-

Equities Valuation: The Impact of Including Share Buybacks in the Dividend Discount Model

There are both advantages and disadvantages to including share buybacks cash flows in the valuation. One advantage is that it provides a more accurate representation of how the company is returning cash to…

-

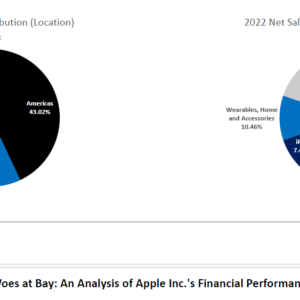

An Analysis of Apple Inc.’s Financial Performance and Growth Prospects

Apple is the largest technology company in the world in terms of revenue and market capitalization and is among the Big Five American information technology companies, which also includes Alphabet (Google), Amazon, Meta…

-

With Saudi Aramco, Oil is not Dead Yet

On Wednesday 11 of December, the World’s largest integrated oil and gas company (and fourth largest integrated refiner in the world) officially listed on the Saudi Stock Exchange after its IPO by selling…