Let us take a closer look at the financial summary of Bayo, a single tech professional living alone. Based on the information available, we can help him plan his finances effectively. Kindly note, the methodology used in this case study is not following an accounting standard, nor would I call it proper accounting even though we are following some principles. Some rules have been modified to fit our objectives.

Bayo has a liability of a 3 million Naira amortized loan from GT Bank, which is payable in 2 years with a 2% monthly interest rate. He also participates in a monthly Ajo/Cooperative contribution with 11 members, including himself, and was the first to receive 1 million Naira.

Let’s assume that Bayo pays his yearly expenses at the end of the year and that this is the beginning of the year. Let’s also assume that he decides to buy his car at the beginning of the year, after taking the GT Bank loan in December of the previous year, and that he receives the 1 million Naira Ajo/Cooperative money in December of the previous year.

It’s important to note that Bayo’s actual monthly expenses are not the same as his initial monthly expenses. Now, it’s January, a new year, and based on Bayo’s goals, we must get him a car. He purchases one for 5 million Naira. Now, let’s take a closer look at his actual monthly expenses. First, we’ll examine his goals. Bayo wants to have saved enough for his yearly expenses by the 6th month of the year (June) and he also wants to start saving for an emergency fund. We can ignore the last goal for now.

Since Bayo will start paying the contribution and the loan from January, we need to calculate his monthly expenses. For the contribution, Bayo must pay 10 other members for 10 months (January to October), which amounts to 100,000 Naira per month. The loan calculation is more complicated. It’s an amortized loan with a 2% monthly interest rate for 2 years, with equal payments starting in January.

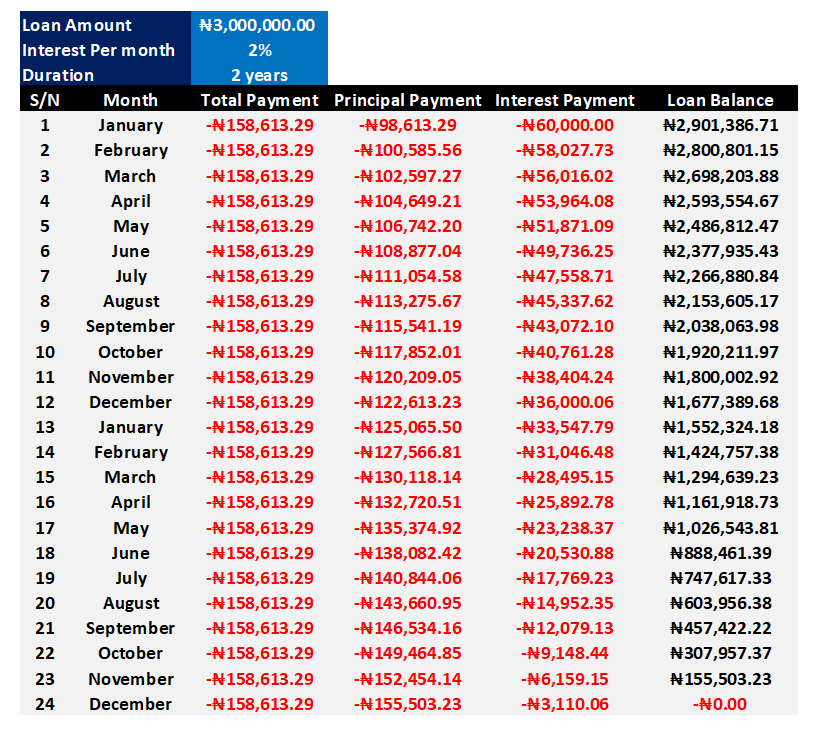

An amortized loan is paid off in regular instalments over time, with each payment going towards both the interest and the principal. As the loan is paid off, the amount of each payment that goes towards interest decreases, while the amount that goes towards the principal increases. This allows the loan to be fully paid off by the end of the loan term. The payment schedule for Bayo’s loan will look like this:

Now we know that Bayo has to pay ₦158,613.29 monthly for the loan, including both principal and interest. He also has yearly expenses of ₦1,750,000.00, which he wants to have saved for by June. We know that Bayo’s total yearly expense is ₦1,750,000.00. We can divide this number by 6 to determine how much he needs to save each month for 6 months. This comes out to ₦291,666.67 per month.

