2021 IMF Free Courses for you

By IMF Institute for Capacity Development

We are pleased to announce these free online courses on the edX platform starting in May, including our new course on Inclusive Growth (IGx). All courses have a single deadline at the end of dates below, many ending on August 31 and some ending April 15, 2022.

Sign up today to begin learning and visit our IMF Institute Learning Channel on YouTube.

NEW COURSE – Inclusive Growth

IGx (May 24, 2021 – July 21, 2021)In this course, IMF economists will introduce you to the roles of the private sector and government in fostering inclusive growth. You will explore how many critical issues of our day—including rising inequality and poverty, gender disparities, job-displacing technological change and globalization, corruption, and climate change—are interlinked and how to design policies to tackle them. We’ll provide you state of the art knowledge on these issues and how you can apply it to your country.

Click here to view a video about this course.

Government Finance Statistics

GFSx (May, 2021 – August 31, 2021)This course focuses on both the conceptual framework of government finance statistics (GFS) as presented in the IMF’s Government Finance Statistics Manual 2014 (GFSM 2014, the update of the 2001 edition), and on practical aspects of data compilation. The basic concepts, definitions, accounting rules, classifications and presentation tables of the GFS framework are discussed. The compilation and dissemination of comprehensive and cross country comparable GFS are explained. Finally, the course shows how to use GFS to evaluate the impact of government activities on a country’s economy.

Click here to view a video about this course.

Balance of Payments and International Investment Position Statistics

BOP-IIPx (May, 2021 – August 31, 2021)This course covers the fundamentals needed to compile the international accounts. The course introduces the conceptual statistical framework for balance of payments and IIP-as presented in the Balance of Payments and International Investment Position Statistics Manual, sixth edition (BPM6), which is harmonized with other macroeconomic statistical frameworks. You will learn about the current, capital, and financial account balances, and how they reflect your economy’s interaction with the rest of the world. Basic concepts, definitions, and classifications are covered, along with the principal accounting rules (including valuation and time of recording) that are relevant for compilation of the international accounts. The course also discusses the functional categories, including direct investment. The need for integration of the balance of payments with the IIP for compiling comprehensive, internationally comparable statistics will also be discussed.

Click here to view a video about this course.

Debt Sustainability Framework for Low Income Countries

LIC-DSFx (May, 2021 – August 31, 2021)The LIC DSF was developed by the IMF and the World Bank (WB) to help low-income countries achieve their development goals while minimizing the risk of debt distress. This one-module course will allow you to understand the LIC DSF, and thus interpret the LIC DSF outputs presented in WB and IMF reports. The course walks you through the steps involved in applying the LIC DSF. First, we identify data requirements and the “realism tools” used for assessing the plausibility of macroeconomic projections. You will next understand how the LIC DSF computes a country’s debt-carrying capacity, which is used for determining thresholds for the debt-burden indicators. When a debt-burden indicator breaches its threshold under either the baseline or stress test scenarios, this signals risk of debt distress. The course concludes with exploring how judgment can be used to arrive at a final risk rating.

Click here to view a video about this course.

Public Debt, Investment, and Growth: The DIG and DIGNAR Models

DIGx (May, 2021 – August 31, 2021)This online course explains how to analyze the relation between public investment, growth, and public debt dynamics, using two dynamic structural models: the Debt, Investment, and Growth (DIG) model and the Debt, Investment, Growth and Natural Resources (DIGNAR) model. The course presents and discusses the key pieces of these models (the investment-growth nexus, the fiscal adjustment, and the private sector response) and their interactions, which helps understand and assess the macroeconomic effects of public investment scaling-up plans, including on growth and debt dynamics. It elaborates on important factors that may shape these effects such as the type of fiscal financing, the rate of return of public capital, the efficiency of public investment, and the capacity of governments to mobilize revenues.

Click here to view a video about this course.

Medium-Term Debt Management Strategy

MTDSx (May, 2021 – August 31, 2021)The course explains the joint International Monetary Fund-World Bank (IMF-WB) MTDS framework and provides comprehensive training on the accompanying analytical tool, the MTDS AT. The MTDS AT is useful for analyzing quantitatively the cost-risk characteristics of an existing debt portfolio, as well as the cost-risk trade-offs of alternative financing strategies. Participants are taught how to develop financing strategies by taking account of the composition of the existing debt portfolio, developments in key macroeconomic and market conditions, potential sources of financing, and linkages with broader medium-term macroeconomic framework, including debt sustainability.

