By Tobias Adrian / IMF

Despite a global economic crisis comparable only to the Great Depression, near-term financial stability risks have been contained with the help of unprecedented monetary policy easing and massive fiscal support across the globe. But many economies had pre-existing vulnerabilities—which are now intensifying, representing potential headwinds to the recovery.

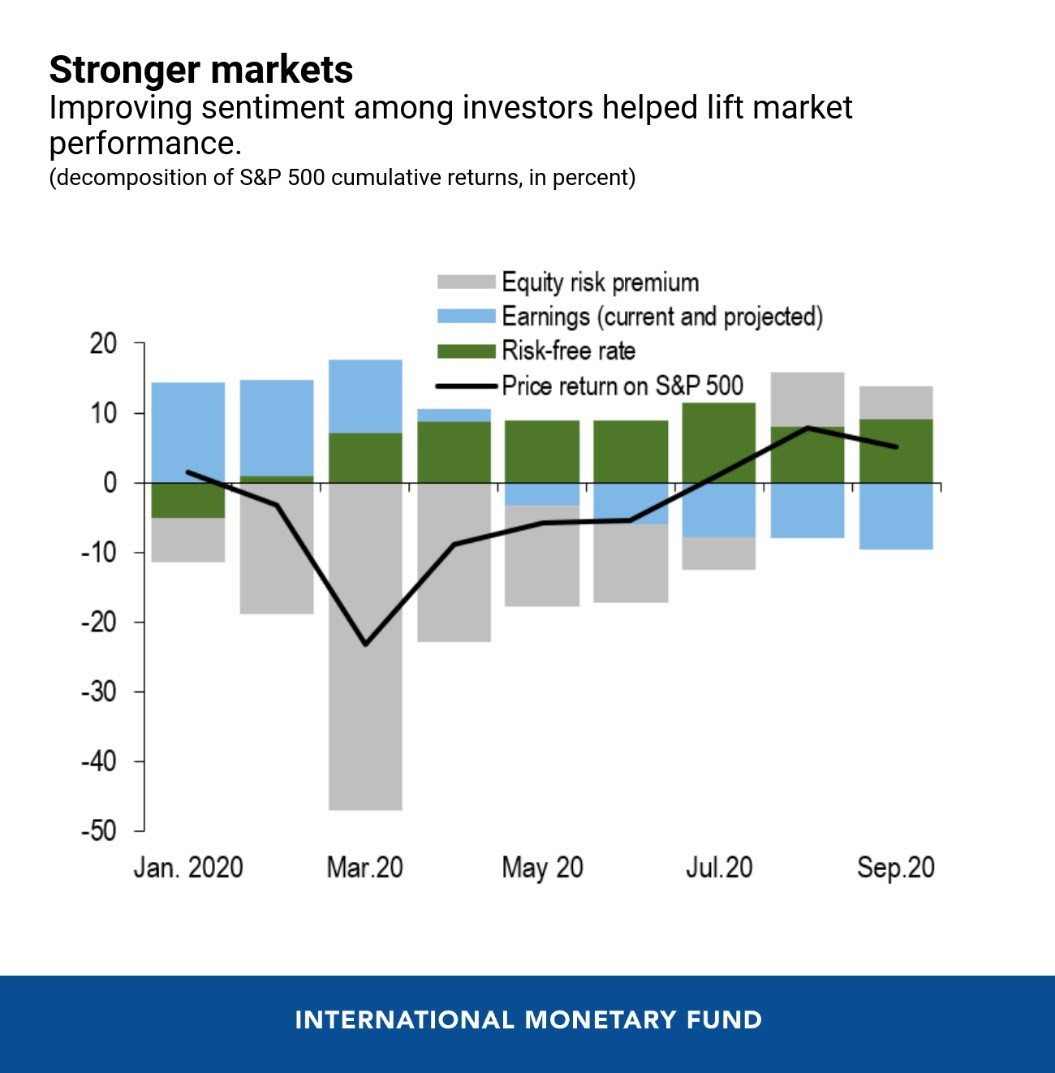

Extraordinary policy measures have stabilized markets, boosted investors’ sentiment, and maintained the flow of credit to the global economy. Critically, these measures helped prevent a slowing economy and sliding financial markets from feeding on each other in a destructive vicious cycle.

