The Federal Reserve Bank of the United States of America, also referred to as “The Federal Reserve” or “The Fed” or “The U.S. Fed,” has an almost monopolistic influence on the functioning and operation of global economies. Due to the U.S. dollar’s status as the World Reserve Currency (WRC) and the currency of choice (or circumstance) for international trade and commerce. The Federal Reserve, which is the apex bank of the world’s largest economy, serves almost as the de facto central bank for the rest of the world, and as such, decisions made within its walls ripple through the halls of other central banks and international/continental financial institutions.

In the first of two pieces on this subject, I will make an effort to present a clear and short explanation of what monetary policy is, how the Federal Reserve has worked to rein in inflation in a manner that is consistent with the objectives that it has articulated, and how inflation is proving to be a structural in the economies of the United States and the rest of the world.

Monetary Policy and its Ultimate Aim

Monetary policy is a set of tools used by a nation’s central bank to control the overall money supply and promote economic development. These tools include revising interest rates and adjusting bank reserve requirements.

The Federal Reserve has a dual mandate to accomplish maximum employment while maintaining price stability (or managing inflation) when implementing monetary policy. Globally, all central banks have access to essentially the same array of instruments to accomplish slightly different mandates. However, for every Central Bank, it all comes down to maintaining inflation at a level that does not impede economic development.

Two primary categories of monetary policy are employed depending on the level of economic growth or stagnation. The types of monetary policy are:

• Expansionary Monetary Policy: Used during slowdowns or recessions, it lowers interest rates to encourage consumer spending and borrowing and reduce savings.

• Contractionary Monetary Policy: To slow growth and minimize inflation, a contractionary policy raises interest rates and limits the money supply.

Central Banks around the globe rely on a few instruments to accomplish optimal monetary policy, these instruments are:

• Interest Rates: The central bank may alter the interest rates or collateral requirements it imposes. This rate is known as the discount rate in the United States. Depending on this interest rate, banks may lend more or less liberally.

• Open Market Operation, or OMO, is the open market purchase and sale of government bonds and treasury bills by central banks. OMOs aim to modify the level of reserve balances to manipulate short-term interest rates, which in turn affects other interest rates, it is popularly described as Quantitative Easing or Tightening.

The ultimate objective of monetary policy is to make decisions that will enable sustainable long-term economic growth with the control and management of the money supply. This article will focus predominantly on how the U.S. Fed is combating inflation using interest rate policy as its primary instrument to ensure long-term economic prosperity.

The Fed’s Fight Against Inflation and How U.S Dollar Inflation Affects Trade in the World

The Federal Reserve is tasked with combating inflation, and since 2009 has set a somewhat arbitrary target inflation rate of 2%-2.5%. Inflation in the United States has remained within this range on average for almost 15 years, with The Federal pursuing a contractionary monetary policy agenda by increasing interest rates whenever inflation went above its stated target range, and reducing interest rates and encouraging money supply when inflation fell below this range to avoid deflation in the economy or a situation in which economic activity slows and prices of goods and services fall.

Earlier in this article, I mentioned how the US Dollar plays a crucial role in international trade and how the Fed, as the US Dollar’s custodian, has a significant impact on the functioning of the world’s economies by executing its monetary policy objectives. The Fed is tasked with keeping inflation in check and thus influences the value of the US Dollar by executing its monetary policy objectives.

An increase in the value of the U.S. dollar affects international commerce by increasing input costs for goods and services and making imports of items priced in dollars more expensive. Higher inflation in the United States and the global currency of trade naturally flows through the supply chain and leads to what is known as Cost-Push Inflation. Higher prices arise due to Increases in input costs such as wages of employees, cost of materials or equipment and higher cost of capital, this eventually leads to higher prices of goods and services as the increase in input costs are passed down to customers. Higher prices of global goods and commodities also impact global trade as importing countries also feel the impact of more expensive products.

