The impact of Covid-19 on the Nigerian economy cannot be estimated with certainty. Various figures released so far have been scary with little or no optimism for the short term. Forecasts by the IMF, National Bureau of Statistics (NBS), Economic Sustainability Committee (ESC) have shown that a recession of about -3.4% y-o-y imminent with various versions of recovery estimated for 2021. With 7.94 million confirmed cases globally and 17,148 in Nigeria as at June 17th, economies are trying to live with Covid-19 following relaxation of lockdown directives being carried out in phases across the globe.

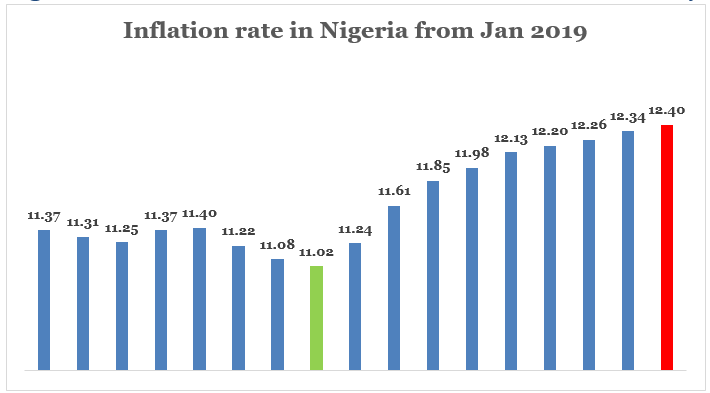

On the back of aggressive lockdown measures by the FG of Nigeria, the month of May (4th May) finally saw the first phase of lockdown relaxation in the major economies of the country (Lagos, Ogun, FCT). Economic activities were characterized with lackluster, due to fear of contracting the virus and low consumer purchasing power. A recent publication by the NBS on the Consumer Price Index (CPI) revealed the inflation rate in the country stands at 12.4%.

Consumer Price Index expresses the change in the current prices of the goods and services in terms of the prices during the same period in the previous year. The index is used to measure the rate of inflation in the economy. 1-2% level of inflation is needed to keep the economy healthy, serving as an indicator of consumer spending which propels economic growth.

CPI increased by 12.4% (year-on-year) in May 2020, 6bps (0.06%) higher than the rate recorded in the previous month (12.34%), marking a ninth consecutive month of increase in inflation since August 2019 (11.02%) and a 25-month high of April 2018 (12.48%). The 12.4% inflation rate means that on the average, if a goods cost NGN100 in May 2019, 12 months ago, the consumer will actually pay NGN112.4 for the same commodity in May 2020.

The Composite food index which tracks changes in the prices of food items in the country rose to 15.04% in May 2020 compared to 15.03% in April 2020 and 14.98% in March 2020. The rise in the food index was caused by increases in prices of Bread and cereals, Potatoes, Yam and other tubers, Oils and fats, Fruits, Fish and Meat. Ban on inter-state transportation hereby hindering the free flow of agricultural output from farm to the market, disruption in supply chain caused by the insecurity menace across the country as well as lean agricultural output are the main culprit leading to increase in consumer food’s prices.

All items less farm produce” or Core inflation, which measures the prices of none agricultural produce stood at 10.12% in May 2020, up by 0.14% when compared with 9.98% recorded in April 2020 and 9.73% in March, 2020. The highest increases in prices were recorded in prices of pharmaceutical products, Medical services, Repair of furniture, Hospital services, Passenger transport by road, Motor car, Bicycles, Maintenance and repair of personal transport equipment, Passenger transport by sea and inland waterways, Paramedical services, Motorcycles and Hairdressing salons and personal grooming establishment. It is obvious that increases in health and pharmaceutical services, transportation fare are direct consequences of the pandemic. Commuters are charging for the social distancing practice in their vehicles, hospitals and pharmacies are implementing measures to protect their businesses.

Moving forward, the Monetary Policy Committee (MPC) of the CBN surprisingly decided to cut its Monetary Policy Rate (MPR) by 100bps (1%) to 12.5%, at the meeting held on the 28th May 2020, after holding the MPR at 13.5% for 14 consecutive months. The CBN’s position shows its willingness to deliver measures to mitigate the virus’s impact on the real economy, despite its commitment to Naira stability.

This stand is aimed at easing credit conditions to stimulate economic activities but will worsen the currency vulnerability. We therefore forecast a modest increase in the rate of inflation following the rate cut as private sector borrowing will increase coupled with limited liquidity in the Forex Market, declining foreign reserve as well as further lean in agricultural produce due to its seasonality. With such in mind, we believe the CBN will likely raise the MPR in its next MPC meeting.

For questions, opinions, corrections and contributions, please drop them in the comment section. You can as well contact the writer on Twitter @ SheriffHolla

Additionally, should you need data backed research and analysis for your business or research needs, you can contact us with your message in the comment section or send a mail to info@giftedanalysts.com