United Capital Plc (UCAP) is one of Nigeria’s leading financial service companies, providing a bouquet of diverse financial services to individuals, corporates, and governments, enabling growth at all levels. It is a holding company with four subsidiaries namely United Capital Trustees Limited, United Capital Asset Management limited and United Capital Securities Limited and UCPlus Advance Limited. Its areas of business include Investment Banking, Asset Management, Trusteeship, Securities Trading and consumer finance. The company recently released its unaudited financial results for the period ended September 30, 2022 to the investing public; here are the financial highlights of the result.

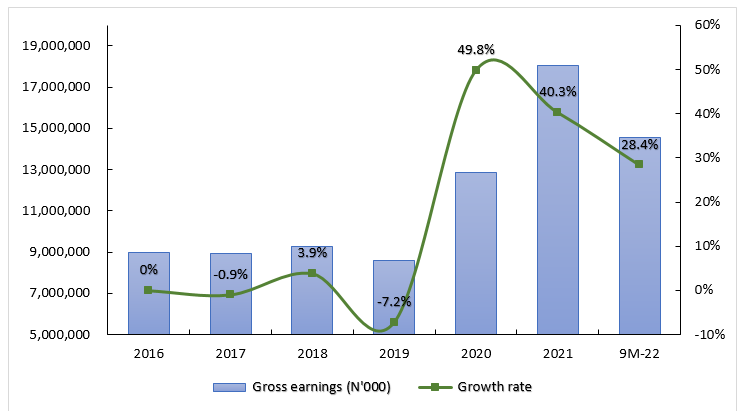

Top line: According to the company’s financial results, gross earnings grew from N11.3 billion recorded in 9M-21 to N14.6 billion in 9M-22, this represents a 28.4% y/y growth in gross earnings. The y/y growth in gross earnings is higher than the cumulative annual growth rate (CARG) of 15% recorded over the past 5 years. The growth in gross earnings was due to a combination of growth in the company’s investment income and fee and commission income, both of which contribute over 80% of the company’s gross earnings. We highlight that the company’s investment income grew by 5.1% y/y from N6.3 billion to N6.6 billion while fee and commission income grew by 31.4% y/y from N4.8 billion to N6.3 billion. In addition, the company’s growth in gross earnings was supported by an impressive 3,834.4% growth in net trading income and a 355.7% growth in the company’s other income.

Fig 1: Trend in gross earnings growth rate (2016 to 9M-22)

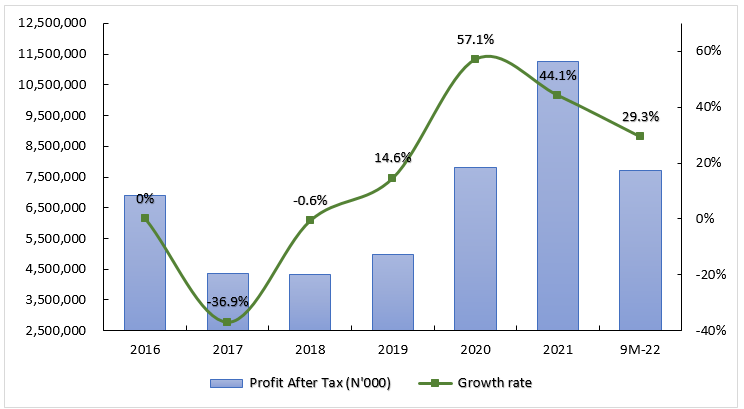

Bottom line: The company’s profit after tax (PAT) grew by 29.3% y/y to N7.7 billion in 9M-22. The growth in PAT is also higher than the CAGR of 10.2% recorded over the past 5 years. We highlight that the 29.3% y/y growth in the company’s PAT was marginally higher than the 28.4% y/y growth in the company’s gross earnings. This was majorly driven by a N317.8 million credit from the company’s share of accumulated profit of associates.

Fig 2: Trend in profit after tax growth rate (2016 to 9M-22)

