A Beginner’s Guide to CBN’s Ways and Means to the Federal Government of Nigeria

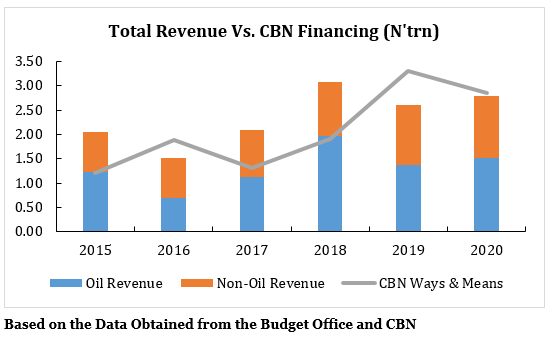

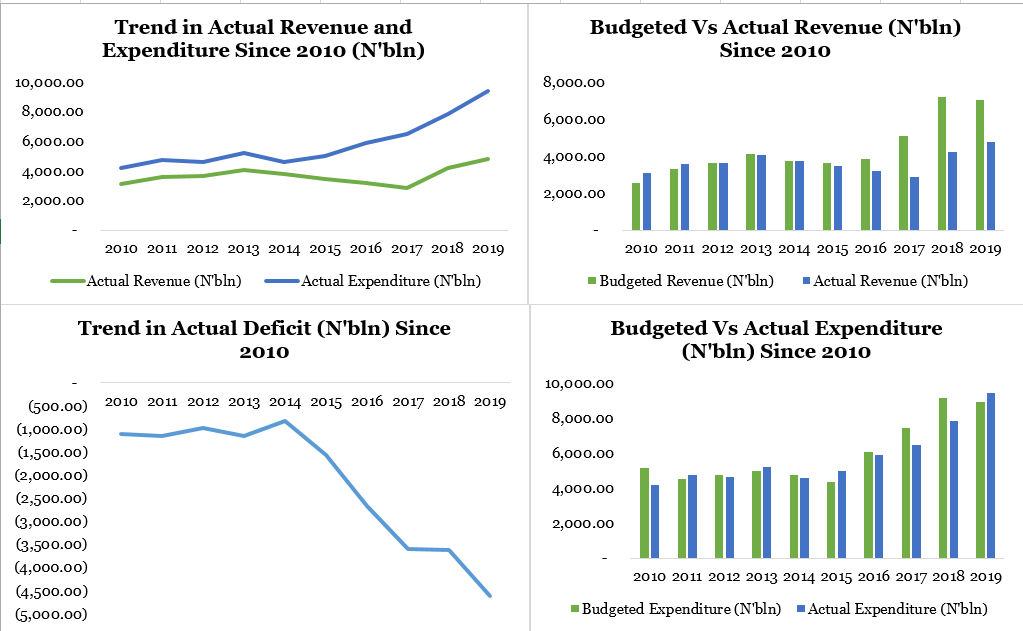

CBN’s financing of the FGN deficits seems to be a structural one and not a one-off event. This is because historical data has shown that the CBN has been financing a huge part of the FGN deficits even when there was no economic downturn. For example, out of the total fiscal deficit of N3.64 trillion in 2018, the CBN financed 52.2%. In 2019, the total fiscal deficit was N4.23 trillion and the CBN financed 78.3% or N3.31 trillion of that amount. There was no downturn during those periods, hence it goes against economic theory for the CBN to be printing money to finance significant proportions of the FGN’s fiscal deficit.