2020 Nigerian Budget: The Questionable Little Line Items

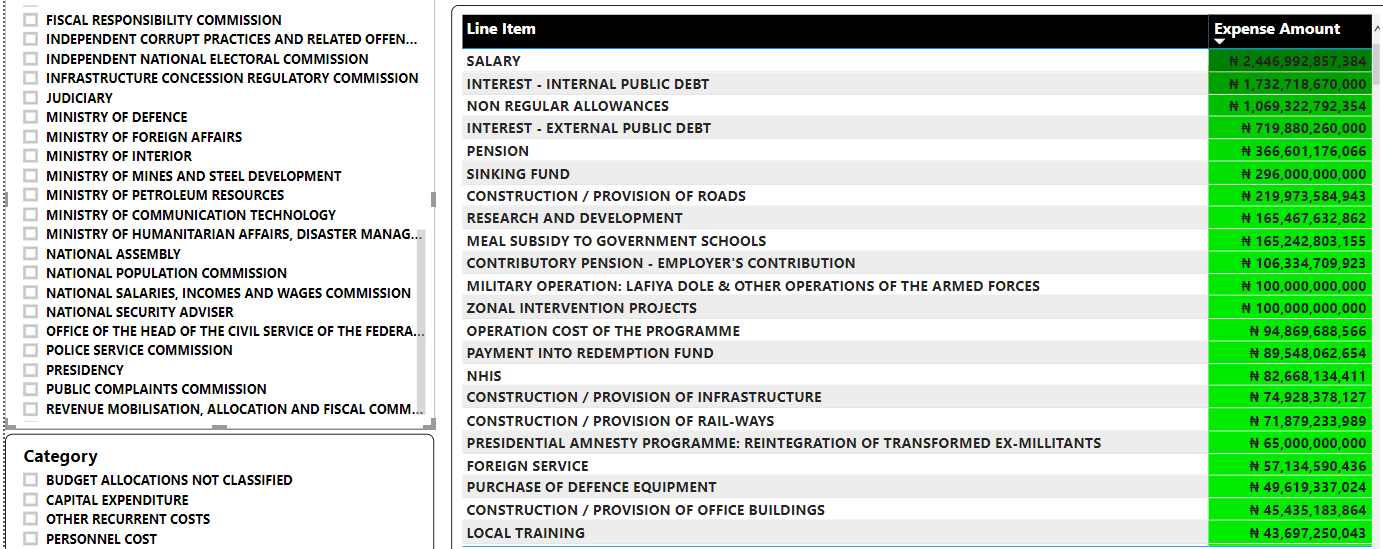

While there have been different efforts from all corners talking about the big figures, this article however aims to breakdown the little figures which seem not to matter (to some individuals) but will make much impact if diverted to other areas that matter.