Slow-Healing Scars: The Pandemic’s Legacy

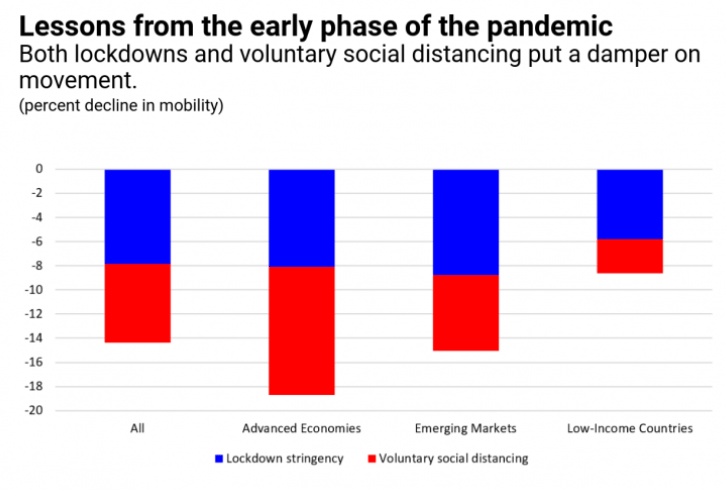

Recessions wreak havoc and the damage is often long-lived. Businesses shut down, investment spending is cut, and people out of work can lose skills and motivation as the months stretch on. But the recession brought on by the COVID-19 pandemic is no ordinary recession. Compared to previous global crises, the contraction was sudden and deep—using quarterly data, global output declined about three times as much as in the global financial crisis, in half the time.