Coronavirus struck in late 2019 and extended into 2020, when it had a significant adverse impact on supply and demand chains. Many jobs were lost; IMF estimated the global economy to have contracted by -4.1% YoY, while the Nigerian economy receded by 1.9% YoY. This moody economic performance exerted downward pressure on oil price, which averaged $44bpd in 2020.

Accordingly, the government’s fiscal revenues posted a murky trend with a shortfall of 18% YoY in gross oil revenue and decline of 31% YoY in non-oil revenue according to the Budget Implementation Report as of H1 2020, which also reflected in the government’s CAPEX as capital expenditure firmed downward by 6% against quarterly estimate.

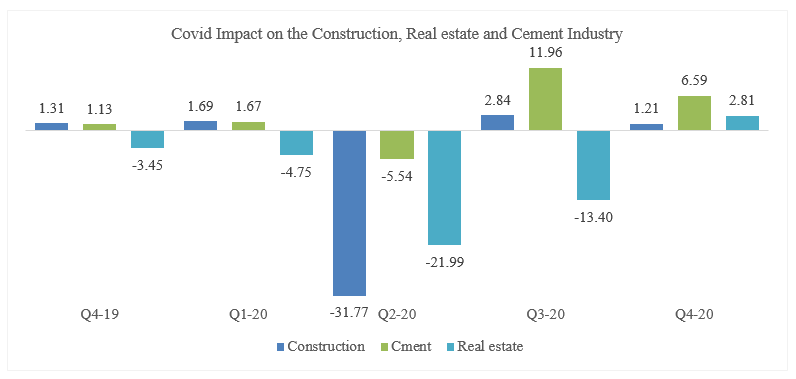

Concomitantly, the construction and real estate industries impacted by the depressed economic activities shrank by 31.77% and 21.99% respectively in Q2 before the construction industry recovered in Q3 with a 2.84 growth as lockdown measures imposed to curb the transmission of the virus was relaxed. The real estate picked up in Q4 with a 2.81% positive growth.

Amidst this economic burst, the Nigerian cement industry recovered in Q3-20 with an 11.99% upturn after that remained resilient. Key players in the cement industry posted an industrywide uptrend in top-line and bottom-line.

The cement industry is dominated by three players that jointly control over 96% of the market. Dangote cement plc (or Dangcem) is the market leader by capacity with a 64% market share, Lafarge Africa plc follows with a market share of 21%, while BUA while commands 16% of the market. In terms of overall domestic capacity, Dangote cement plc added 3MMT, which brings the total domestic capacity to 50.8MT

2020 Review: Uptick in Volume and Favourable Pricing Drove Top-Line

On the eve of the coronavirus, the government’s measures to curb the virus encouraged companies to adopt a work-from-home policy. This, among other factors like rising inflation, economic uncertainty, and reduced disposable income, impacted demand for cement adversely in Q2-20, resulting in the market leader (Dangote cement) reporting a half-year decline in sales volume of 1.5% YoY. Conversely, BUA and Lafarge’s impressive performances in Q1-20 masked overall half-year performance as sales volume returned 7.9% growth for BUA, while Lafarge printed 3.47% growth in volume sold.

As a health measure to contain the virus, the government and some private sector players engaged in makeshift projects like building and rehabilitation of isolation centres across the country, resulting in an uptick in cement volume sales.

As economic activities picked up in Q3-20, companies that adopted a work-from-home policy maintained the policy which had–and is having–a twin impact on the real estate sector – while there are more vacant office spaces, households increased their demands for residential spaces, as reported by north court. The preceding thus cushioned the downtrend in demand imposed by the empty office spaces.

The preceding and the government’s CAPEX, which picked up in Q3, resulted in a favourable YoY volume growth by DANGCEM (6.6% YoY), BUA (16% YoY) and Lafarge (29.7% YoY). Accordingly, the increased demand for cement and the cement industry’s oligopolistic structure encouraged an upward pressure in the domestic price of cement estimated to have advanced by 5% YoY.