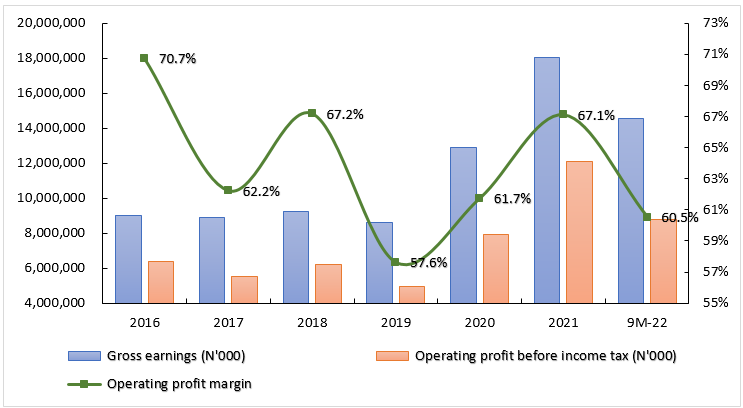

Margins: The company recorded an operating margin of 60.5% in 9M-22, slightly lower than the 62.6% operating profit margin recorded in 9M-21 by -210bps and lower than the 5-year average operating profit margin of 63.2% by -270bps. The decline in the company’s operating profit margin was due to a 35.5% y/y rise in the company’s total expenses from N4.2 billion recorded in 9M-21 to N5.7 billion in 9M-22. The rise in total expenses is higher than the 28.4% growth in the company’s gross earnings. We attribute the rise in total expenses to a 33.4% rise in the company’s personnel expenses, a 29.8% rise in other operating expenses and a 77.4% rise in the company’s impairment for credit losses.

Fig 3: Trend in operating profit margin (2016 to 9M-22)

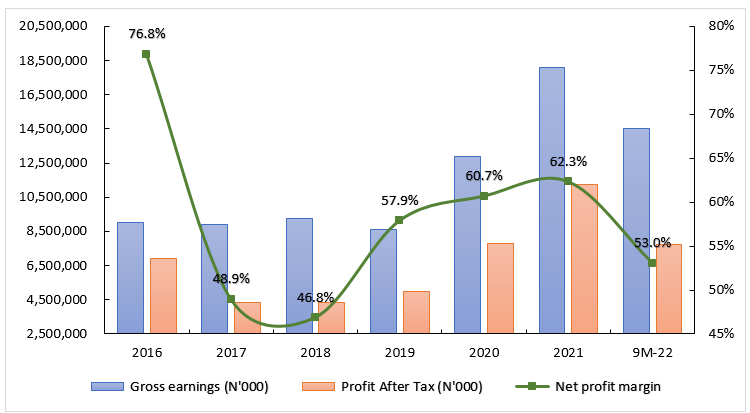

However, despite the marginal drop in the company’s operating profit margin, the company recorded an improvement in its net profit margin. Net profit margin improved by +30bps to 53.0% in 9M-22 compared to 52.7% recorded in 9M-21. The improvement in net profit margin was due to the N317.8 million credit from the company’s share of accumulated profit of associates. In addition to this, the company’s taxation cost grew by 25.0% y/y from N1.1 billion in 9M-21 to N1.4 billion in 9M-22. The 25.0% rise in taxation cost is lower than the 28.4% growth in the company’s gross earnings. It is important to note that the company is very cost efficient as it has been able to maintain very high net profit margins over the years. Over the past 5 years, the company’s net profit margins have averaged above 50%, reflecting that for every N100 the company makes in gross earnings, the company is able to keep N50 as net profit.

Fig 4: Trend in net profit margin (2016 to 9M-22)

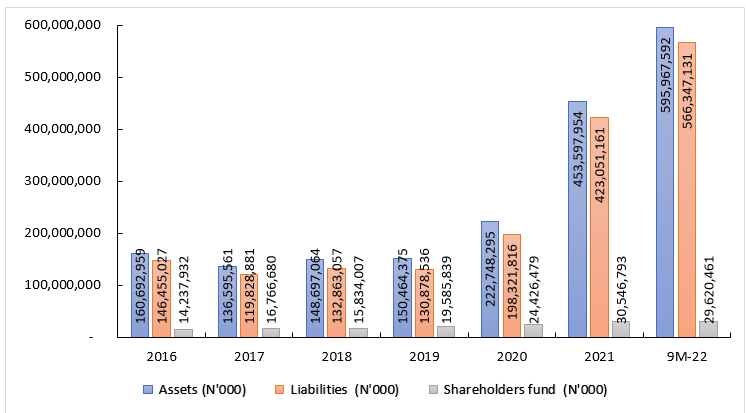

Balance sheet performance: The company’s balance sheet recorded a 31.4% year-to-date (YTD) growth in total assets from N453.6 billion recorded in FY-21 to N596 billion in 9M-22. The principal driver of growth in total assets was a 326.2% growth in cash and cash equivalents from N53.7 billion recorded in FY-21 to N228.7 billion recorded in 9M-22. The company’s balance sheet also recorded a 33.9% YTD growth in total liabilities from N423.1 billion recorded in FY-21 to N566.4 billion in 9M-22 majorly driven by a 29.5% growth in the company’s managed funds from N327.3 billion in FY-21 to N423.9 billion in 9M-22 and a 281.8% growth in other liabilities from N14.2 billion in FY-21 to N54.3 billion in 9M-22. Finally, the shareholders’ fund declined by 3.0% YTD to N29.6 billion in 9M-22 due to the N9 billion dividend payment made during the period under review.

