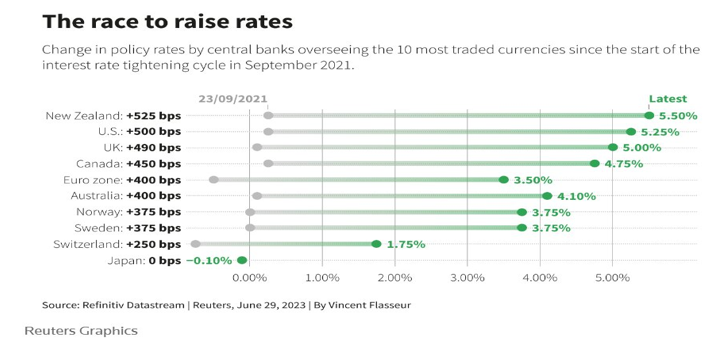

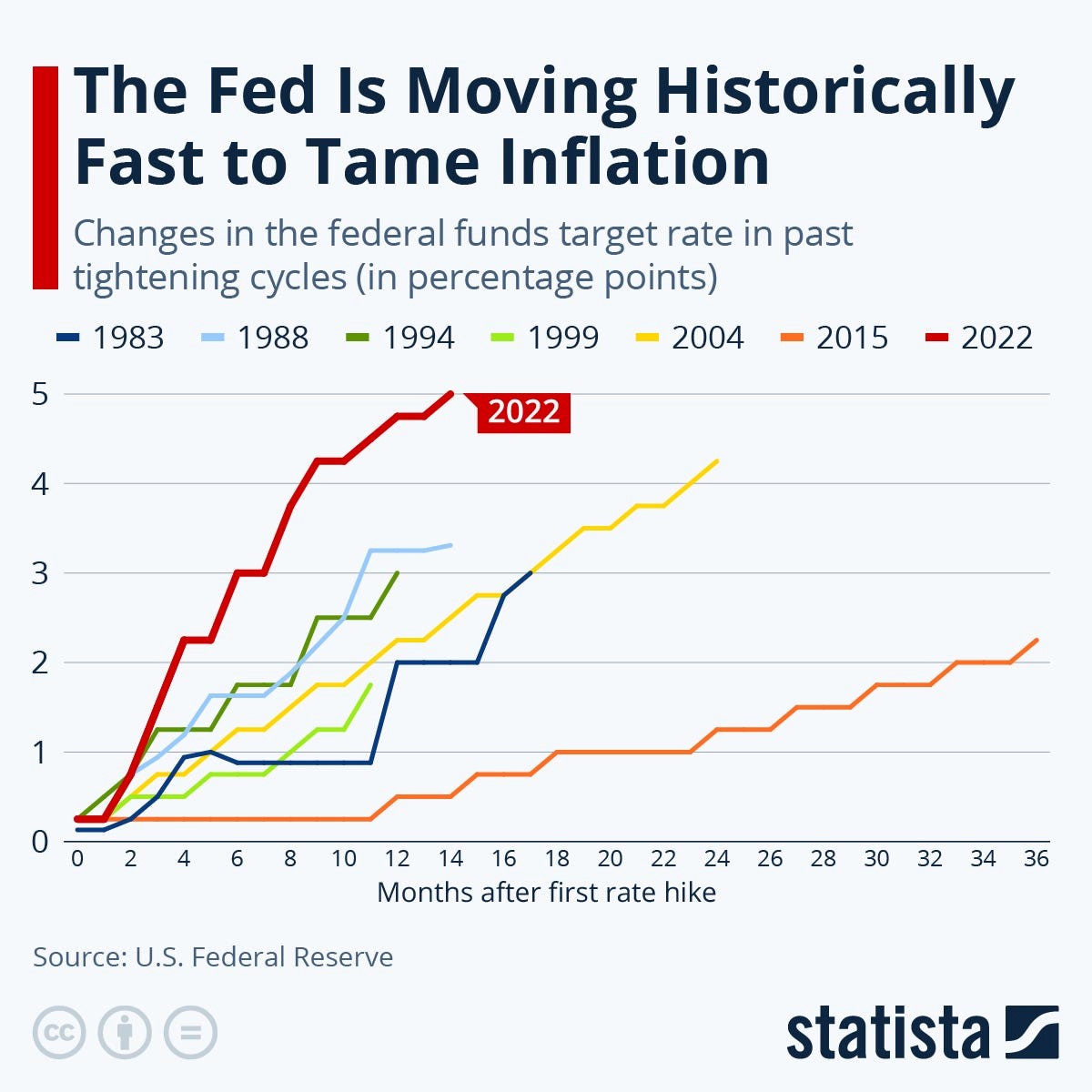

The Federal Reserve Bank of the United States of America, also referred to as “The Federal Reserve” or “The Fed” or “The U.S. Fed,” has an almost monopolistic influence on the functioning and operation of global economies. Due to the U.S. dollar’s status as the World Reserve Currency (WRC) and the currency of choice (or circumstance) for international trade and commerce. The Federal Reserve, which is the apex bank of the world’s largest economy, serves almost as the de facto central bank for the rest of the world, and as such, decisions made within its walls ripple through the halls of other central banks and international/continental financial institutions.

In the first of two pieces on this subject, I will make an effort to present a clear and short explanation of what monetary policy is, how the Federal Reserve has worked to rein in inflation in a manner that is consistent with the objectives that it has articulated, and how inflation is proving to be structural in the economies of the United States and the rest of the world.