Nigeria’s Tax Reform: Easing the Burden on the Taxpayer and Tax Collector

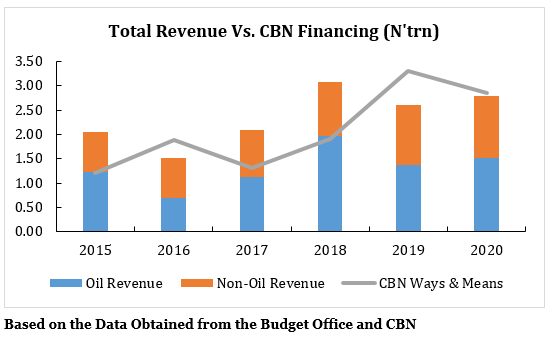

In an ever-evolving economic landscape, Nigeria stands at a critical juncture, poised to reform its tax system to address the longstanding challenges faced by both taxpayers and tax collectors. The burden of taxation has weighed heavily on individuals and businesses for years, often accompanied by inefficiencies in revenue collection that hinder the government’s ability to provide essential services. However, with a renewed commitment to tax reform exemplified by initiatives like the newly established Presidential Fiscal Policy and Tax Reform Committee, Nigeria is embarking on a transformative journey aimed at not only lightening the load on its taxpayers but also streamlining the processes for tax collection. This paradigm shift signifies an important moment in the nation’s fiscal history, promising improved equity, transparency, and efficiency in the tax system, ultimately fostering economic growth and development for the benefit of all stakeholders. Therefore, the objective of this article is to examine reforms that can alleviate the challenges faced by both tax collectors and taxpayers.