Demand-Pull Inflation is another way in which inflation of the U.S. dollar affects global trade. Demand-Pull Inflation occurs when too much money chases too few goods or services, or when demand exceeds supply. With higher inflation in the United States due to excessive demand or shortages of certain goods, the U.S. dollar, the primary currency for trade and the Global Reserve Currency becomes more expensive or difficult to acquire to pay down debt, purchase equipment, conduct trade, and meeting other foreign currency requirements.

Import-dependent economies already suffering from low productivity and high cost of capital to finance socio-economic projects or expand manufacturing and industrial sectors of the economy experience a slowdown in economic activity because of increased difficulty in accessing foreign currency.

Ultimately, the actions (or inactions) of the U.S. Federal Reserve regarding what constitutes sustainable inflation and how it maintains such inflation have a significant impact on global trade and commerce.

U.S and Global Inflation in Post-pandemic World

Since the beginning of the pandemic, the U.S. and the entire global economy have experienced an unprecedented rise in inflation, which peaked at a 40-year high in most of the Organisation for Economic Co-operation and Development (OECD) nations such as the United Kingdom and Germany and reached catastrophic levels in sub-Saharan Africa and certain nations in the Middle East, Southeast Asia, and South America.

What has caused these unprecedented inflationary pressures? Too much money is in circulation because of previous expansionary policies, food and energy scarcity across the globe, and a shift in global supply chains.