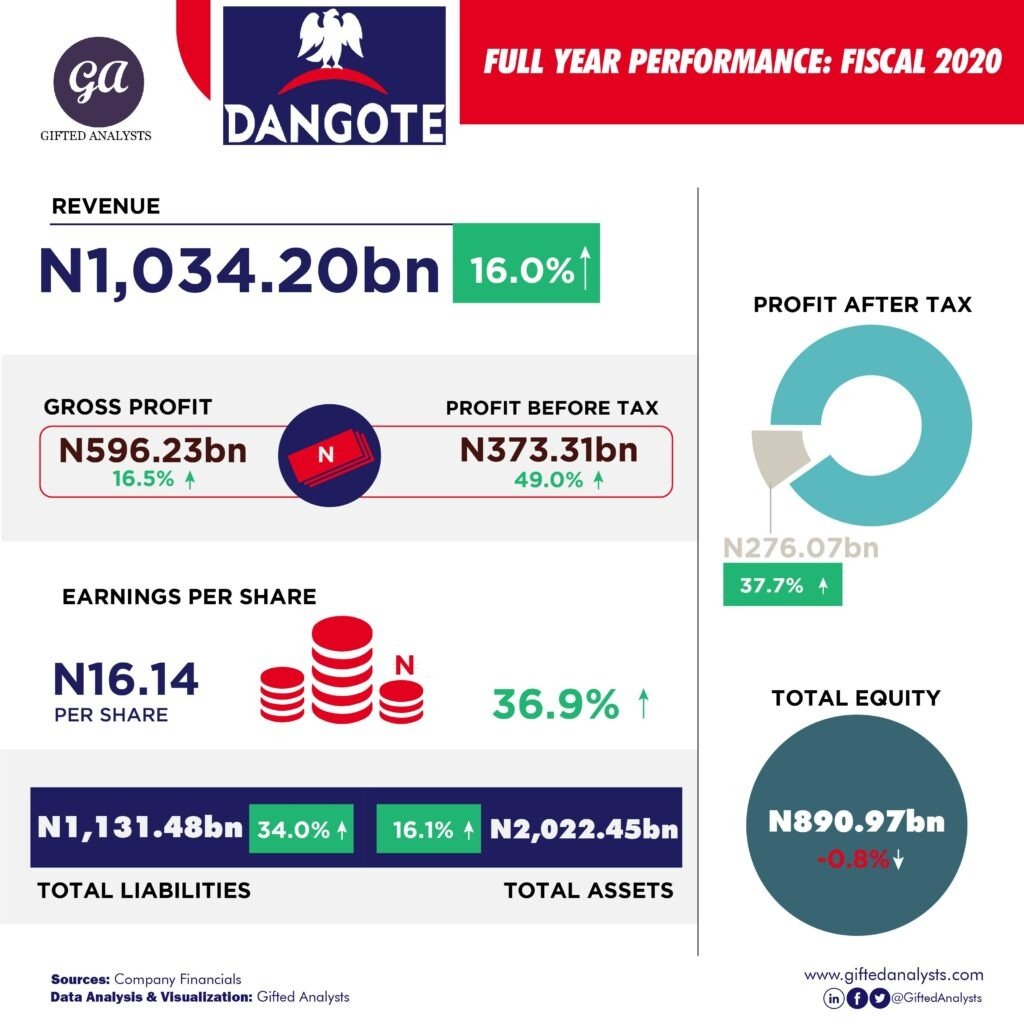

Dangote plc grew group revenue by 16% YoY to be company-specific, supported by a 12.9% and 4.4% growth in its Nigeria and pan Africa operations, respectively. In its pan Africa operations, favourable recovery from the coronavirus induced economic halt and improved investment climate resulted in increased demand in Ethiopia, Cameroon, Congo. Senegal. However, these increased demands were watered down by competitive pressure in Ghana and continued slowdown in economic activities in Zambia.