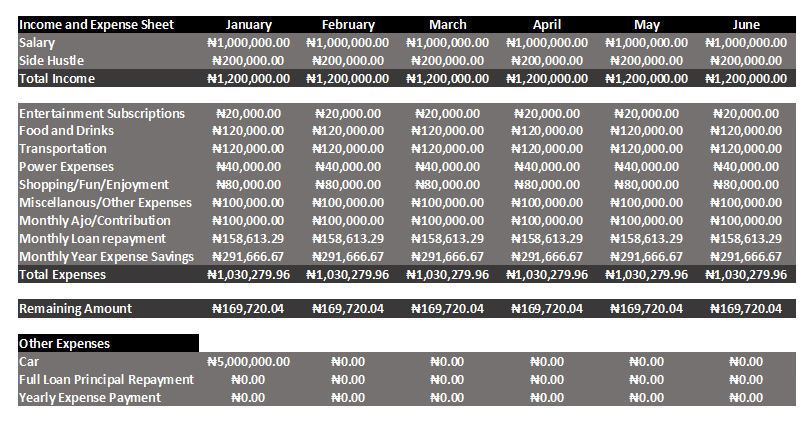

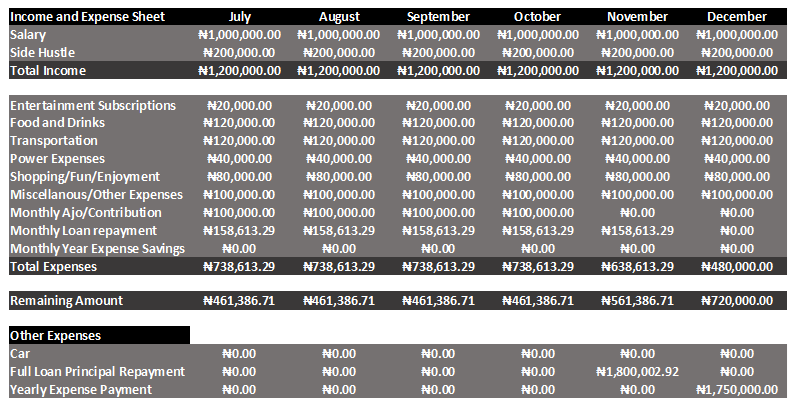

Adding the monthly Ajo/Cooperative contribution, the monthly loan payment, and the monthly savings for yearly expenses to his monthly expenses, we can calculate Bayo’s total monthly expenses. We should also include the one-off expense of the car he plans to buy in January. Bayo’s monthly expenses will look like this:

Bayo’s monthly expenses include additional expenses such as the monthly Ajo/Cooperative contribution, the monthly loan repayment, and the monthly savings for yearly expenses. The car expense has also been added under ‘other expenses’ for January. Everything else remains the same until June. Unlike the monthly Ajo/Cooperative contribution and the monthly loan repayment, which Bayo will pay to his cooperative society and GT Bank respectively, the monthly savings for yearly expenses will be paid to himself. The remaining amount after deducting total expenses from total income (₦169,720.04) will go towards his emergency fund savings.