The rebound in asset prices and the easing in global financial conditions have benefited not only advanced economies, but also emerging markets. In addition, unlike in previous crises, emerging markets this time were also able to respond by cutting policy rates, injecting liquidity and, for the first time, employing asset purchase programs.

Beware of the real-financial disconnect

The significant improvement in financial conditions has helped maintain the flow of credit to the economy, but the economic outlook remains highly uncertain. A disconnect persists, for example, between financial markets—where there have been rising stock market valuations (despite the recent repricing)—and the weak economic activity and uncertain outlook. This gap can gradually narrow if the economy recovers swiftly. But if the recovery is delayed, for example because it may take longer to get the virus under control, the investor optimism may wane.

As long as investors believe that markets will continue to benefit from policy support, asset valuations may stay elevated for some time. Nonetheless, and especially if the economic recovery is delayed, there is a risk of a sharp adjustment in asset prices or periodic bouts of volatility.

Corporate sector vulnerabilities are high and rising

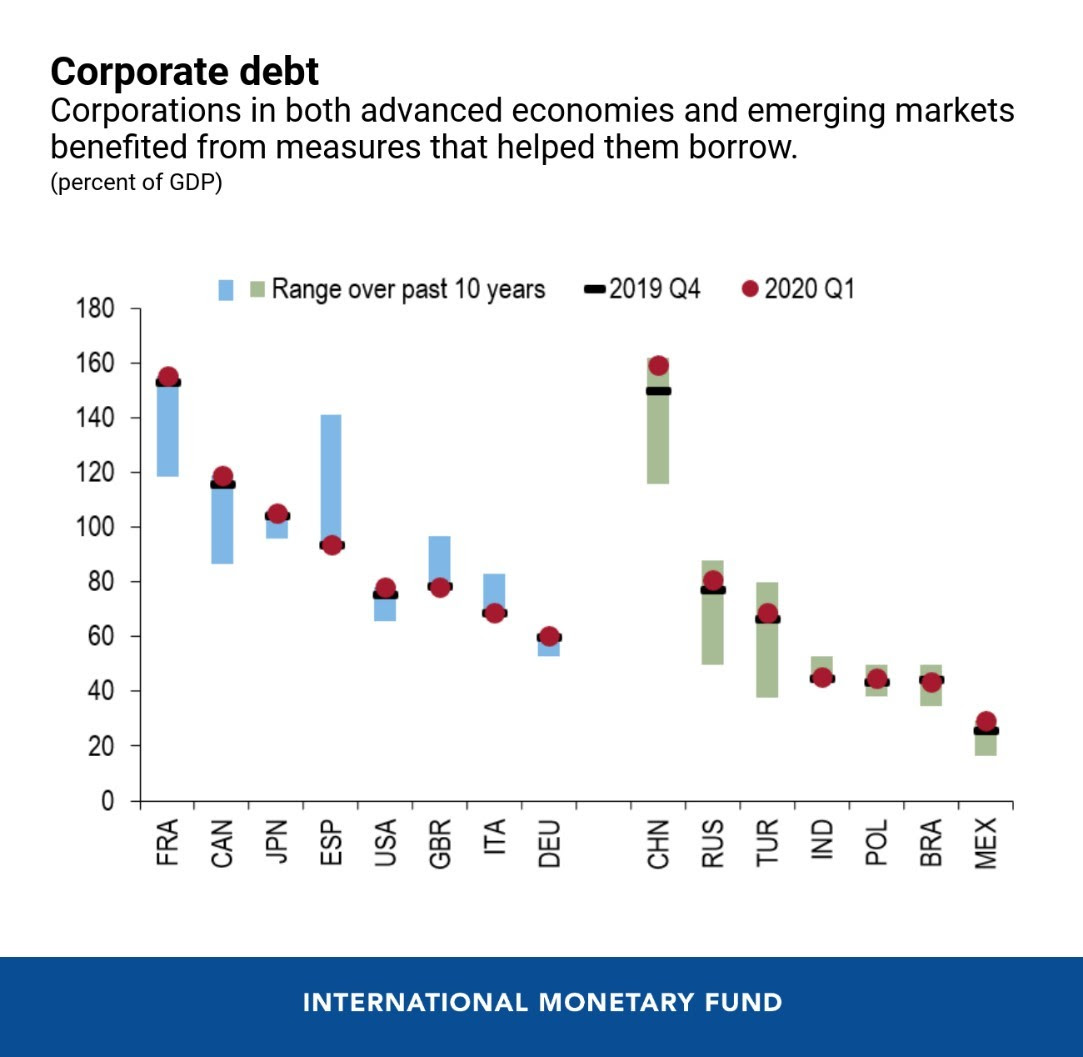

