Nigeria: A Frail Giant?

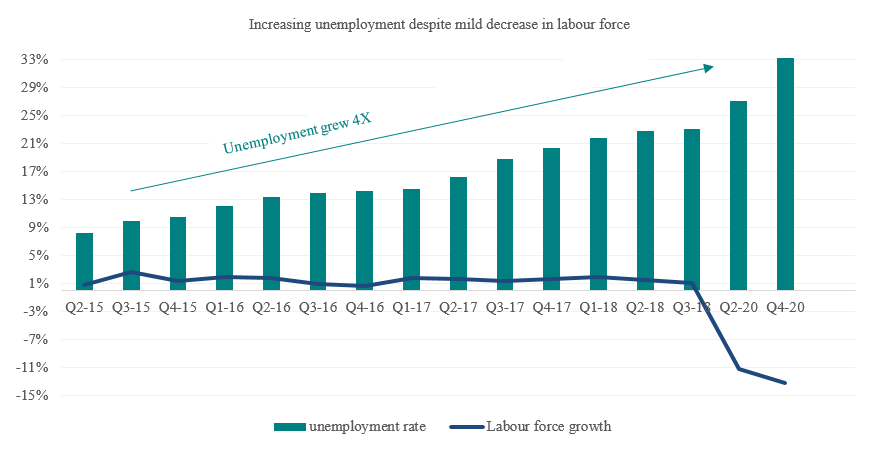

Since President Muhammadu Buhari’s re-election in 2019, the country has faced a myriad of social and economic challenges. Inflation had surged from 11.40% in May 2019 to 17.33% last month; the Naira has been devalued three times, losing 33% of its value, insecurity has increased, and the general investment climate has waned. All these have happened while Nigerians have not seen any meaningful increase in their economic welfare: the country slumped into a second recession in five years. Many states have found it challenging to implement the new minimum wage signed into law in 2019. We also note that even if all the states had implemented the new minimum wage, the total number of civil servants to the entire labour force is considerably low. To sum it, you would still be worse off if you hold 2X the same Naira note you had in 2010 today.

![[ANALYTICS] Domestic Debt Profile by Geo-Political Zone](https://giftedanalysts.com/wp-content/uploads/2020/07/Debt-by-Geo-1.png)

![[ANALYTICS] States with the Highest Debt Profile as at Q1’20](https://giftedanalysts.com/wp-content/uploads/2020/07/Top-10-Highest-1.png)