Download Data on Nigeria’s Financial Inclusion

According to Enhancing Financial Innovation and Access (EFInA), financial inclusion is the provision of a broad range of high quality financial products such as savings, credit, insurance, payments and pensions, which are relevant, appropriate and affordable for the entire adult population, especially the low income and rural segment of the population.

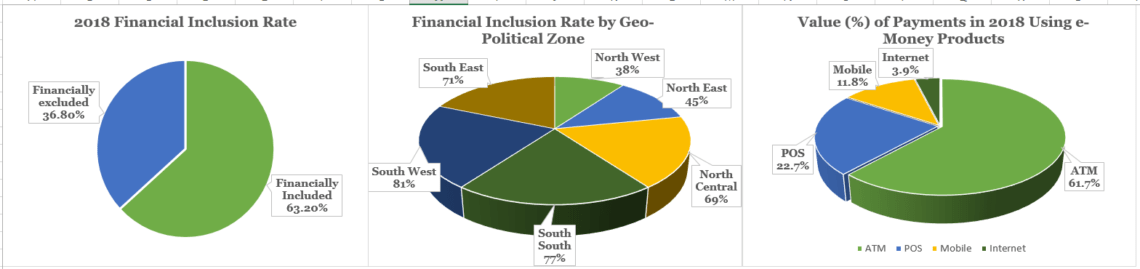

In a glance, there are 99.6 million citizens above the age of 18 years in Nigeria in 2018. They are called the adult population. According to the CBN, of this 99.6 million adult population, 56.9% are less than and equal to 35 years, that is, are 35 years and younger as 50.1% are female while 49.9% are male.

In terms of mobile usage, the EFInA report of 2018 shows that 3.08 million (representing 3.1% of the adult population) have both mobile money and bank account while 0.3% adults have only mobile money account. Also, 82% of the adult population receive their income in cash while 10% receive their income into bank accounts or mobile money.

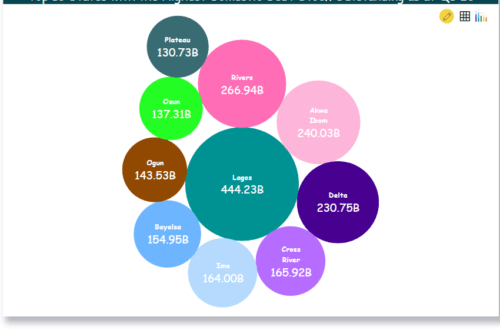

The file below contains data on the financial inclusion rates in all the six geopolitical zones of Nigeria. It also contains data on growth in number of bank branches in Nigeria from 2015 to 2018, as well as value of payments in 2018 using e-money products.

Download the data below:

You May Also Like

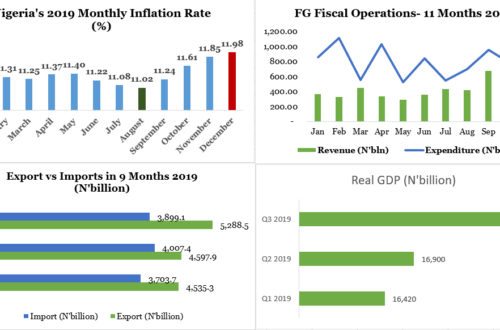

Assessment of Nigeria’s Economic Performance in 2019

February 12, 2020

Full Project on Impact of Informal Sector on Employment Generation

October 8, 2019