Policy measures have allowed firms to cope with cash shortages experienced during economic shutdowns by taking on more debt. While this additional borrowing has helped avoid a wave of bankruptcies at the early stages of the crisis, it has also led to further rise in corporate debt burdens. But many of these firms already had very high levels of debt before the crisis, and now indebtedness in some sectors is reaching new highs. This means that solvency risks may have shifted into the future and renewed liquidity pressures could easily morph into insolvencies, especially if the recovery is delayed.

Banks’ resilience will be tested

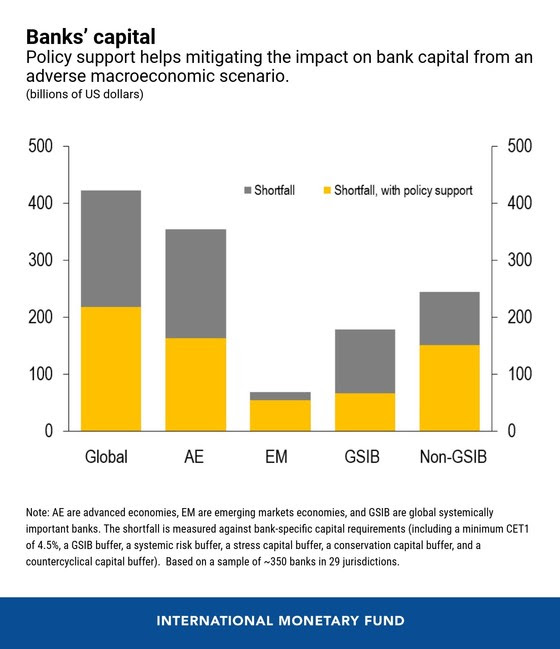

The banking sector entered the COVID-19 crisis with stronger capital and liquidity buffers than at the beginning of the Global Financial Crisis. The success of reforms undertaken over the past decade has allowed them to be part of the solution rather than part of the problem so far, as banks continued providing credit to businesses and households during the pandemic. Nonetheless, in an adverse macroeconomic scenario, our analysis shows that some banking systems may suffer significant capital shortfalls because a large number of firms and households will not be able to repay their loans (even after accounting for the currently deployed policy measures) and profitability falters.