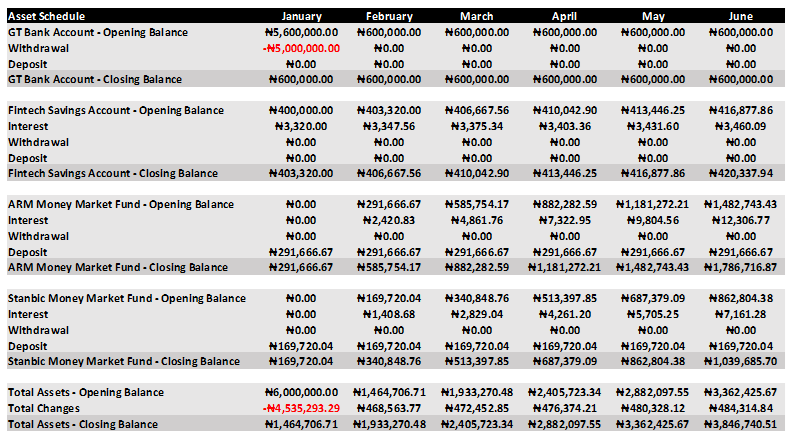

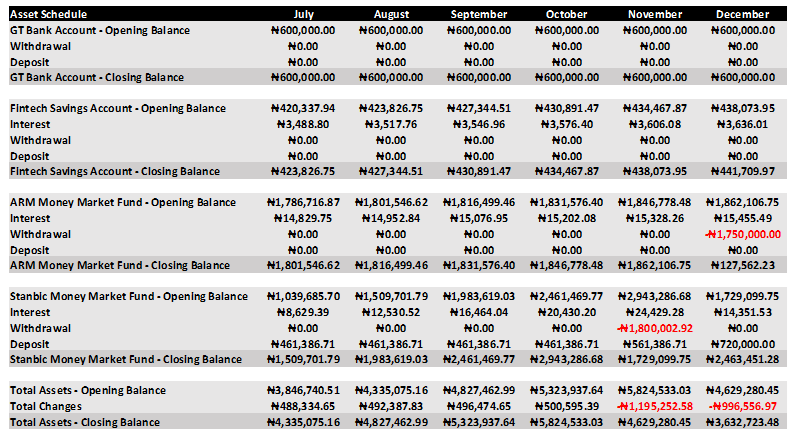

This means that the monthly savings for yearly expenses and the remaining amount will be recorded as deposits in the asset schedules, while the car expense will be recorded as a withdrawal. The liability and asset schedules are movement schedules that help keep track of changes in a company’s balance sheet over time. By monitoring these changes, movement schedules can provide valuable information about how a company’s financial situation is evolving.

We can apply the same concept of movement schedules to plan both assets and liabilities schedules, with an opening balance, a series of changes, and a closing balance. Different types of assets will have different types of changes. For a normal bank account, the changes will include withdrawals, deposits, transaction fees, and interest (if it’s a savings account). It’s similar to the bank statement you receive at the end of every month, showing an opening balance, a series of credits and debits, and a closing balance.

In Bayo’s asset schedule, we assume that the Fintech Account and Money Market Fund accounts give 10% per annum in interest, which is 0.83% monthly. Bayo’s monthly savings for yearly expenses go into his ARM Money Market Fund account and his emergency fund savings go into his Stanbic Money Market account. We can see the 5 million Naira for the car being withdrawn in January from his GT Bank Account.

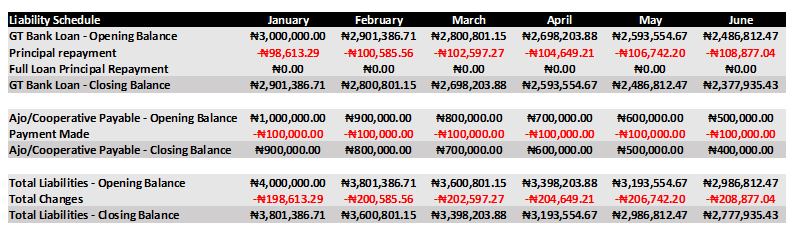

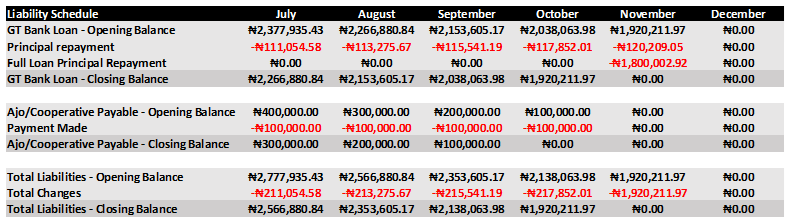

For Bayo’s liabilities over the same 6 months, we can see that the principal repayment is increasing, meaning the interest repayment is decreasing. The principal repayment is part of the monthly loan repayment. When you add this principal repayment to the interest repayment, you get the total monthly loan repayment of ₦158,613.29.