Fig 5: Trend in Balance sheet performance (2016 to 9M-22)

Outlook:

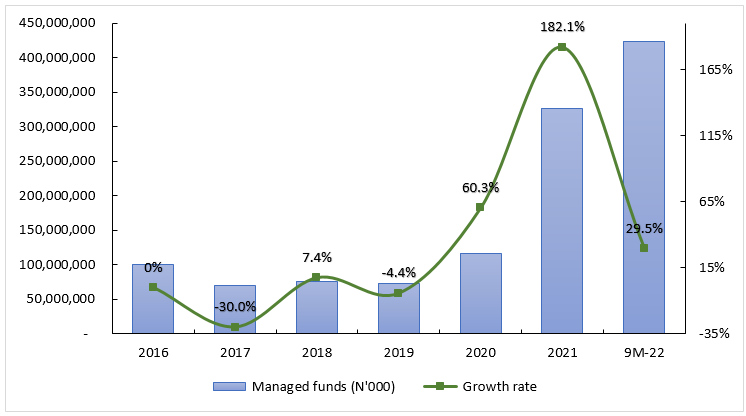

United Capital Plc has seen growth in its managed funds over the years. The company’s managed funds have grown by a CAGR of 26.6% over the past five year. The company also has a large amount of cash and cash equivalents on its balance sheet, maintaining a high level of liquidity. Therefore, for Q4-22, we anticipate a rise in the company’s purchase of investment securities/financial assets such as loans to customer, treasury bills, Federal/State government bonds, corporate bonds and mutual fund assets. Considering the Central Bank of Nigeria’s (CBN) hike in the Monetary Policy Rate (MPR) throughout the year from 11.5% to 14% and now recently to 15.5%, we anticipate a rise in the yield of some of these investment securities/financial assets.

Fig 6: Trend in Managed funds growth rate (2016 to 2022F)

However, due to the rise in the MPR, we also anticipate a rise in the company’s interest expense on managed funds and other borrowings. This will likely dampen the interest income the company makes on the investment securities/financial assets. We also anticipate a rise in the company’s fees and commission income from management of mutual funds and customers’ portfolio. It is worth noting that the company recognizes fee and commission income from the management of mutual funds over time on a monthly basis as fees are accrued as a percentage of the Net Asset Value (NAV) of the mutual funds. We anticipate a growth in mutual funds as the company’s managed funds have grown. Consequently, we forecast gross earnings of N22.6 billion for FY-22, this is 25.3% higher than the N18.1 billion gross earnings recorded in FY-21. The growth in gross earnings will be supported by a 11.5% growth in investment income and a 27.5% growth in fee and commission income. We forecast investment income of N9.9 billion by FY-22 against N8.9 billion recorded in FY-21 and fee and commission income of N7.9 billion by FY-22 against N6.2 billion recorded in FY-21.

Valuation:

The company’s stock was valued at N18.01 and N9.68 per share using the Dividend Discount Model (DDM) and the Comparable method of valuation, respectively. The DDM valuation was done by projecting the company’s future dividend payment and discounting them to the present using the company’s cost of equity of 18.3% as the discount rate and 10% as the company’s perpetual growth rate. The comparable method was done by multiplying the company’s forward EPS of N2.41 by the 5-year average Price-to-earnings ratio (P/E) of 4X.

United Capital Plc has seen steady growth in both top and bottom lines over the years, and we expect both to continue to grow at double digits over the next five years. The company’s Return on Equity (ROE) has averaged over 30% in the past 5 years. This is one of the highest among publicly listed financial service companies and highlights the company’s strong value creation for its shareholders. We recommend a buy for the stock based on our findings and the future prospects of the company. Our blended target price of N15.10 suggests a potential upside of 20.8% compared to the current share price of N12.50 (24th October, 2022). The target price was arrived at by using a weighted average of 65% for the DDM method and 35% for the comparable method of valuation.

The company also has the following market value ratios:

P/E ratio: 6.7X (FY-21 EPS: N1.88)

Forward P/E: 5.2X (FY-22 EPS: N2.41)

Dividend yield: 12% (last dividend reported: N1.50)

P/B ratio: 2.55X (Book value: N4.9)