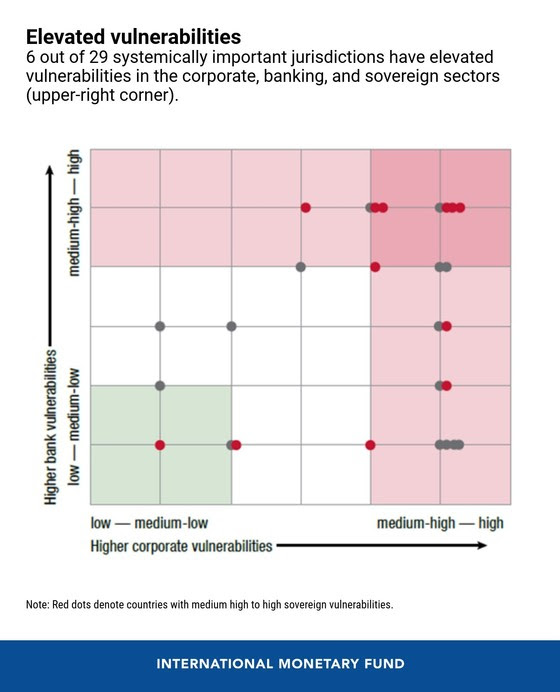

More interconnected

The unprecedented scale of the pandemic crisis means that vulnerabilities have risen across multiple sectors. The governments had to run larger fiscal deficits to be able to provide support to firms and households. At the same time, banks and other financial institutions had to purchase more government bonds. Going forward, the fiscal capacity to provide further support may become more limited.

In addition, nonbank financial institutions, like asset managers and insurance companies, now play an important role in credit markets, including in its riskier segments. They have managed to cope with the pandemic-induced market turmoil thanks to policy support, but fragilities, such as liquidity mismatches and exposure to credit risk, remain high. At some point, fragilities could spread through the entire financial system.

Emerging markets’ financing challenges

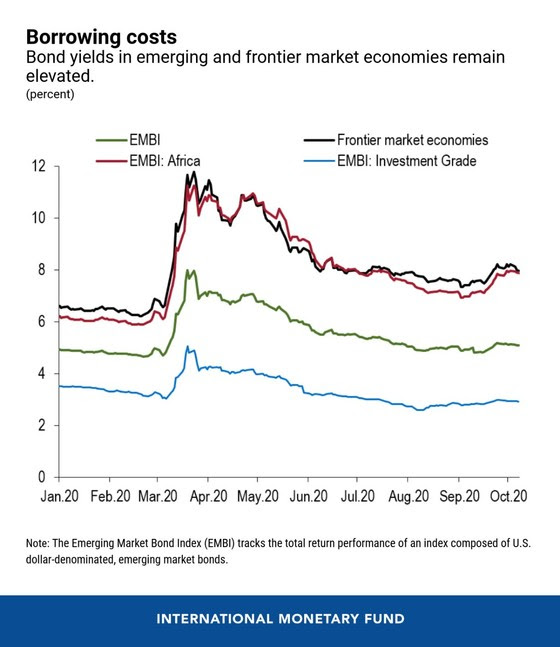

Emerging markets and low-income countries face their own set of financing challenges. The global easing of financial conditions has generally improved the outlook for portfolio flows to most emerging markets and stabilized their access to financing. However, some low-income countries are so heavily indebted that they face imminent debt distress, because of borrowing costs at prohibitive levels.

Policies for the recovery and beyond

Looking ahead, policymakers should carefully sequence their response to build a safe bridge to recovery. They will face stark tradeoffs between short-term support and medium-term macro-financial stability risks, and they need to closely monitor any potential unintended consequences of their unprecedented support.

As economies reopen, monetary policy should remain accommodative to sustain the recovery. Liquidity support should also be maintained, even if its pricing should be gradually adjusted to incentivize the return to normal market funding. A robust framework for debt restructuring will be critical to reduce debt overhangs and resolve nonviable firms. Multilateral support to low-income countries with financing difficulties should be extended.

After the pandemic is under control, a robust financial reform agenda could focus on rebuilding bank capital buffers, strengthening the regulatory framework for nonbank financial institutions, and on stepping up prudential supervision to contain excessive risk-taking in a “lower for longer” interest-rate environment.

Credit: The Post A Bridge to Economic Recovery: Be Aware of Financial Stability Risks first appeared in the IMF Blog on 13th October, 2020.