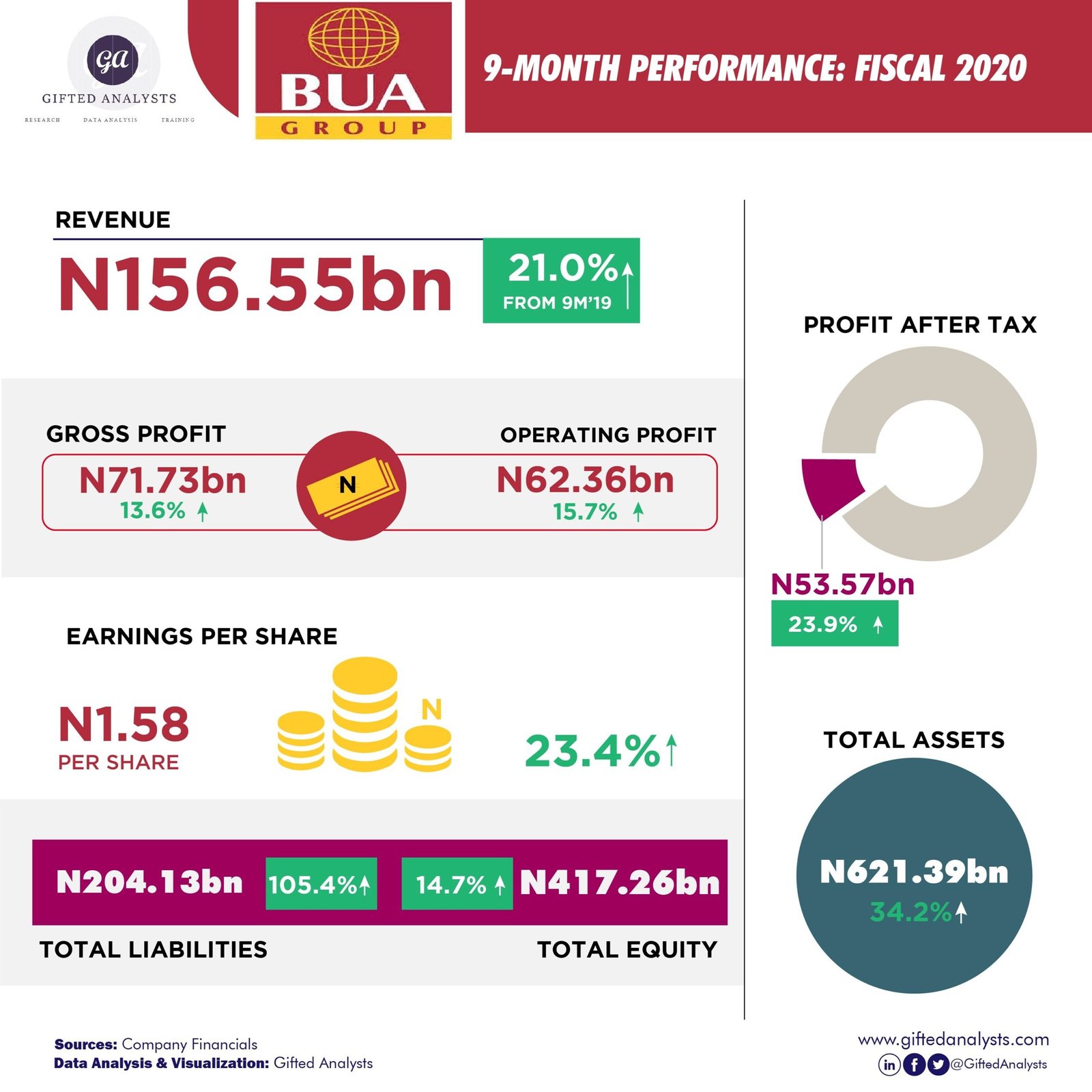

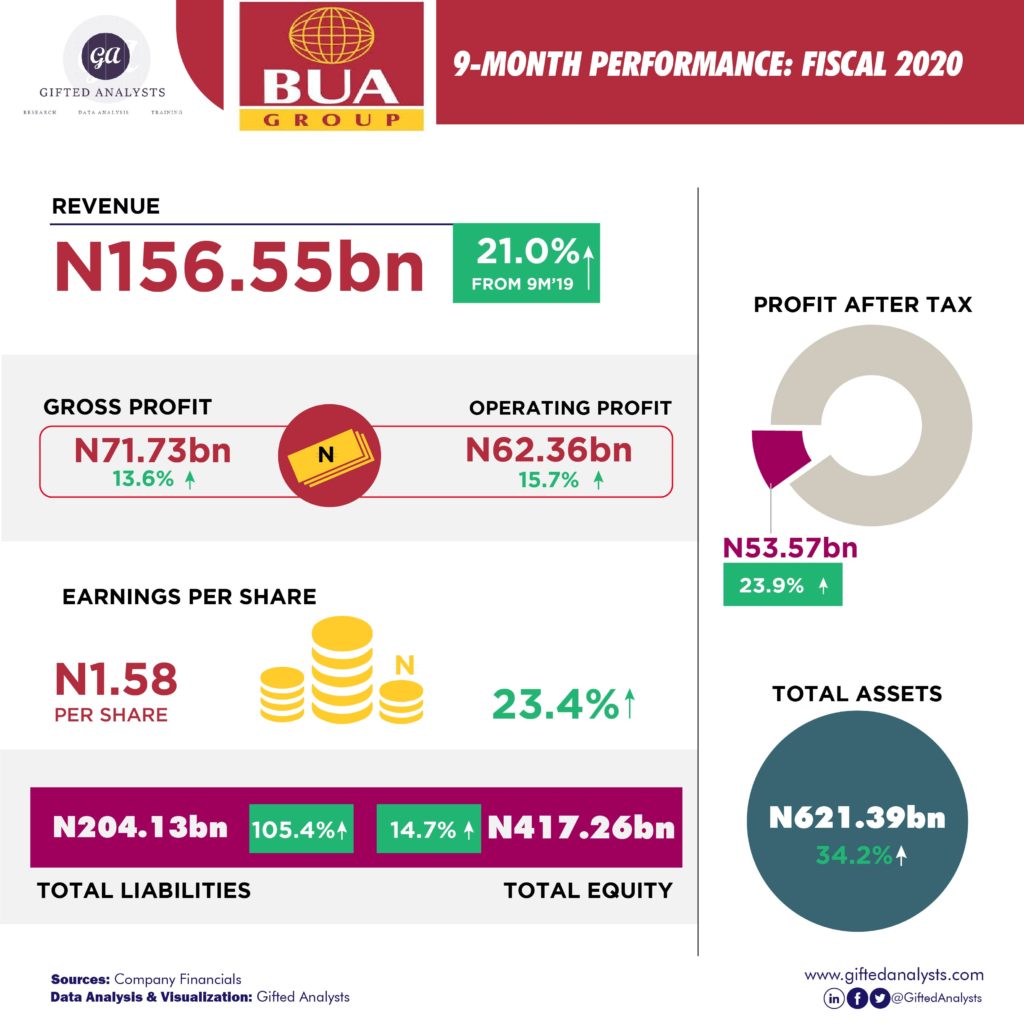

Revenue grew by 25% y/y to N156.55 billion in the first 9 months of 2020. No breakdown was provided on the drivers of the revenue growth in terms of volume and countries of operation. Hence, the N156.55 billion in revenue is the total amount of revenue generated from the sale of cement in the first 9 months of the year.

Gross profit grew by 13.6% compared to the corresponding period of 2019. The gross profit growth is however slow due to the fact that the growth in cost of sales was more than the growth in revenue. While revenue grew by 13.6% y/y, the cost of sales grew by 28.8%. Hence, gross profit printed N71.73 billion.

Elsewhere, selling and distribution expenses (+25% y/y to N9.68 billion) and administrative expenses (+16.7% y/y to N7.03 billion) all grew as the company incurred more operating expenses which moved in tandem with growth in sales. The growth in the expenses was however moderated by the growth in other income (+20% y/y to N6.14 billion) and the write back of impairment (N1.20 billion). Hence, operating profit (N62.36 billion) increased by 15.7% when compared with the operating profit (N53.90 billion) generated in the first 9 months of 2019.

Bua cement used N3.11 billion to finance its loans in the first 9 months of the year. It however received interest worth N6.65 million on End of Service Benefit (EOSB) as well as on loan (N233.80 million). Thus, the net finance cost during the review period was N2.87 billion. Adjusting for the net finance cost , the total profit before tax printed N59.48 billion which is 18.5% improvement when compared with N50.19 billion recorded in the corresponding period of 2019.

Overall, the profit after tax 23.9% y/y to N53.57 billion. Adjusting for the total share outstanding (33.86 billion), the earnings per share for the period was N1.58 per share which is an increase of 23.4% when compared with the earnings per share of the first 9 months of 2019.