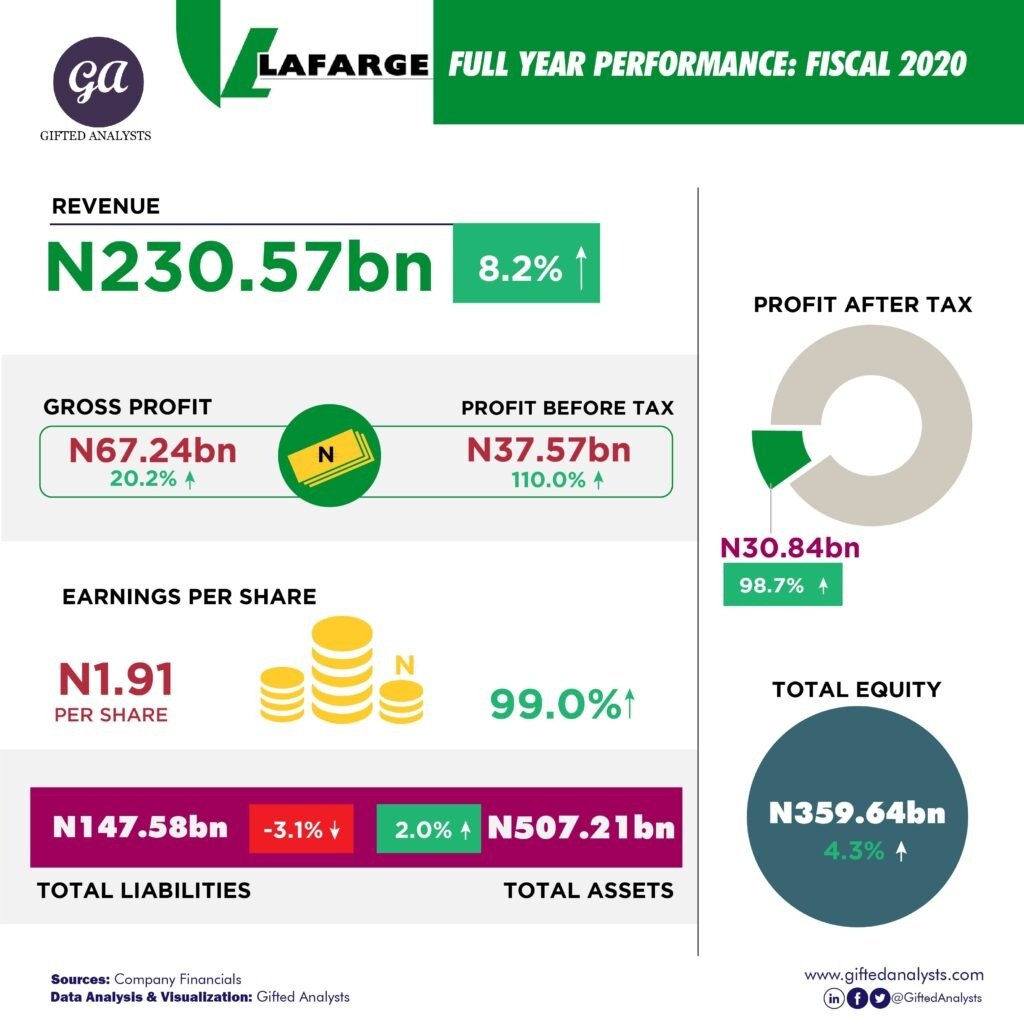

Similarly, BUA cement benefited from its continued reinvestments as it maintained its bullish revenue growth with a 19% YoY growth. Lafarge, however, continued its post-restructuring improvement in performance with an 8.3% revenue growth. The favourable market conditions and its focused strategy, having discontinued its South Africa operations, underpinned its performance.

Bottom-line Remained Steadfast Despite Devaluation Pressure

All the industry players reported improved EBITDA margin despite facing devaluation pressure from the Naira as the currency lost 33% of its value in 2020. Consequent to the devaluation, fuel and energy cost increased by 19% YoY for both DANGCEM and BUA and 22% YoY for Lafarge. However, supported by a buoyant volume-price dynamic which we discussed earlier and the fact that virtually all inputs in producing cement were sourced locally, all the three players printed a 2% improvement on their 2019 EBITDA margin. BUA and DANGCEM reported a 46% EBITDA margin while Lafarge’s EBITDA firmed up to 32%.

In semblance to its position as the dominant player and the industry’s price maker, Dangote cement plc reported a 23% Return on Invested Capital (ROIC), which overshot its nearest competitor (BUA) by 600bps. Lafarge came in a distant third with an ROIC of 6%. We, however, note the gradual increase in Lafarge’s performance over the last five years as it continues to grow its ROIC from the 1% it reported in 2016. We believe this continued uptrend in its performance is hinged on the selloff of its South Africa operations, a strategic action that has continued to impact performance favourably.

Increased Leverage Amid Favourable Yield Environment

The central bank decision to exempt corporate and individual investors from the Open Market Operation (OMO) resulted in excess liquidity in the market, thus exerting a downward pressure on yields as reflected by the treasury bills and 10-year bonds yields which printed as low as 0.05% and 6% in 2020 respectively. On the back of this excess liquidity episode, large corporates in the country like Dangote cement and BUA sized on the low yield environment to issue their maiden bonds.

For Dangote cement plc, on the back of the successful commercial paper issued in 2018, it issued an NGN100bn series1 unsecured bond at 12.5%, which matures in 2025. The interest rate will be paid semi-annually, while the principal is a bullet payment when the debt matures. The new Issue impulse leverage level mildly as its net debt to EBITDA grew from 0.63 to 0.73, showing its proxied cash flow can cover its debt with annual cash generated. However, net debt to equity increased significantly from 28% to 40%, reflecting an increase in its financial risk.

