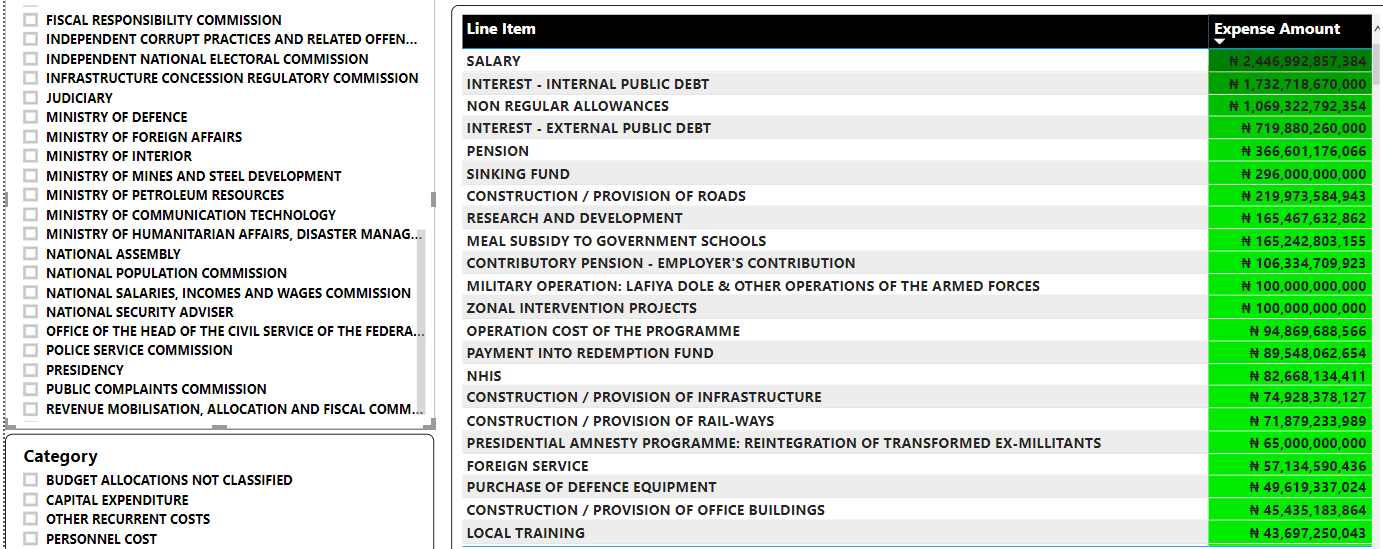

2021-2023 MTEF: Key Implications and Market Impact

We recently received the 2021-2023 Medium Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP) released by the budget office of the Federation. We have thus provided an update on the key highlights, their implications and market impacts.