Equities Valuation: The Impact of Including Share Buybacks in the Dividend Discount Model

The Dividend Discount Model (DDM) is a technique for valuing a stock based on the premise that its worth is equal to the sum of all future dividends. The model calculates a stock’s price by discounting its future dividends to their present value. The model assumes that a company’s future dividend payments will continue to grow at a rate equal to the historical increases in its past dividends.

However, when using this method, many people only consider the dividend cash flow and overlook the cash flow used for share buybacks. Share repurchases or buybacks occur when a publicly traded company buys its own shares on the open market. Share repurchases, along with dividends, are one way for a company to return cash to its shareholders. When a company buys back shares, it is generally seen as a positive sign because it indicates that the company believes its stock is undervalued and has confidence in its future earnings.

After conducting recent valuations on Apple Inc. and The Hershey Company and observing the relatively large amounts of cash allocated to share buybacks by these two firms, it raises the question of whether there is a way to capture those cash flows. Can share buybacks and dividends be considered equivalent? While the processes for both may differ, from an investor’s perspective, they may appear to be the same when considering overall returns per share.

Two articles from McKinsey on share buybacks and dividends research are worth discussing. The first, titled “Share Repurchases Still Don’t Prop Up Value,” explains that, according to their research, “When a company pays out cash through dividends or share buybacks, it reduces the company’s market value by the same amount. Dividends lower the price per share, while share buybacks reduce the number of outstanding shares without affecting the price per share. Share buybacks can increase EPS, but this does not necessarily result in a higher share price. Finance professionals often use TSR, which factors in capital gains and dividends, to evaluate market performance and design incentive systems.”

Total Shareholder Return (TSR) is a measure of the total return an investor receives from an investment in equities or shares of stock. It is expressed as a percentage and takes into account capital gains, dividends, special distributions (such as share buybacks), stock splits, and warrants.

The article also stated that an analysis found that between 1965 and 2008, US companies returned an average of 60% of their net income to shareholders through dividends and share repurchases, with no clear impact on returns or multiples. This analysis was repeated, and the findings remained consistent. Between 1995 and 2021, the total payout by US companies to shareholders increased to an average of 78%, with slightly more repurchases than dividends.

The second article, titled “Share Repurchases and Dividends: Which Create More Value?” sheds further light on the subject. The article discusses the common misconception that share buybacks create more value than dividends. For a fairly valued company, share repurchases may increase earnings per share, but they do not necessarily translate into higher value than that seen with dividend payments. The article provides an example showing that whether a company distributes excess cash as dividends or share repurchases, the total value to shareholders remains the same at $1,600. The only difference is a change in the mix of shareholders.

Based on these statements, it can be concluded that share buybacks and dividends are equivalent to an investor in terms of cash flow and value. When considering the concept of Total Shareholder Return (TSR), it makes sense to include both share buybacks and dividends in a DDM valuation to calculate total disbursements, which can then be discounted to the present to determine the Intrinsic Equity Value.

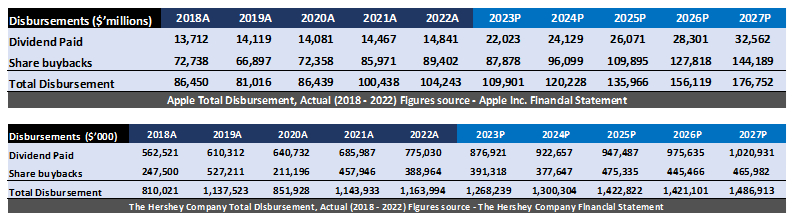

A closer look at Apple Inc. and The Hershey Company reveals what results are obtained when using total cash disbursements instead of just expected dividends paid. Projections for the expected cash amounts to be disbursed from 2023 to 2027 were made for both dividends and share buybacks based on actuals from 2018 to 2022. These amounts were added together to calculate total disbursements (see figures below).

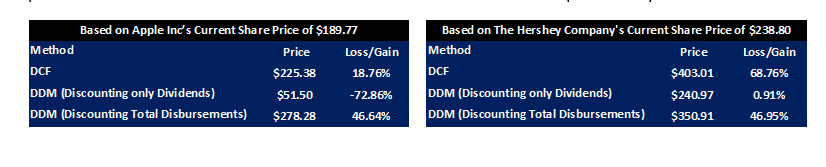

Essentially, the dividends and share buybacks from 2023 to 2027 are added up and discounted to their present value. The table below shows all the valuation methods and the price each yield.

The current share price was last updated on July 12, 2023, at 21:15 BST for Apple Inc. and July 12, 2023, at 21:10 BST for The Hershey Company. While the DDM (discounting only dividends) for The Hershey Company shows a modest upside of just 0.91%, that for Apple Inc. shows a downside of 72.86%. However, when total disbursements are factored in, the picture begins to change. For both companies, there is a significant upside when total disbursements (as with the DCF) are factored in, suggesting that this may be a better way to value a company than simply looking at dividends paid.

There are both advantages and disadvantages to including share buybacks cash flows in the valuation. One advantage is that it provides a more accurate representation of how the company is returning cash to its shareholders. Since share buybacks are another means by which companies return cash to shareholders, it makes sense to include them in the valuation. Another advantage is that including share buybacks can provide a more accurate picture of the company’s financial health. If a company consistently buys back shares, it may indicate confidence in its future earnings.

On the other hand, one disadvantage of including share buybacks cash flows in the valuation is that it can make the valuation more complex. Since share buybacks are not as straightforward as dividends, accurately factoring them into the valuation can be more challenging. Additionally, share buybacks can be less predictable than dividends, making it more difficult to accurately forecast future cash flows.

In conclusion, while there are advantages and disadvantages to including share buybacks cash flows in the Discounted Dividend Model method of valuation, it is important to consider all relevant information when valuing a stock. By including share buybacks in the valuation, analysts may be able to provide a more accurate and comprehensive picture of the company’s financial health and potential future performance.