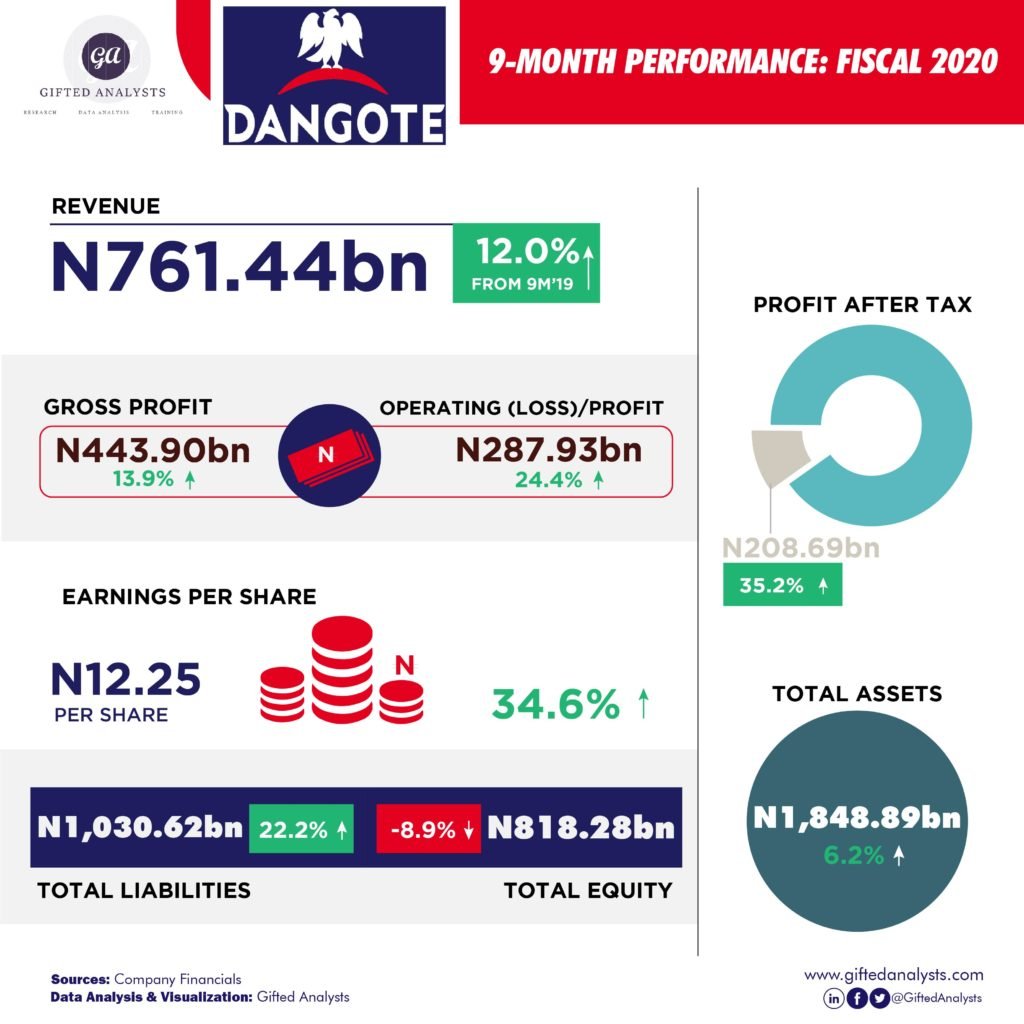

In the first 9 months of 2020, Dangote Cement (DANGCEM) plc was able to grow its revenue by 12% on the basis of solid production volume (+5.6% y/y to 18.40 million tonnes) with an overall effect on sales volume (+6.6% y/y to 19.21 million tonnes). Thus, topline grew to N761.44 billion from N679.79 million in the corresponding period of 2019. Of the total revenue, the Nigerian market contributed 70% (N531.51 billion) while the pan African market contributed the remaining 30% (N232.61 billion).

Because cost of production grew slowly (+9.4% y/y to N317.5 billion), the gross profit came in stronger at N434.90 billion which is 13.9% increase when compared to the gross profit of N389.78 billion recorded in the first 9 months of 2019.

Although Administrative expenses was up by 5.2% y/y to N39.95 billion, selling and distribution expenses were down by 26.1% y/y to N119.46 billion. This therefore had a net positive effect on the operating profit which grew by 24.4% y/y to N287.9 billion.

The company recorded N18.3 billion in finance income compared to N5.98 billion in the first 9 months of 2019. Finance costs also reduced marginally to N34.3 billion from N39.8 billion in the corresponding period of 2019. Hence, profit before tax increased by 37.4% y/y to N271.96 billion. Netting out the income tax (N63.28 billion) paid, total profit after tax printed at N208.69 billion which is 35.2% greater than the N200.52 billion recorded in the first 9 months of 2019.

On the balance sheet side, Total equity however declined to N818.28 billion (9M-2020: N897.94 billion) due to the 22.2% increase in total liabilities which were enough to offset the 6.2% growth in total assets during the review period.