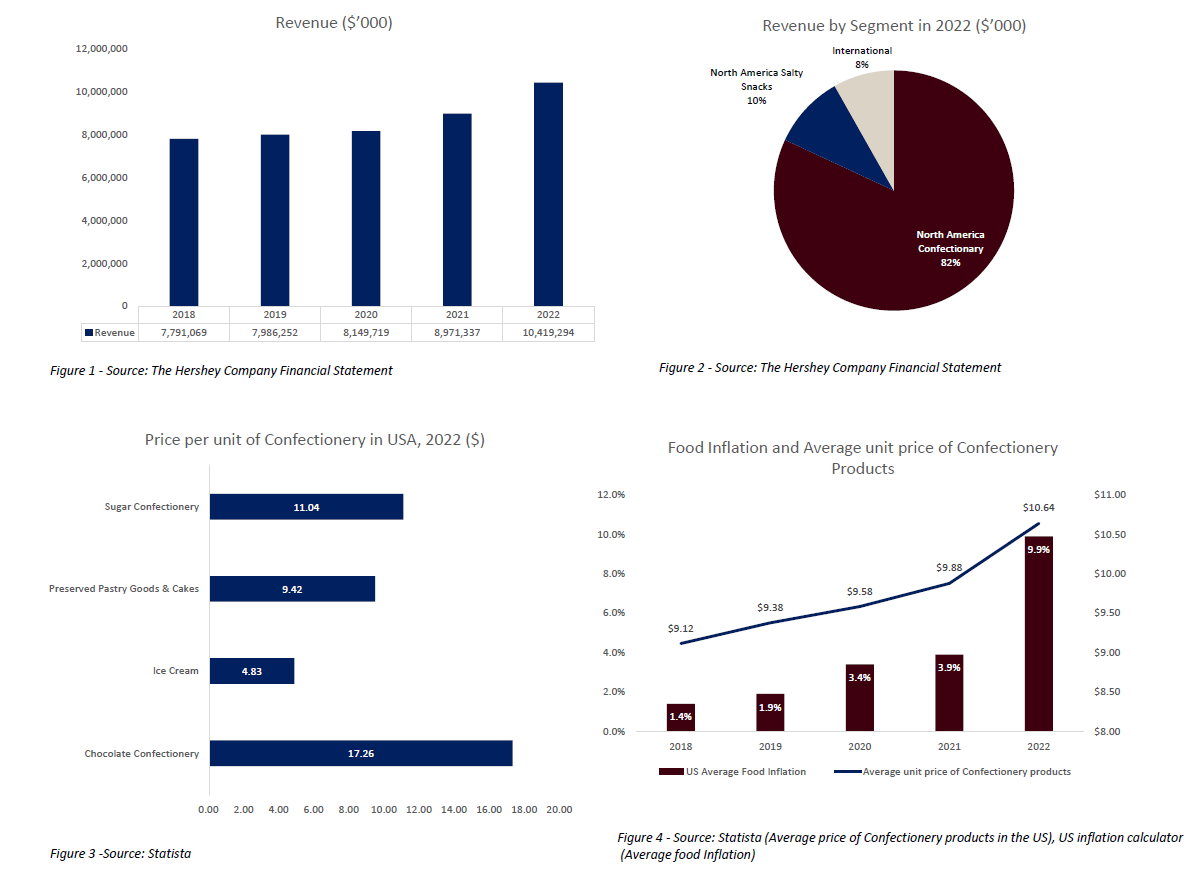

The Hershey Company is a leading American multinational chocolate manufacturer that also produces baked goods, beverages, and other products. Operating under 80 brands in 70 countries, Hershey’s is a global leader in chocolate, sugar confectionery, and chocolate related grocery products. The company prides itself on its values driven approach to snacking, offering moments of goodness through its more than 90 brands and products. Hershey’s values include togetherness, integrity, making a difference, and excellence.

Hershey’s offers a wide variety of flavours, sizes, and variations of its products. Popular items include Hershey’s Milk Chocolate Bar, Hershey’s Special Dark Mildly Sweet Chocolate Bar, Hershey’s Air Delight Chocolate Bar, Hershey’s Milk Chocolate with Almonds Bar, Hershey’s Cookies ‘ Creme Bar, Hershey’s Drops, and Hershey’s Miniatures. The company sells its products to a diverse range of customers through various channels, including its own retail stores and online. With a wide range of products catering to different income and age groups, Hershey’s target market is essentially everyone.