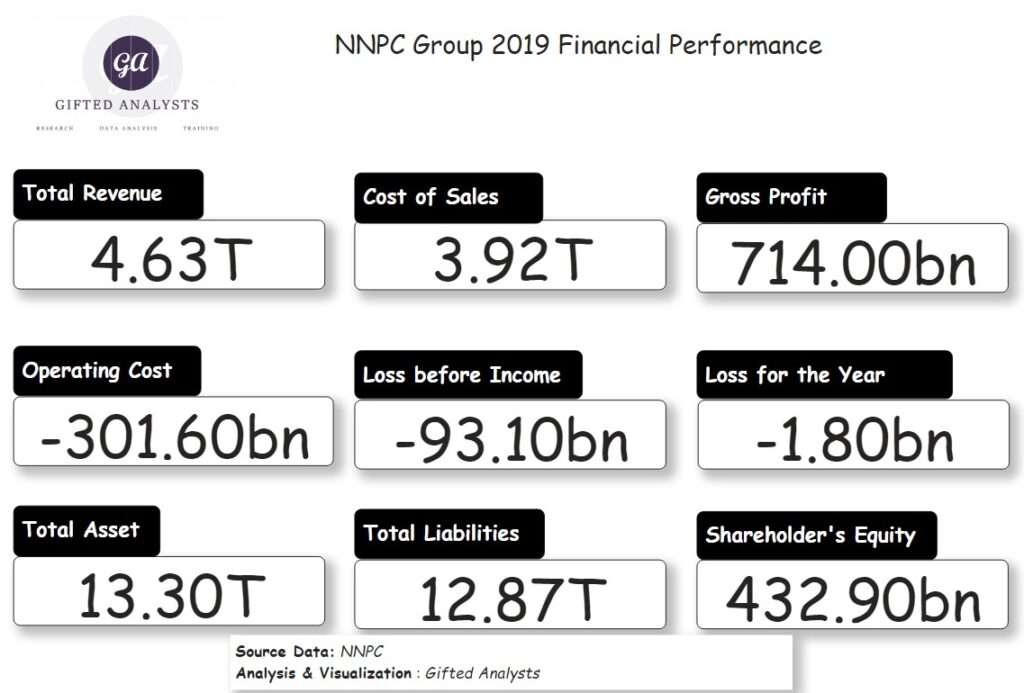

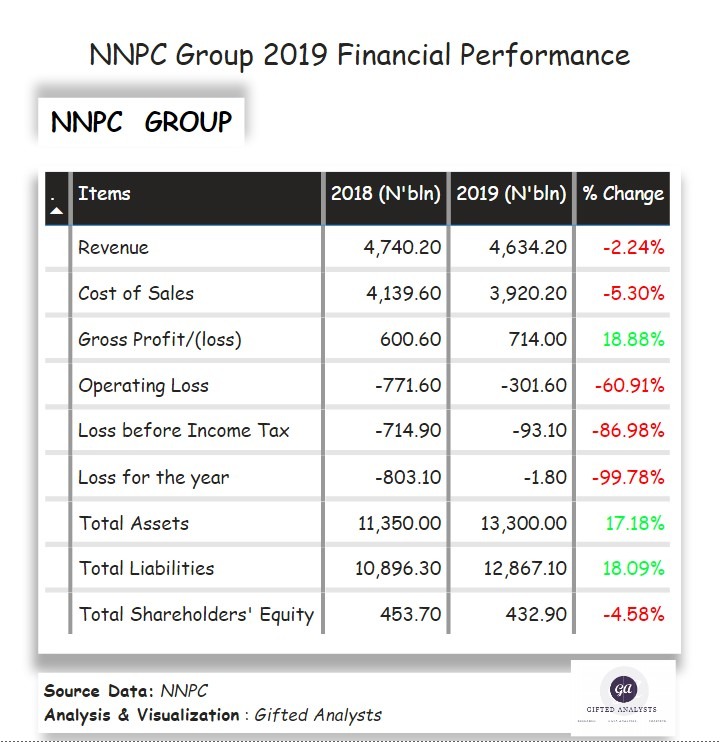

Of the N4.63 trillion revenue the NNPC Group made in 2019, N1.08 trillion came from the sale of crude oil, N2.92 trillion came from the sale of petroleum products (PMS, DPK, AGO, lubricants and other related products), N489 billion came from the sale of gas, while the remaining N144 billion was revenue from services offered.