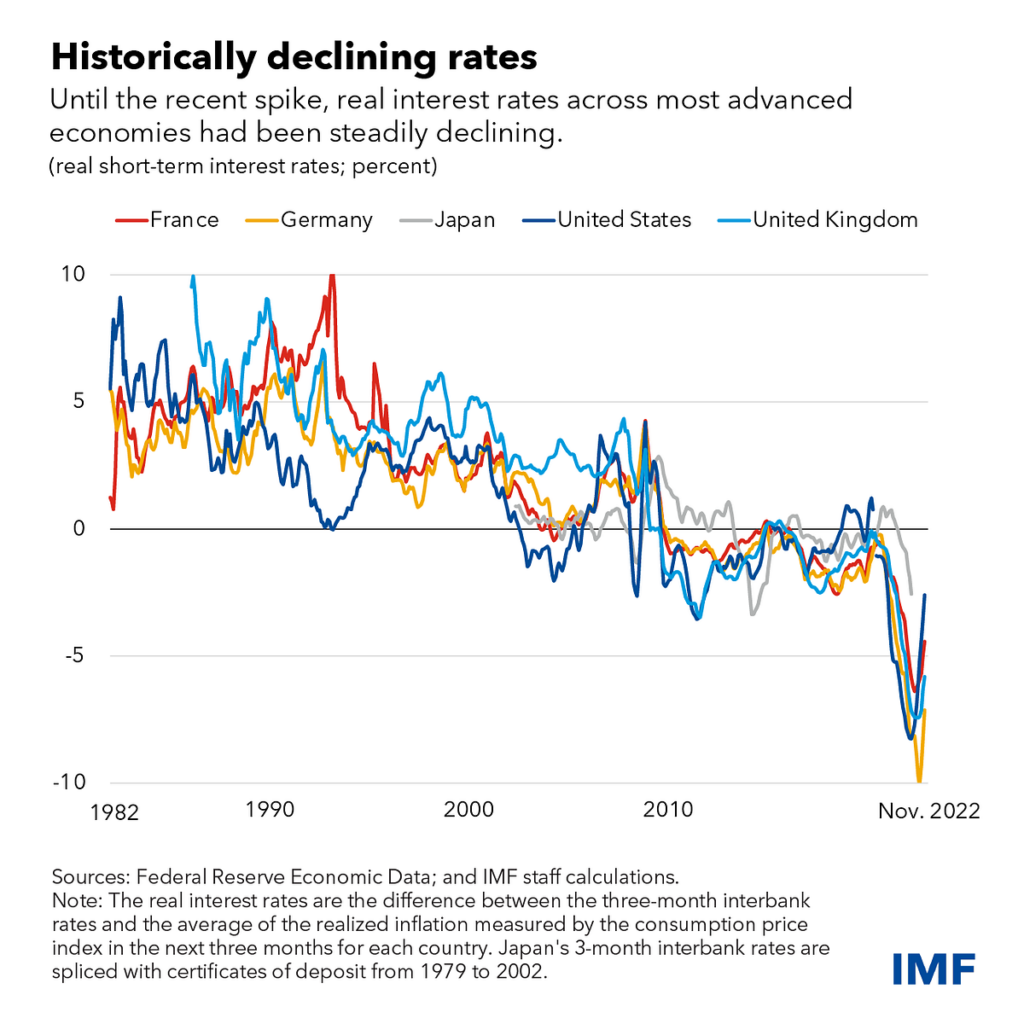

The pandemic prompted a significant shift in global economic supply chains and a relaxation of fiscal and monetary policy. Monetary policymakers favoured a Zero Interest-Rate Policy (ZIRP) program which is characterized by ultra-low interest rates set by central banks on loans and government bailout and stimulus packages to sectors of the economy, and citizens, to stimulate economic activity and the growth of new industries or to ensure the survival of essential sectors of the economy.

The U.S. Federal Reserve and other central banks around the world before and during the pandemic employed ultra-low interest rate policies that made it easier for businesses and individuals to borrow money and expand economic activities. There was also a spate of stimulus packages by central governments to businesses and individuals, which led to an excessive supply of money in the economy chasing a shortage of goods and services caused by lockdowns and uncertainty of global trade.

In addition, the special military operation in Ukraine and the sanctions policy against Russia caused food and energy shortages in Europe and other developing nations. As Europe was no longer able to rely on cheap oil and gas from Russia, a vacuum was created to supply Europe’s residential and industrial needs, an energy crisis ensued, and Brent Oil reached a near decade-high average annual price of $101 per barrel in 2022, a 42% increase from the previous year average annual price and a 240% increase from the average annual price in 2020, which was the peak of the pandemic. In Europe and other parts of the world, Diesel, Natural Gas, and (LNG) prices doubled and even quadrupled in some regions because of the reopening of the global economy following the pandemic, changes in global energy supply chains, some shortages, and uncertainties caused by the special military operation in Ukraine.

Higher cost of fuel and disruption of food and fertilizer supplies from Russia and Ukraine have caused a rise in headline inflation, with higher food and energy prices accounting for the largest portion of inflation in the U.S., Europe, Africa, and other regions.

Recent spikes in food and energy prices have been most pronounced in sub-Saharan Africa, the middle east, and southeast Asia, where food and energy make up a significant portion of the cost of living for most of the population.

The transition in energy supplies away from Russia by EU countries is an additional element of the inflation narrative. European Union nations have decided to wean themselves from Russia due to the conflict in Ukraine, European nations have lost the benefit of cheap and reliable oil and gas which they got from Russia, and this has resulted in more expensive energy purchases from other sources. The increased energy costs are then passed on to the final consumer and companies in the form of higher energy bills.

A further shift in global supply chains has been the onshoring and nearshoring activities of several companies relocating their manufacturing operations from China to the United States or other Western Allies, such as India and Mexico. The pandemic exposed manufacturing lapse and the deficiencies of just-in-time inventory systems of industrial nations in the Western world, which led to shortages of medical supplies, equipment, and other consumer goods. As a result, many companies and nations have sought a de-risking policy for supply chains and have established new factories in other countries at home or closer to home. The shift in where goods and services are manufactured has resulted in a splintering of supply chains and an increase in the price of key commodities for the final consumer and businesses, because of the high startup costs of new factories and insufficient scale or technical expertise of the new manufacturing hubs.

The imbalance between supply and demand has resulted in higher prices, with inflation in the United States reaching as high as 9.1% in June 2022, more than 10 in the European Union, and even reaching 3% in Japan which is popular for having chronic deflation.