Click here to view a video about this course.

Financial Programming and Policies, Part 1: Macroeconomic Accounts & Analysis FPP.1x (May, 2021 – August 31, 2021)Financial programming is a framework to analyze the current state of the economy, forecast where the economy is headed, and identify economic policies that can change the course of the economy.

Learn the basic skills required to conduct financial programming. The course presents the principal features of the four main sectors that comprise the macroeconomy (real, fiscal, external, and monetary); demonstrates how to read, interpret, and analyze the accounts for these sectors; and illustrates how these sectors are interlinked.

Financial Programming and Policies, Part 2: Program Design

FPP.2x (May, 2021 – August 31, 2021)

Improve your skills in macroeconomic policy analysis and learn to design an economic and financial program, using real economic data. The financial programming exercise simulates what IMF (International Monetary Fund) desk economists routinely do in their country surveillance and program work.

Financial Market Analysis

FMAx (May, 2021 – August 31, 2021)

This course is designed to provide a common language in finance, thus allowing you to interpret and analyze financial data. It will also provide you with a foundation upon which you can proceed to more advanced or policy-oriented training in areas in which macroeconomics and finance meet.

Click here to view a video about this course.

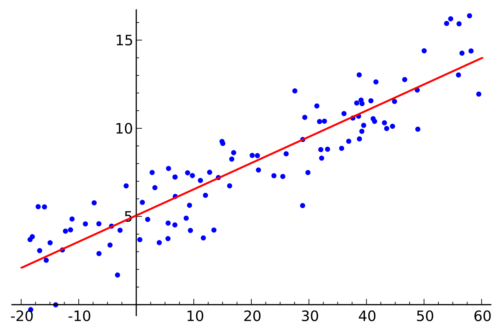

Macroeconometric Forecasting

MFx (May, 2021 – August 31, 2021)

Build skills in macroeconometric forecasting and policy scenario analysis. This hands-on course focuses on the application of econometric techniques for modeling macroeconomic variables (e.g.: consumption, investment, inflation, etc.) and their response to policy changes.

If you are looking for training in the science (and art) of building forecasting models, this is the course for you!

Model-based Monetary Analysis and Forecasting

MPAFx (May, 2021 – August 31, 2021)

Learn about the macroeconomic motivation of the quarterly projection model (QPM), its key properties, model calibration, data filtration, and how to implement the QPM in MATLAB software in order to learn and understand practical model building and model operation as it is usually done in central banks.

Click here to view a video about this course.

Public Financial Management

PFMx (May, 2021 – April 15, 2022)

This course will strengthen your ability to assess why Public Financial Management (PFM) is important; and how it supports macroeconomic stability, economic growth, and the achievement of the Sustainable Development Goals.

Presented by staff of the International Monetary Fund who provide advice to countries on their PFM institutions and reform plans, the course provides a practitioner’s view to PFM starting with what PFM is, and why it is important. Over five parts, the course modules cover all stages of the budget cycle, and discuss key concepts from budget preparation, to government accountability in budget execution, and reform implementation.

Click here to view a video about this course.

RA-Gap Tax Gap Analysis

VGAPx (May, 2021 – April 15, 2022)

This course provides instruction on how to prepare and execute the Revenue Administration Gap Analysis Program (RA-GAP) universal VAT gap model. The course focuses on four main pillars: what is the VAT gap; how the VAT gap is measured by the IMF RA-GAP; how to prepare the worksheets to execute the IMF RA-GAP VAT gap model; and how to troubleshoot the IMF RA-GAP VAT gap model after execution.

Click here to view a video about this course.

Foundations of Central Bank Law

FCBLx (May, 2021 – August 31, 2021)

This online course introduces participants to the foundations of central bank law. The course covers the legal issues that are necessary to support sound and effective central banks. It addresses the legal nature and ownership structures of central banks, the legal underpinnings of their mandates, decision-making structures, autonomy, accountability, transparency, and the legal aspects of their key functions. This interactive course combines theoretical discussions and examples of best practices with practical exercises and polling questions on how to analyze and design central bank legal frameworks.

Click here to view a video about this course.

