that as at 2018, there are 39 agents per 100 thousand adults in the country of which the country requires 62 agents per 100 thousand adults as well as 500 thousand agent networks (with most of them located in the highly unbanked regions) across the country in order to meet a financial inclusion target of 80% by 2020. Also, the 2018 total ATMs in Nigeria was 18,910 of which there are 19 ATMs per 100,000 adults in Nigeria while bank branches per 100,000 adults is put at approximately 5 banks.

Payments Value using e-Money Products

In the electronic money product services section, the total value of payments using e-money products in 2018 amounted to N10.5 trillion of which N6.48 trillion worth of transactions was done through the use of Automated Teller Machines. Furthermore, PoS payment transactions in 2018 were valued at N2.38 trillion while mobile money and payment through the web were valued at N1.24 trillion and N405 billion respectively.

Data Source: CBN Annual Report 2018

Increase in the rise of the internet, ATM, mobile and POS transaction services compared to 2017 (N184.6bln, N6.4 trillion, N1.1 trillion and N1.4 trillion respectively) can be attributed to the increased awareness and public confidence in the use of the channels.

National Savings in 2018

In terms of savings rate, the total national savings increased to N15.58 trillion in 2018 from N13.4 trillion total savings of 2017 and this represents a rise in national savings by 16% in 2018. Further analysis of the savings rate showed that the banks remain the dominant depository institutions in the Nigerian financial system as they accounted for 95.2% (N14.8 trillion) of the total savings in 2018. The other financial institutions such as the insurance companies, pension fund custodians, and microfinance banks accounted for the remaining 4.8% national savings. When compared with the N127 trillion aggregate GDP of 2018, it shows that the ratio of financial savings to the GDP is still low at 12.2% (11.8% in 2017) and the reason for this is not far-fetched as most of the aggregate income is spent on the consumption of goods and services.

Conclusion

Incidentally, 2018 served as a measurement year for financial inclusion in Nigeria which saw the financial exclusion rate reduce from 41.2 million adults in 2008, to 40.1 million adults in 2016 to 36.6 million adults in 2018. This means that 63.2 per cent Nigerians are now included compared to 58.4 per cent in 2016.

A key milestone recorded in 2018 towards increasing the financial inclusion rate, was the approval of the Licensing and Regulation Guidelines for Payment Service Banks (PSBs), which seeks to provide a level playing ground and expanding the financial services space for non-traditional players with extensive distribution networks. Telecommunication firms (Telcos) and Fast-Moving Consumer Goods (FMCGs) can now set up subsidiaries to be licensed as PSBs and take advantage of the expanded ecosystem to drive financial inclusion and grow new clientele base, particularly in the underserved areas of the country, scaling up the drive for 80% financial inclusion target by 2020.

Therefore, though the financial inclusion actual statistics is far below the targets set by the CBN, it is however believed that the achievements of 2018 and the policies and initiatives implemented within the year will yield further results as we kick-off the implementation of the revised National Financial inclusion Strategy in 2019. This is anticipated to move us much closer to achieving the financial inclusion target for 2020, setting Nigeria on a pedestal to achieve sustained economic development and inclusive growth.

Download the 2018 Financial Inclusion Report Here

You might also be interested in the following articles:

- Understanding Lagos State Finances and its Preference for External Debt over Internal Debt

- More Than 90% of the 774 Local Government in Nigeria Exist to Only Pay Salaries

- Two Months to go: Performance Review of Nigeria’s Vision 20: 2020 (2009- Oct 2019)

- The World, Africa, West Africa and Nigeria’s Economy in 2018

- Demystifying Nigeria’s Conscious Attempt to Keep a Low Debt Profile as Debt Servicing Becomes Worrisome

You May Also Like

Sesame Seed as a Nigerian Cash Crop- An Unsung Hero

October 6, 2019

Tracking Trade During the COVID-19 Pandemic

May 15, 2020