Why Inflation has become Structural despite U.S Fed Policy

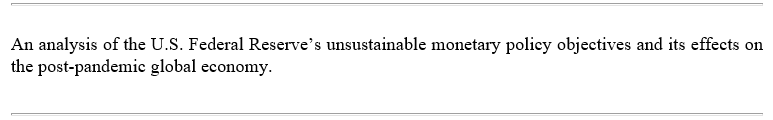

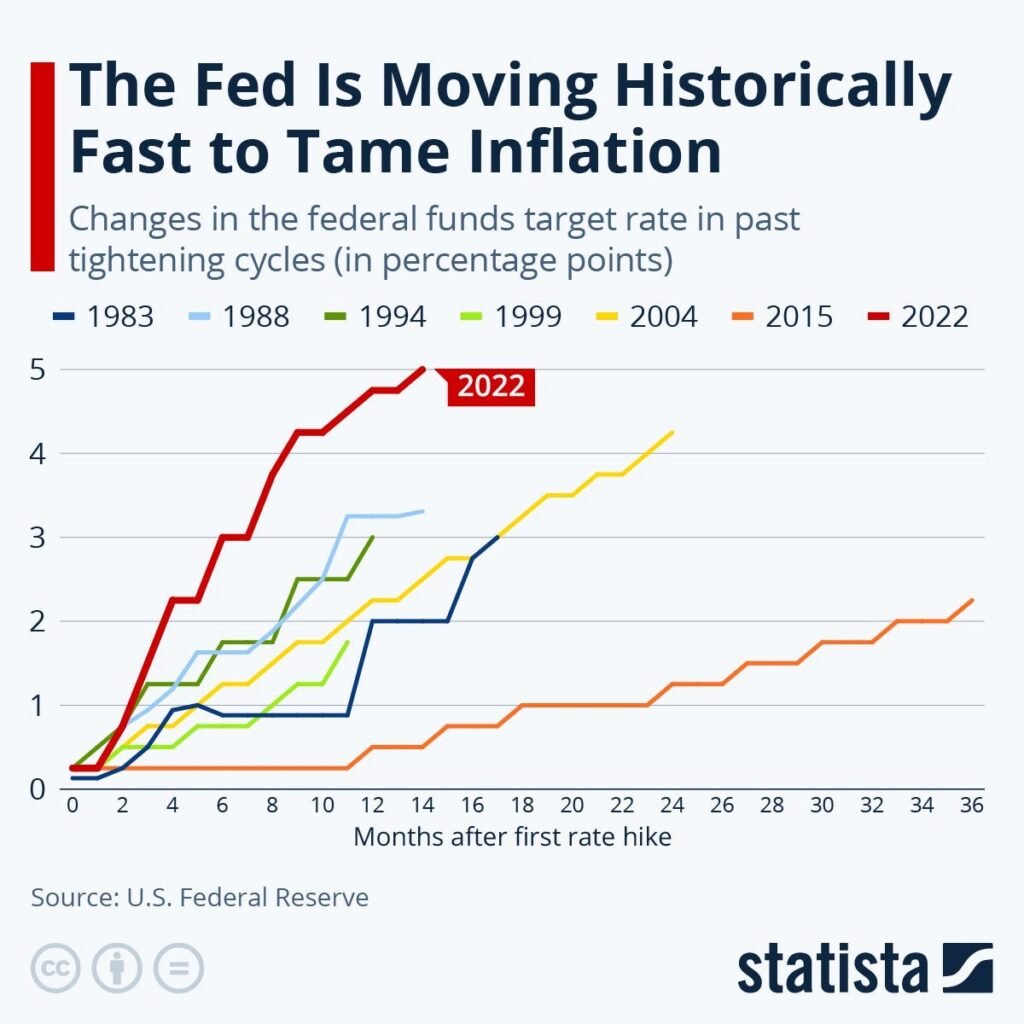

It is important to note that the Federal Reserve had previously and repeatedly described the rise in prices as temporary when inflation began to look uncontrollable in mid and late 2021, but since March 2022, the Fed has changed its tone and begun increasing the Federal Funds Rate at an unprecedented pace. In an attempt to tame inflation, it has gone on to increase short-term interest rates from 0.25 per cent in March 2022 to 5.25 per cent as of June 2023. Inflation in the United States has gradually fallen every month since September 2022 and currently stands at 3% as of June 2023, despite this unprecedented increase in short-term interest rates over the past year has so far failed to bring down inflation within the Fed’s preferred target range of 2%-2.5% range.

