The dynamics of pharmaceutical industry has changed after the COVID-19. Fidson Healthcare is listed amongst the twenty (20) key players in pharmaceutical industry in Nigeria. In this article, we examined the Company’s income statement performance H1-22 and provide our outlook for the short-to-medium term.

FIDSON’s revenue surged from N12.93 billion recorded in H1-21 to N20.38 billion in H2-22 representing a massive revenue growth of 57.6%. This is 2760bps higher than 5 years compound annual growth rate (CAGR) of 29.9%. We note that the reason for the strong growth in top line are due to the inflationary increase in price of pharmaceutical products and the commencement of GlaxoSmithKline outsourcing arrangement – a contract that was signed 2019 but kick-started in December 2021. This involves a transfer of manufacturing capabilities and assets from GSK to Fidson. Also, recall that the company announced the completion of its N9 billion Manufacturing facility in 2016.

Cost of Goods sold (COGS) settled higher at N10.51 billion in H1-22 from N6.95 billion documented in H1-2021 showing an increase of 51.6% growth. We highlight that the increase in COGS is as result of the increase in the cost of production due to currency pressures, higher inflation rates, and overall disruption in worldwide value chain which have impacted the freight costs linked with the importation of active Pharmaceutical Ingredients and excipients.

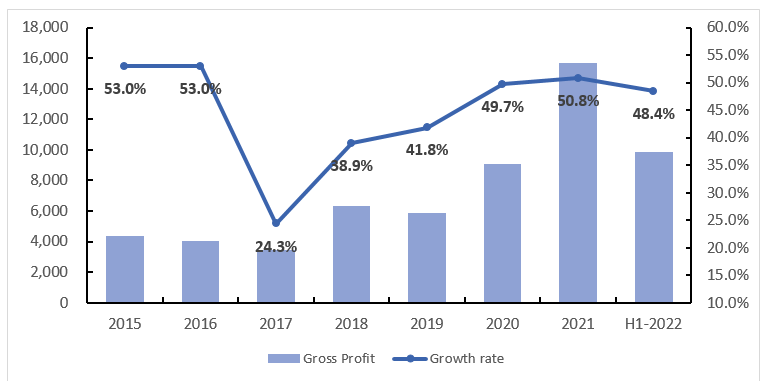

Figure 1: Trend in gross profit margin (2015 to H1-22)

Margins:

Gross margin printed 48.4% H1-22. This represents 225Bps higher than the gross margin recorded in H1-2021 of 46.2%. We highlight that the increase in margin was driven by high revenue recorded in the period.

The company’s Profit After Tax (PAT) grew from N1.19 billion H1-2021 to N2.70 billion printed H1-2022, this represents an impressive 132.42% growth y/y.

We note that the growth in PAT is significantly higher the CAGR of 42.9% registered in the past 5year, primarily supported by the growth in revenue. However, we notice an increase in administrative expense by 8.06%, selling and distribution expense 69.90% while other income dipped by -4.22%.

PBT Jumps to N4.00 billion in H1-2022 from N1.75 billion recorded in H1-2021, an impressive 128% increase.

Currently, the local drugs manufacturers are faced with an intense competition from imported products and multinational companies. For instance, 70% of the drugs consumed in Nigeria are imported. Also, almost all the local manufacturers source their active pharmaceuticals ingredients or raw material through importation. The preceding suggests that they are merely purchasing drugs and repackaging them for use. These account for the major challenge in the pharmaceutical industry in Nigeria. Though, Fidson is currently working to expand into Active pharmaceutical production (API). Other constraints, will be infrastructural challenges such as inconsistent energy, weak technology, scarcity of forex and high taxation etc.

Outlook: We anticipate the price of drugs to remain high for the rest of the year as those factors above remain constant. We also expect the cost of importation of raw material remain high as the naira continue to depreciate at the parallel market. Therefore, we expect a robust revenue over the medium term. Precisely, we expect revenue to settle higher at N42.80 billion, compared with the revenue recorded in FY-21 which peaked at N30.86 billion. Like we noted previously, the key drivers would be price and higher traded volumes from the new plant versus the GSK partnership. We expect the COGS to rise by 10% in H2-2022, underpinned by the expected persistence inflation and currency depreciation. Elsewhere, we forecast the Gross profit to stay 47.1% with PAT of N5.41billion.

Interesting and precise…please keep me updated.

Accurate

This is well articulated and analyse…

Good job. Keep it up

Brilliant analysis. Will be paying particular attention to the company