Introduction

By definition, Tier 1 banks are the banks that their financial capital are considered most reliable. The tier-1 capital is seen simply as the core measure of a bank’s financial strength from the point of view of the regulators (in the Nigerian scenario, the CBN). In Nigeria, the tier-1 banks are shortened using an acronym- FUGAZ which is First Bank, United Bank of Africa (UBA), Guaranty Trust Bank (GTBank), Access Bank and Zenith Bank.

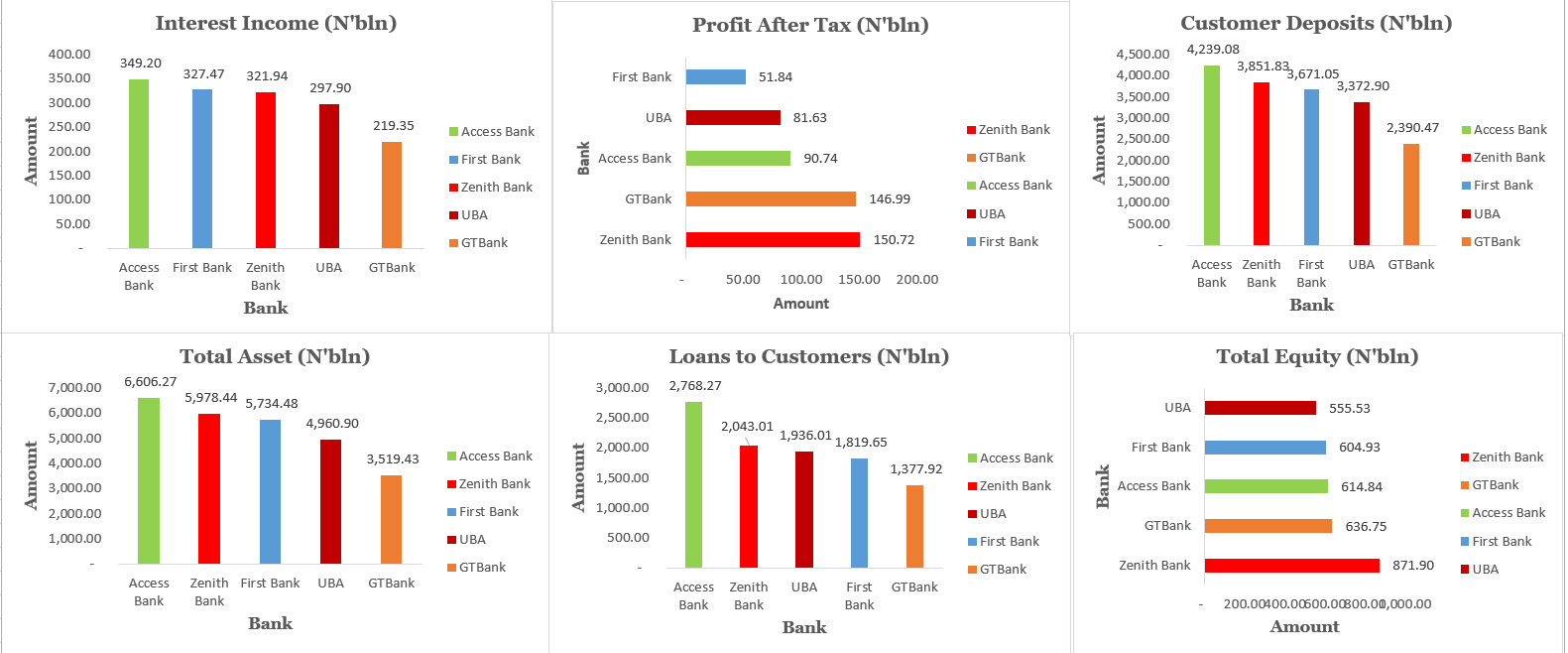

The Q3 financial statement of the five banks reveal they earned N1.52 trillion on charging interest in the first 9 months of 2019 and they made a Profit After Tax of N521.92bln in total. This research work therefore aims to further break down the financial performance of each of the five banks while also ranking them based on how they have performed from January 2, 2019 to September 30, 2019.

Ranking Based on Interest Income

As noted earlier, the FUGAZ banks made a total of N1.52 trillion as interest income during the period under review of which Access Bank topped the rank with 23% of the total amount (N349.20bln) while First bank and Zenith bank came second and third with interest income of N327.47bln and N321.94bln respectively.

Source: Companies Q3 Financial Statement

GTbank during the period, emerged as the lowest earning of interest income among the tier-1 banks as it earned N134.67bln from interest on loans and advances to customers and N202.09 million from interest on loans and advances to banks. Other components of its interest earnings are interest on investment securities and assets pledge as collateral.

UBA on the other hand, earned N3.3bln as interest on loans and advances to banks and N150.68bln as interest on loans and advances to customers during the period. Interest on investment securities amounted to N130.58, thereby making the interest income for the period under review to total N297.90bln (including interest on cash and bank balances at N13.305bln).

Ranking Based on Profit After Tax (PAT)

Zenith However topped the list as the most profitable bank as it made a total Profit After Tax for N150.72bln for the first 9 months of 2019, followed by GTbank with a value of N146.99bln as Profit After Tax has been deducted.