The question then becomes, why has the U.S. Federal Reserve’s most important weapon failed to effectively combat inflation? The straightforward answer is that inflation has become more persistent in the economy and will not disappear quickly.

Even by the admission of the head of the Federal Open Market Committee (FOMC) Jerome Powell, who chairs the main body within the U.S. Fed that decides monetary policy decisions and sets the Federal Funds Rate, they do not expect inflation to return to the U.S. Fed’s preferred range until late 2023 or early 2025 at least, which will require the FOMC to maintain its already harsh rates policy for a longer period, resulting in untold economic tightening in the U.S. and subsequently the global economy.

After more than a decade of Zero Interest Rate Policy (ZIRP) monetary policy and primarily unfunded government spending, it is unrealistic for the Fed to anticipate that quantitative tightening will produce immediate results in less than 18 months.

Inflation has become structural for a variety of reasons, including a permanent shift in global supply chains away from reliance on China, which has perfected manufacturing at scale and at lower costs compared to a more expensive value chain in other locations whose factories are less efficient. A more permanent shift of global supply chains away from China is supported by the significant industrial policies pursued by central governments, such as the Inflation Reduction Act (IRA) in the United States, the European Green Deal proposed by the European Union, and a whole host of protectionist policies designed to make local manufacturing more attractive and shift companies away from China, where they have access to cheaper labour and cheaper raw materials.

Due to the higher cost associated with local production, the transition from Chinese imports to locally produced goods and the continuation of high tariffs on Chinese imports will result in high prices for essential goods and services.

The substantial investments associated with the transition to a more sustainable energy future are another significant reason why inflation will not disappear soon due to the high costs of transitioning to renewable energy sources.

Along with this policy, governments around the globe will need to implement a stricter stance on the extraction and distribution of fossil fuels, which will result in significant energy security uncertainties. This increases the likelihood of energy shortages and protectionist policies, which will impede access to much-needed energy and raise the cost of living in the United States and around the world, particularly for countries that import oil and gas or lack the resources to transition efficiently to renewable energy sources.

The special military operation in Ukraine and the subsequent energy crisis in Europe and sub-Saharan Africa serve as a useful examples of what is likely to occur in the future in terms of the relationship between energy security and the cost of living.

Based on solid economic fundamentals, monetary policy has no chance of resolving inflation when the price increase is caused by significant government spending policies that are influenced by geopolitical and ideological tensions with established trade partners. The current and future root cause of inflation is likely to come from uncertain supplies of food and energy, as well as increases in the cost of producing certain goods and services required by the economy as a whole. These additional costs are then passed on to the final consumer, who is less dynamic due to the high cost of acquiring capital because of the central banks’ high-interest rate policies.

Monetary policy is not always the most effective way of taming inflation in a situation where the underlying cause of inflation is caused by volatility in energy and food prices. The best way to reduce food and energy inflation to acceptable levels is to increase the supply of cheaper energy sources for manufacturing and residential needs and to alleviate costs directly attributable to crop production and distribution.

The Federal Reserve has been unable to accomplish its desired inflation target objectives despite more than a year of unprecedented monetary policy tightening.

Author’s Note

This is the first of two pieces that will be published on this subject; the follow-up piece is scheduled to come out on July 28, 2023. In the second section, I will talk about the worldwide effects of aggressive monetary policy, in Africa, the EU, and the United States. In addition, I highlight a few analyst recommendations and the potential repercussions of those recommendations.

Feel free to comment, like, and share! Many thanks!