Financial Development and Financial Inclusion

FDFIx (May, 2021 – August 31, 2021)

This course outlines the macroeconomic relevance of financial development and financial inclusion. Beginning with an analytical framework that defines the role of finance in the economy, the course reviews the conceptual and empirical literature on the impact of finance on macroeconomic performance and growth. It also addresses key policy issues to encourage financial development (market-enabling policies) and limit its potential destabilizing effects (market-harnessing policies). The course introduces financial inclusion as an integral dimension of financial development—a perspective that has only recently received proper attention, as the discussion for many years revolved around the concept and measure of financial depth. The course reviews the indicators currently used to measure financial inclusion, the distinct macroeconomic impact of financial inclusion, and the main policy strategies that have been pursued.

Click here to see a video introducing the course.

This course was developed by the IMF in collaboration with the European Investment Bank.

Macroeconomic Diagnostics

MDSx (May, 2021 – August 31, 2021)

Learn applied tools that will allow you to assess the economic situation in a country. These analytical tools are the ones most used by applied macroeconomists—including those at the IMF. Learn both how to technically implement these tools and to interpret their results.

Beyond the tools themselves, we will also be showing how to refine and interpret their output. We will be doing more than just plugging numbers into a spreadsheet formula. We will want to use the results of these tools – filtered through our judgement – to develop a narrative of a country’s economic situation.

Energy Subsidy Reform

ESRx (May, 2021 – April 15, 2022)

In the first part of the course, economists from the IMF will introduce the definition and measurement of subsidies, and then describe the economic, social, and environmental implications of subsidies. The second part of the course has two principal purposes: first, to review what works best in energy subsidy reform, in light of country experiences globally; and second, to illustrate successes and failures in particular country contexts by summarizing some case studies.

Whether you are a civil servant working on economic issues for your country or simply interested in better understanding issues related to energy subsidies, this course will provide hands-on training on the design of successful reforms of energy subsidies.

Click here to view a video about this course.

Macroeconomic Management in Resource Rich Countries

MRCx (May, 2021 – April 15, 2022)

Learn about macroeconomic policy issues and challenges that confront resource-rich countries (RRCs)!

Natural resources such as oil, gas, and minerals, can make a significant difference to a country’s exports and economic growth. Being rich in natural resources has allowed some countries to accumulate large financial assets abroad, enabling them to invest in schools, hospitals, and roads to promote growth and diversification. However, natural resources come with challenges too. In addition to the reality that these resources will eventually run out, policy-makers must cope with the volatility of prices.

Click here to see a video introducing the course.

Compilation Basics for Macroeconomic Statistics

CBMSx (May, 2021 – August 31, 2021)

This course covers concepts, definitions, and principles commonly applied in the compilation and dissemination of all macroeconomic statistics. You will learn the basics about residence, institutional units, institutional sectors, stock positions and economic flows, accounting rules for macroeconomic statistics, financial instruments in the balance sheet, the IMF’s Data Standards Initiatives, and the basic macroeconomic linkages between the accounts of the real, fiscal, external, and financial sectors.

Click here to see a video introducing the course.

Public Sector Debt Statistics

PSDSx (May, 2021 – August 31, 2021)

This course covers the fundamentals needed to compile and disseminate comprehensive public sector debt statistics (PSDS) that are useful for policy- and decision-makers, as well as other users.

It introduces the conceptual statistical framework for PSDS—as presented in the Public Sector Debt Statistics: Guide for Compilers and Users—in the context of the government finance statistics (GFS) framework, which is harmonized with other macroeconomic statistical frameworks. Basic concepts, definitions, and classifications are covered, along with the principal accounting rules (including valuation and consolidation) that are relevant for PSDS compilation.

It discusses the recommended the instrument and institutional coverage for compiling comprehensive, internationally comparable PSDS, and how to record contingent liabilities such as government guarantees. It also deals with the impact on PSDS of some debt-related issues such as debt assumption, debt forgiveness, on-lending, financial leases, and financial bailouts.

Important PSDS compilation considerations—including what PSDS to compile and disseminate—and the IMF’s guidelines and standards on disseminating PSDS are also covered. The course also presents possible uses of PSDS, including debt sustainability analyses (DSA), and fiscal risk and vulnerability analyses.

Click here to see a video introducing the course.

IMFx

International Monetary Fund

Washington, D.C.