Taming Market Power Could (also) help Monetary Policy

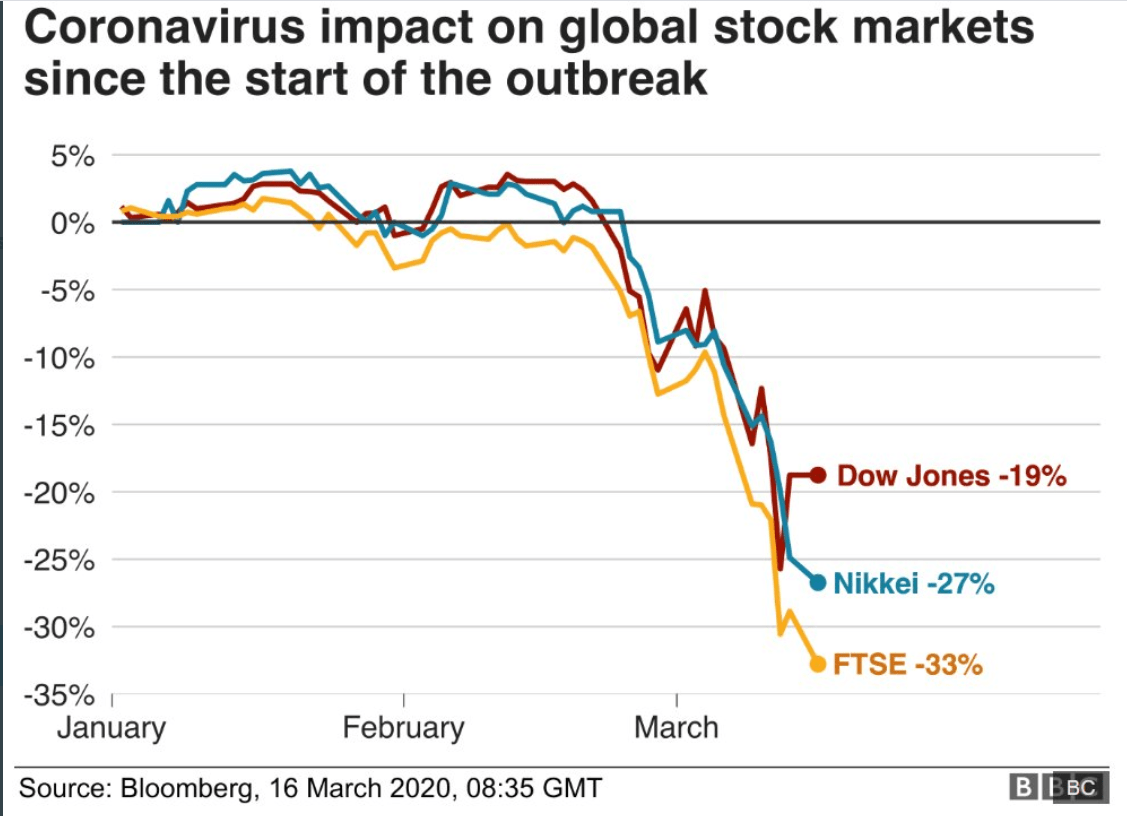

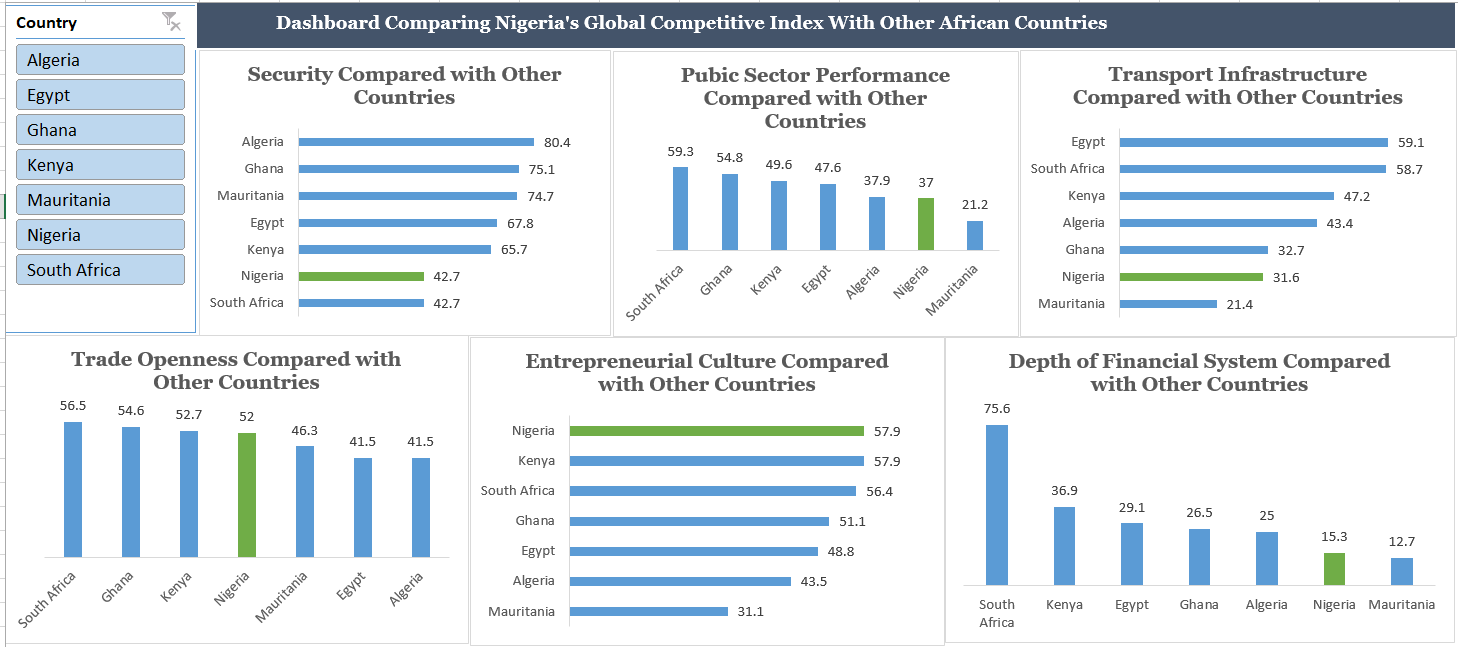

Some central banks are currently debating whether to tighten monetary policy to fight inflationary pressures, after having eased decisively in response to the COVID-19 shock. In making such decisions, central bankers have to consider how much businesses and consumers will respond. The structure of the financial system and the future expectations of consumers and businesses are key drivers of how effective monetary policy actions will be. Yet there’s another, overlooked, driver: corporate market power.