By Marcos Chamon and Jonathan D. Ostry / IMF

Many countries are experiencing a combination of high public debt and low interest rates. This was already the case in advanced economies even prior to the pandemic but has become even starker in its aftermath. A growing number of emerging market and developing economies are likewise enjoying a period of negative real rates—the interest rate minus inflation—on government debt. The IMF has called on countries to spend as much as they can to protect the vulnerable and limit long-lasting damage to economies, stressing the need for spending to be well targeted. This is especially critical in emerging market and developing economies, which face tighter constraints and associated fiscal risks, where greater prioritization of spending is of the essence.

But what should eventually be done about the high levels of public debt in the aftermath of this crisis? In an earlier paper we showed that, provided fiscal space remains ample, countries should not run larger budget surpluses to bring down the debt, but should instead allow growth to bring down debt-to-GDP ratios organically. More recently, the IMF has stressed the need to rethink fiscal anchors—rules and frameworks—to take account of historically low interest rates. Some have suggested that borrowing costs—even if they move up—will do so only gradually, leaving time to contend with any fallout.

Two issues seem salient. First, will borrowing remain cheap for the entire horizon relevant for fiscal planning? Since that horizon seems to be the indefinite future, our answer here would be “no.” While some have argued that permanently negative growth-adjusted interest rates might be a reasonable baseline, we would highlight the risks around such a benign future. History gives numerous episodes of abrupt upticks in borrowing costs once market expectations shift. This risk is especially relevant for emerging market and developing economies where debt ratios are already high. At some point, debts may well need to be rolled over at higher rates. Limits to how much can be borrowed have not disappeared, and the need to stay well clear of them is even sharper in a world where interest rates and growth are uncertain.

Second, will it suffice to respond gradually to higher interest rates? Our answer again is “no.” Theory and history suggest that, when investors begin to worry that fiscal space may run out, they penalize countries quickly. Market-driven adjustments are not necessarily gradual, nor do markets only ratchet up the cost of borrowing once healthy growth returns—indeed, just the opposite seems plausible.

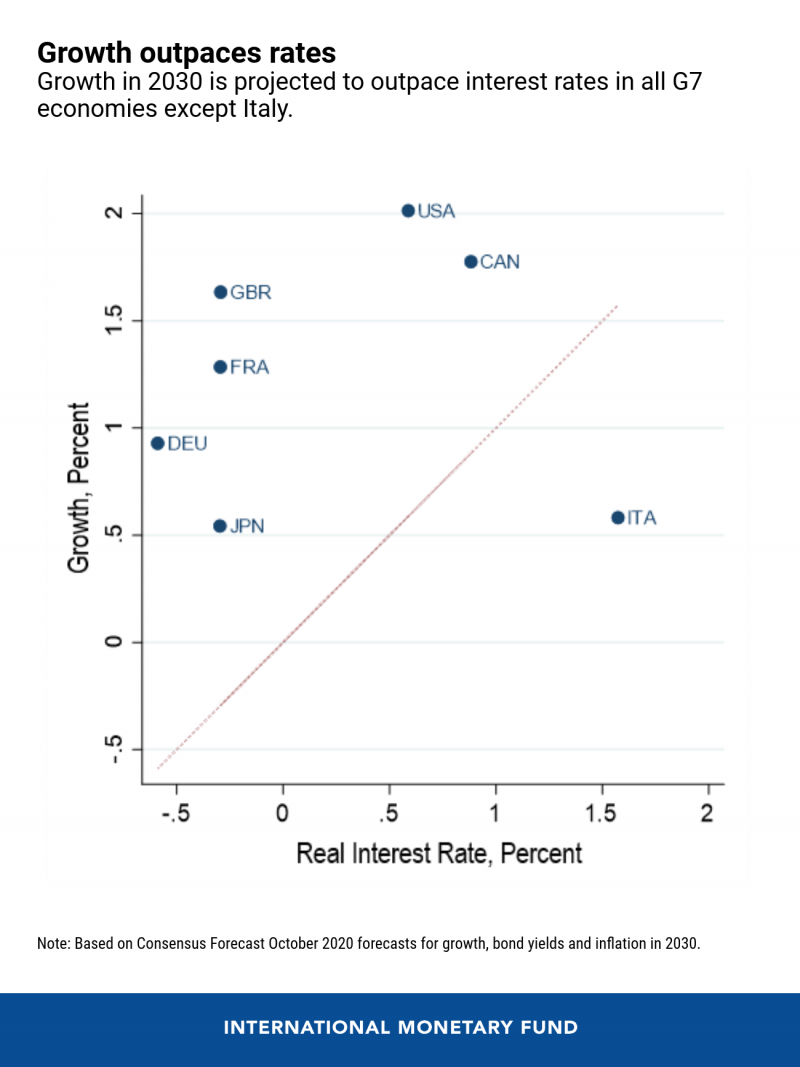

There are deeply engrained market expectations of negative interest-growth differentials (where real interest rates are less than growth rates) for most advanced economies. While long-term rates in the United States have been rising for the past several months, they remain low even by post-2008 standards. The chart below compares the Consensus Forecast for growth in the G7 economies with the real interest rate (10-year bond yield minus inflation) in 2030. The forecasts imply growth rates well in excess of real interest rates for all G7 countries except Italy.

