COVID-19: The Trouble that Lies Ahead for the Federal Accounts Allocation Committee (FAAC)

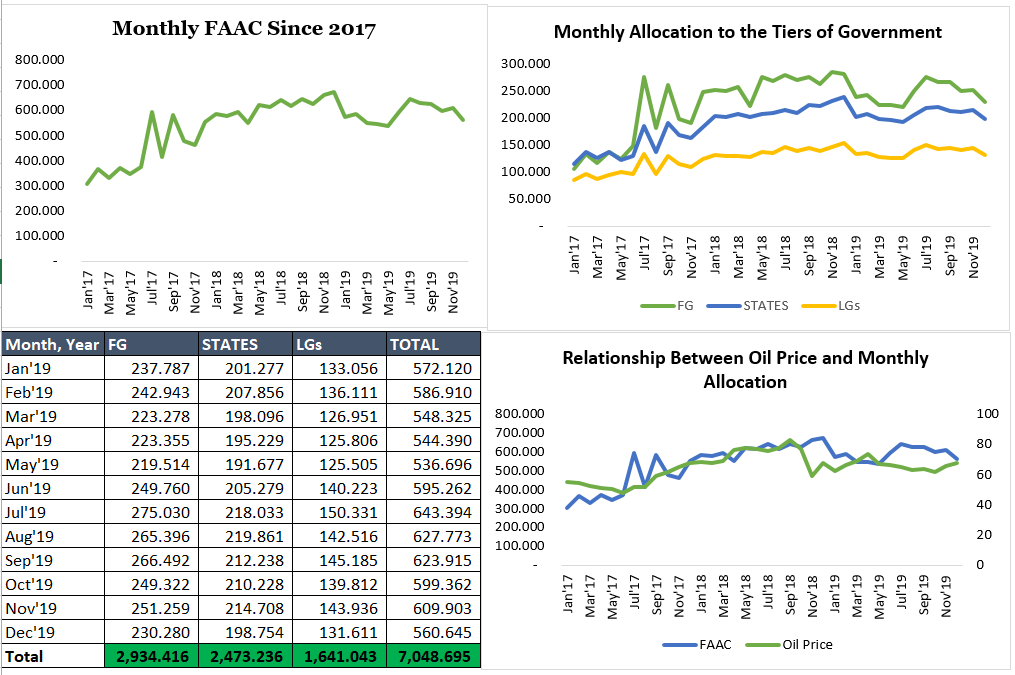

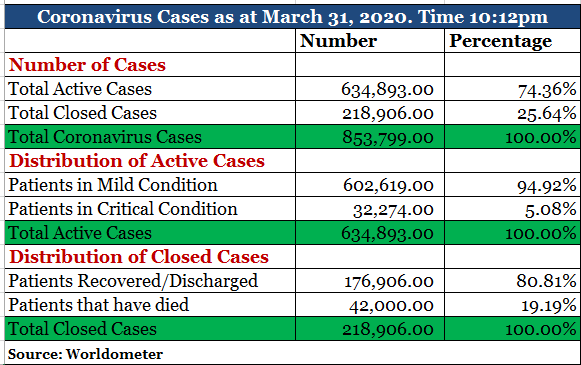

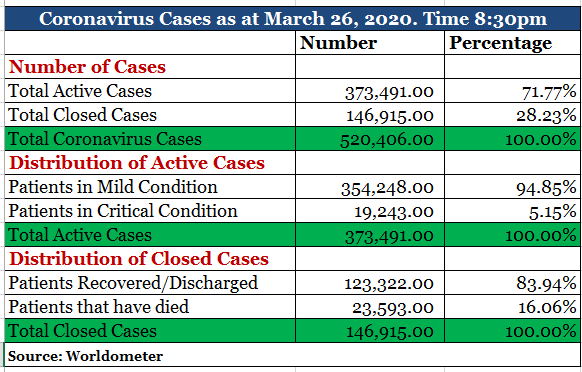

This article explains the trouble that lies ahead of FAAC going forward by first graphically explaining the relationship between oil prices and total monthly allocation, then examining the trend in monthly revenue sharing since 2017, compare with other months and years, as well as forecast what will happen going forward given the global pandemic as well as the price war which have led to share decline in the price of crude oil in the international market.