By the end of June, Bayo has successfully achieved three of his financial goals. He has bought a car, saved the total amount for his yearly expenses, and started building his emergency fund.

As shown above, Bayo’s remaining monthly amount that will go into his emergency fund is now ₦461,386.71. This will continue until after October when his Ajo/Cooperative monthly contribution ends. By November, his net monthly income or remaining amount for his emergency fund (after subtracting total expenses) will be ₦561,386.71. Based on his goals, Bayo can decide to pay off some or all of his loan principal or continue saving for his emergency fund.

This leads us to another calculation: how much does Bayo need for his emergency fund? This will be his yearly expense plus his initial total monthly expense multiplied by 12. The calculation will look like this:

Emergency Fund = Yearly Expense + (Initial Total Monthly Expense x 12)

Emergency Fund = ₦1,750,000.00 + (₦480,000.00 x 12)

Emergency Fund = ₦1,750,000.00 + ₦5,760,000.00

Emergency Fund = ₦7,510,000.00

This calculation assumes that Bayo wants to have an emergency fund that will cover his expenses for a year. In November, we can examine his financial position and make a decision.

Bayo has enough assets to clear his liabilities. After making his monthly loan repayment, he can contact his account officer to take care of this. His Ajo payable has also been cleared (this happened in October, as explained earlier). We will remove the loan amount from his emergency fund savings (Stanbic Money Market Fund). Bayo’s total monthly expense has returned to ₦480,000.00 and his new remaining amount for his emergency fund is ₦720,000.00 (December), which has been added to his Stanbic Money Market Fund. He is also ready to pay his yearly expense, which he has saved for since June. These two transactions can be traced from the income and expense sheet to the asset and liability schedules.

The full loan principal repayment of ₦1,800,002.92 in ‘other expenses’ in November can be traced to the withdrawal in the same month in the Stanbic Money Market Fund account. This can also be traced to the GT Bank Loan, full loan principal repayment in the liability schedule of the same November.

The yearly expense can be traced from ‘other expenses’ in the income and expenses sheet in December to the ARM Money Market Fund withdrawal in December, in the asset schedule. Even though Bayo saved ₦1,750,000.00, there was still some amount left due to the interest earned on the monthly injected amounts since January.

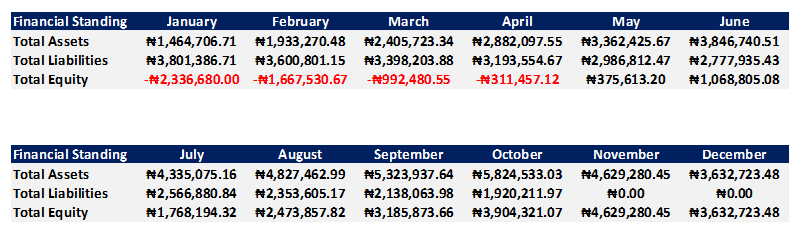

From the first article, we explained that Equity = Assets – Liabilities, and that this determines your financial standing. If your equity is negative, it means you are in a net debt position. If it’s positive, it means you don’t have net debt and have enough to cover expenses to the degree of the magnitude of the positive amount. With that being said, Bayo’s actual financial standing from January to December of this current year is shown below:

This means that Bayo could have paid off all his liabilities in May and still have ₦375,613.20 left. This whole process and template can be used in many ways, but three important ways that come to mind are: determining your net worth (equity), financial budgeting and planning for the foreseeable future or for a project that requires capital you want to save for, and monitoring your expenses, income, liabilities, asset earnings, and cash flow.

Thank you so much for this detailed financial breakdown on savings, income budgeting, assets, liabilities etc.

It is simple to comprehend with all the tables therein.

Welldone