Despite a slight decline in topline (revenue), the NNPC Group was able to reduce its loss for the year by 97% majorly due to (1) reduction in administrative expenses to N696 billion from N894 billion in 2018, (2) reduction in net impairment loss on financial assets to N274 billion from N468 billion in 2018, (3) increase in other income from N78 billion in 2018 N266 billion in 2019 and (4) income tax credit of N91 billion compared to income tax expenses of N88 billion in 2018.

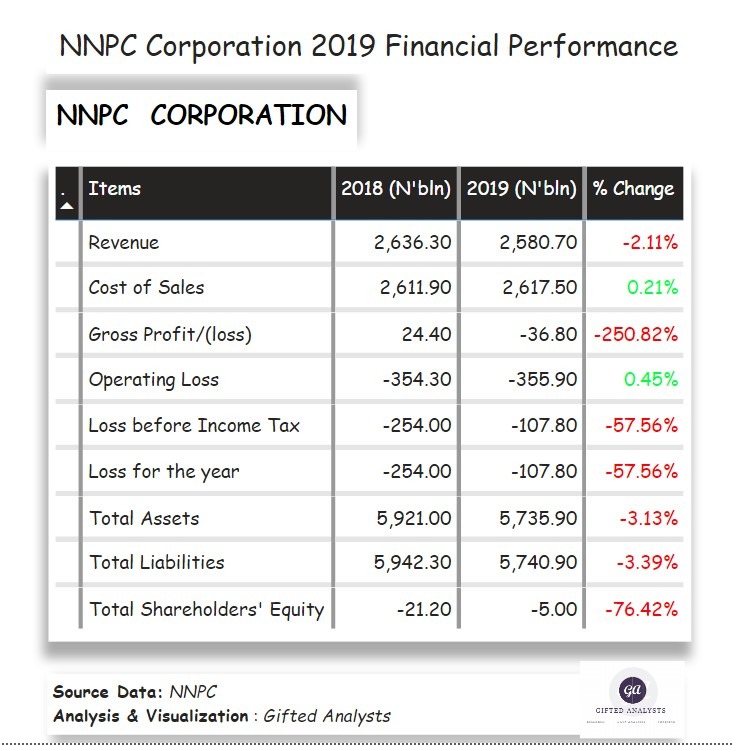

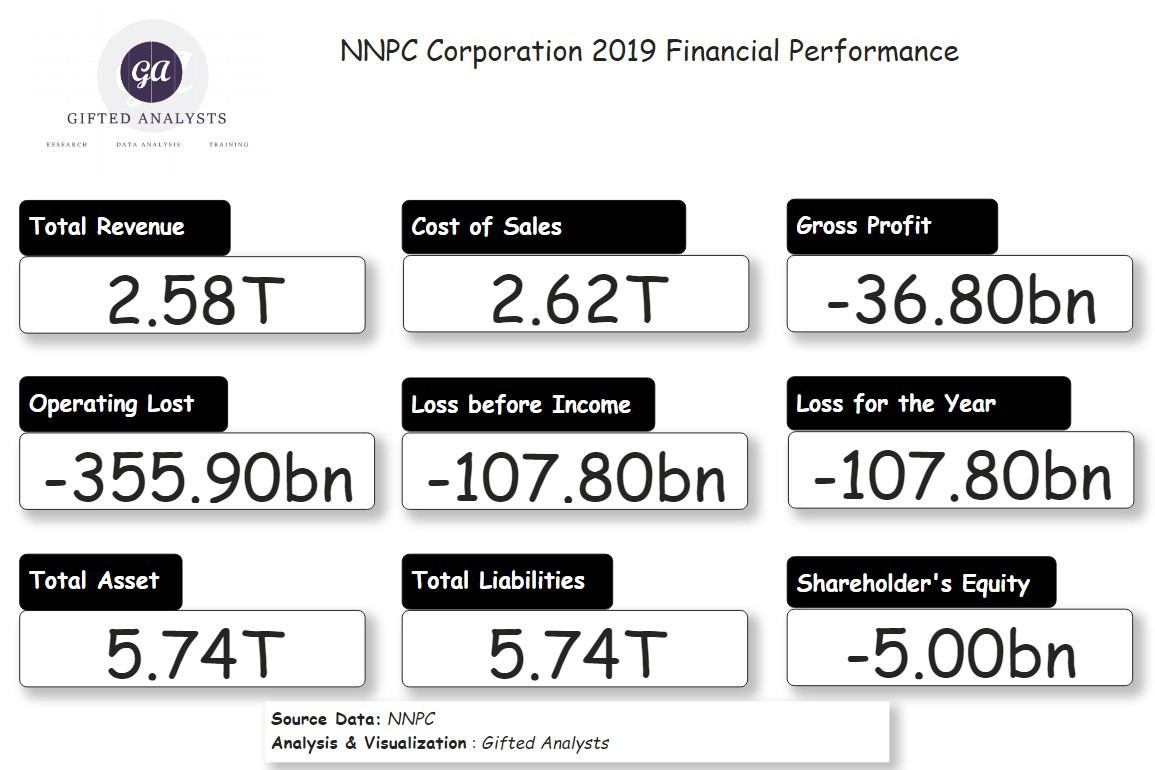

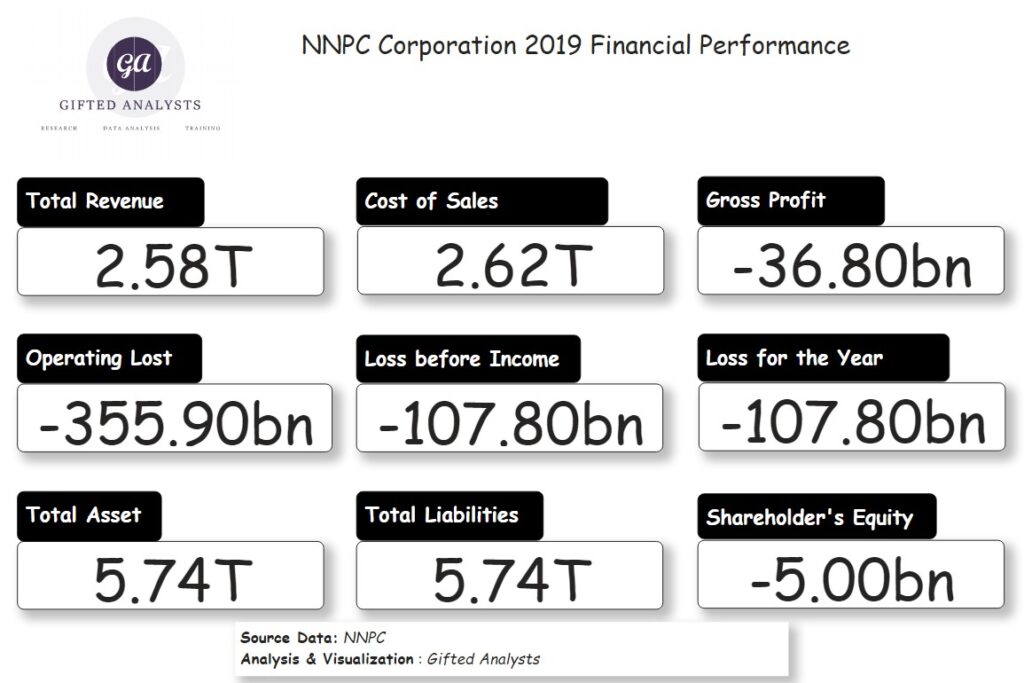

For the NNPC corporation, all the revenue earned during the period was through the sale of petroleum products such as PMS, Dual Purpose Kerosene (DPK), Automotive Gasoline Oil (AGO), lubricants and other related products.

The NNPC Corporation just like the NNPC Group, also operates on a loss. A significant observation is the shareholders’ equity which is negative, as the total liabilities exceed the total assets. As such, PWC indicated that a material uncertainty exists that may cast significant doubt on the Group and Corporation’s ability to continue as a going concern.