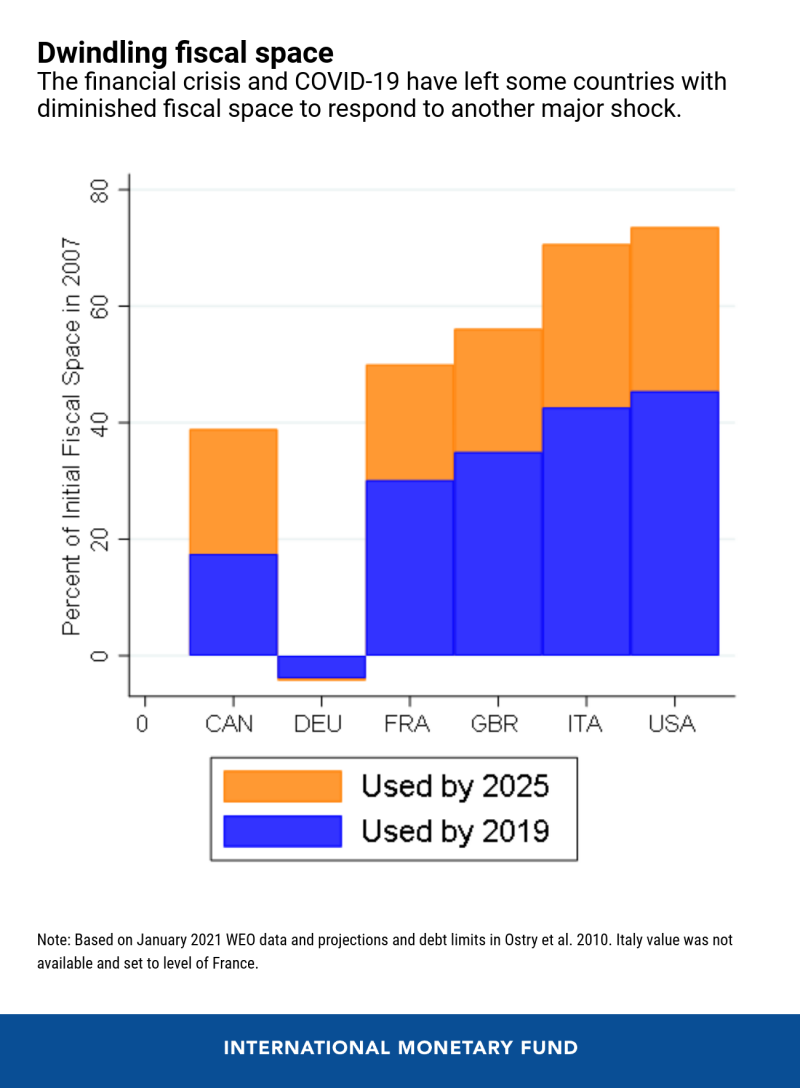

But on the flipside, debt is getting closer to levels that were previously considered dangerous. Earlier we estimated debt limits beyond which the fiscal balance would not be able to adjust to market-driven increases in risk premia. These model-based estimates, built on a methodology later adopted by rating agencies in their own forecasts, reflect market conditions after the Global Financial Crisis but prior to COVID-19. Nevertheless, they are still informative by conveying what was perceived to be the debt limit as of a decade ago. This provides an indication of what could be expected if those previous conditions resurfaced. The bar chart shows how much of the estimated fiscal space (debt limit minus 2007 debt) was used from 2007 to 2019 (blue bars), and how much is projected to be used from 2019 to 2025 (orange bars). For some countries, the remaining fiscal space would not allow a response of a size comparable to what was deployed following the Global Financial Crisis or COVID-19—potentially constraining action in the event of another major shock.

At the risk of over-simplifying, we can consider three alternative views:

- Interest rates remain low in advanced economies even if debt continues to increase. In such a case, there is no need to worry about debt or steady (non-accelerating) deficits. The debt ratio would continue to rise but will eventually stabilize at a higher level.

- Interest rates are low at given debt levels, but they would not remain low if debt were to rise significantly. Most G7 countries can run a primary deficit close to 2 percent of GDP while still stabilizing their debt ratios. In this scenario, they do enjoy a free lunch provided deficits remain below the debt (ratio)-stabilizing level.

- Interest rates are low but could adjust, perhaps abruptly. In this scenario, there is a case for taking advantage of favorable conditions to reduce debt and rebuild buffers. Even if the perceived risk is small, the large costs associated with forced adjustment could justify worrying about high debt and planning already for a riskier future.

What’s the moral of the story? It is indeed self-defeating to target a higher budgetary balance when the pandemic is not behind us. But that does not mean we should not worry about the consequences for debt paths, not least because markets may eventually worry, even if low borrowing costs now suggest those worries are far away. A prudent baseline is that borrowing costs might become significantly higher, especially for emerging market and developing economies. Then the task is to determine the fiscal policy needed to anchor expectations for a riskier future. Advanced economies with ample space may not need to worry much, but those with very high debt—where the reasons for low borrowing costs are imperfectly understood—might need to take some anchoring insurance. Emerging market and developing economies are likely to face more binding fiscal constraints and may need to adjust sooner (but again, not before the recovery is firmed up). All countries will need to anchor fiscal plans with some notion of sustainability, which can also attenuate the concern of a market repricing of risk. This is not tomorrow’s worry if fiscal space is uncertain and market expectations can turn abruptly. Laying out plans to anchor expectations should be today’s worry for all.

Marcos Chamon is a Deputy Division Chief in the Debt Policy Division of the IMF’s Strategy and Policy Review Department.

Jonathan D. Ostry is Acting Director of the IMF’s Asia and Pacific Department.

CREDIT: The Post A Future with High Public Debt: Low-for-Long Is Not Low Forever first appeared in the IMF blog on 20th April 2020.