Similarly, BUA concluded its N115bn series1 bond issue at 7.5% to finance its working capital, and short-term debt refinance. This told on the company’s gearing position as net debt to equity and net debt to book capitalisation increased from 2% to 39% and 23%, respectively. On EBITDA to debt basis, the company’s ability to cover its debt with its cash flow increased to 1.5 years, while interest cover trended upward (despite the addition to interest cost from its bond issue) as the company capitalised more interest cost YoY.

Elsewhere, Lafarge continued to reap the benefits of the deleveraging it carried out in 2019 that ensured a continued downtrend in its finance cost as it declined 58% YoY. Concomitantly, the company reported a net cash position of 1% in 2020. The company has not guided us to increased leverage in the short term. However, we believe the company will secure some form of debt funding to finance its planned expansion given its competitors’ activities.

Shareholders’ Return

The trio reported a solid operating free cash flow (FCF) to investors in 2020.

We determined an operating free cash flow of N194bn for Dangote plc, while BUA generated N57.5bn operating FCF. Lafarge maintained its upturn in 2019 with an improved FCF of N46.5bn for the year ended 2020.

On dividend, Dangote cement maintained an N16 per share dividend payment to shareholders, representing a 99% payout ratio. BUA cement announced a 97% (N2.067 per share) dividend to shareholders on the back of its impressive performance, while Lafarge returned to a dividend payment payout of 53%, representing N1.0 per share.

Outlook

We employed the Discounted Cash flow valuation method, Dividend Discount Model and Relative valuation method to determine the companies’ fair values. For DANGCEM, we apply a cost of equity of 24.02%. Our risk premium is determined using the country risk premium approach, which resulted in an equity risk premium of 11%. Consequently, we believe the fair price of DANGCEM should be N189.20. We applied a 50%, 35% and 15% apportionment rate between DCF, DDM and relative fair price, respectively.

We employ the same BUA and Lafarge approach but with a different cost of equity reflecting their financial risks. We used a cost of equity of 25% for BUA, while a 24.5% cost of equity was applied to Lafarge’s cash flows. Consequently, we determined their respective fair values to be N55.19 and N28.71, respectively.

We believe the industry is well-positioned to return favourable returns to shareholders in 2021. Our opinion is supported by the various expansions carried out by the key three companies. Specifically, we think the favourable macroeconomic condition in the guise of improved real GDP growth and an uptick (also stable) oil price will exert a positive touch on the government’s fiscal revenue, which will, in turn, improve CAPEX.

Similarly, the Guardian reported that cement is among the 131 items submitted by Nigeria to the African Union for AFCFTA exemption. If negotiation is successful, it will prevent market erosion from importing cement into the country and ensuring key players can dictate an upward price adjustment if the need arises. Conversely, Dangote cement and BUA are well-positioned to increase exportation. Dangote cement began the exportation of clinkers in June 2020 from its Apapa terminal, and it has announced its intention to export a total of 4m through that route in the coming years. We think the outlook is favourable for the entire industry in the short, medium and long term.

The government’s housing ambition to build 300,000 housing units, which will begin later this year, will have a positive impulse on domestic demand for cement. Already, Dangote cement and BUA cement have signed an agreement with the federal government to supply cement at a discounted price. This will ensure an upward trajectory of volume over the short and medium term.

Specifically, we believe BUA cement expansion drive with its imminent completion of three million metric tonnes Sokoto Cement Plant this quarter and additional three new lines of 9 million metric tonnes total capacity in Adamawa, Edo and Sokoto States by 2023, which would increase its full capacity above 20 million. The preceding will further stamp its position as a viable competitor to the industry leader (DANGCEM). Besides, its agreement to supply liquified gas for its Sokoto plant will impact, though mildly, the cost of sales positively, which will further protect margin.

We posit that Lafarge will continue its uptrend in performance as the company continue to reap the benefit of its focused strategy, having expunged its South Africa operations in 2019. Like BUA cement, the company continues to provide guidance on its intention to increase its capacity.

On the downside, persistent inflation could pressure consumers’ wallets and limit their drive for real-estate demand as they seek to fulfil their feeding needs. Inflation has grown 17.44% YoY. Furthermore, increased volatility and a significant drop in oil price could have a strong and negative impact on the government’s infrastructural drive and demand.