Source: Companies Q3 Financial Statement

GTBank with the lowest interest income, competes heavily with Zenith Bank in the race for the most profitable bank in 2019, and this is aided by a low interest expenses at N51.25bln compared to first bank interest expenses at N116.031bln which is more than double that of GTBank, Access Bank interest expenses of N194.81bln, Zenith bank interest expenses valued at N107.311bln and UBA interest expenses valued at N138.99bln. Also, its fee and commission income (income largely related to charges raised by the bank on holders of other ATM cards, who used the bank’s machines while transacting business; and SMS alert related expenses) during the period was N48.38bln. The company also earned other income valued at N43.82bln while it kept personnel expenses low at N27.299bln (First bank- N71.61bln, UBA- N55.204bln, Access Bank- N54.69, and Zenith Bank at N57.065bln).

Ranking Based on Total Assets

Not only led in interest income, Access bank also led the tier-1 banks in terms of total assets as its total assets as at 30th September 2019 was N6.6 trillion as loans and advances to customers hits 42% of the total assets. Zenith bank came second with total assets valued at N5.98 trillion while First bank with a total asset of N5.73 trillion came third in the rank.

Total asset of Access Bank was impacted by its merger with Diamond Bank as its total asset increased by 33% from N4.95trillion as at December 2018 to N6.60 trillion as at September 2019. For GTBank and UBA, loans and advances to customers also constitute the largest share of each of their total assets at 39% as GTBank had N627.22bln in cash and bank balances.

Ranking Based on Loans and Advances to Customers

Giving of loans and advances to customers represent a major business of banks which brings majority of their gross earnings during a financial period. Hence, it is not surprising to see that loans and advances constitute a larger proportion of their total assets as interest earning represent the largest share of their total gross earnings.

During the period under review, Access Bank gives out the most loans and advances to their customers as its loans and advances as at 30th September 2019 amounted to N2.77 trillion while Zenith Bank came second with loans and advances to customers totaling N2.04 trillion as at 30th September 2019. Overall, the loans and advances to customers by the tier-1 banks amounted to N9.94 trillion as at 30th September 2019 with GTBank having the lowest loans and advances to its customers at N1.38 trillion.

Ranking Based on Customers’ Deposits

The structure of loans and advances to customers is somewhat similar to customers’ deposits of the tier-1 banks as Access bank still leads in the rank while GTBank came lowest in the rank among the tier-1 banks.

This time around however, First bank and UBA switched sides as First banks has more customers’ deposits than UBA. This shows that First bank gives out less loans to its customers as UBA gives more loans to its customers.

Ranking Based on Loan to Deposit Ratio

Recall that the CBN fined some banks on the 2nd of October 2019, for not meeting the 60% loans to deposits ratio. Zenith bank, First Bank, GTBank and UBA were the tier-1 banks fined at N135.63bln, N74.67 billion, N25.15 billion and N99.68 billion respectively. The loan to deposit ratio has now been raised to 65% for the last quarter of the year.

Of all the tier-1 banks, Access Bank is the only bank that met the loan to deposit ratio. If the rate at which its customers deposits and loans to customers increases at a constant rate in the last quarter of 2019, then the bank would meet the CBN directive. The table therefore shows that while other banks are improving on their loans to deposit ratio, First banks is still struggling as its loan to deposit ratio is even still less than 50%.

Ranking Based on Total Equity

Based on total equity, Zenith bank has the largest equity value at N871.90bln, followed by GTBank with total equity value of N635.75bln. Access bank, First bank and UBA came followed the ranking with total equity values of N614.84bln, N604.93bln and N555.53bln respectively.

Ranking Based on Return on Equity

Return on Equity is the measure of the rate at which a company uses its assets to raise profit for its shareholders and it is calculated by dividing the PAT of the company by the total equity of that company. Here, the PAT of each of the companies for the period under review was divided by their respective total equity during the period under review.

The table above shows that of the tier-1 banks, GTBank is the most efficient in terms of using its assets to raise profit for its shareholders. The bank is the most cost effective going by what has been established earlier on and it also reflects here as it creates more wealth for its shareholders than the other banks. While Access Bank and UBA are trying to do more to maximize their shareholders wealth, First Bank still lags behind as its ROE is still on one digit at 8% as GTBank creates wealth for its shareholders, more than double the rate at which First Bank creates for its own shareholders.

For further enquires, questions, opinions and contributions, you can feel free to send in your comments through the comment section.

Related Articles

1. Analysis of the Operations and Performance of MTN Nigeria and Airtel Nigeria as at September 30, 2019

2. More Than 90% of the 774 Local Government in Nigeria Exist to Only Pay Salaries

3. Two Months to go: Performance Review of Nigeria’s Vision 20: 2020 (2009- Oct 2019)

4. The World, Africa, West Africa and Nigeria’s Economy in 2018

5. Demystifying Nigeria’s Conscious Attempt to Keep a Low Debt Profile as Debt Servicing Becomes Worrisome

6. Average Official Exchange Rate Increases by 132% in 14 Years; External Reserve Grew by 51%

8. Will The Price of a Bag of Rice Fall Anytime Soon?

9. Significant Relationship among the Components of a Misery Index: The Nigerian Scenario

10. Sesame Seed as a Nigerian Cash Crop- An Unsung Hero

11. Simple Analysis of ORide’s Business Model

12. Analyzing Time Series Data Using Eviews: A case for Single Equation

13. Using Excel for Data Analysis

Thank you. And to add.

Reason why Gtbank earns less from Interest income is because they don’t focus much on giving loan like the other banks. Their strength is more in deposit mobilization.

Their income may further be reduced as they have decided to waive all charges on their GTcrea8 account which is a great development by the nation’s most Capitalzed bank.

Kudos to Giftedanalysts and Team for this wonderful piece.

Thank you solutionwheels. It is definite that their income will reduce with waiver on all charges for those within 16 and 25 years bracket. But should be partly offset by their strategy in cutting costs while looking for other ways to earn income.