In the second part of two articles, I will be talking about the global effects of aggressive monetary policy, in Africa, the EU, and the United States. In addition, I highlight a few analyst recommendations and the potential repercussions of those recommendations.

You can read the first part of this article here on Gifted Analysts.

Unrealistic U.S Fed Monetary Policy Objectives as a Chokehold on The Global Economy

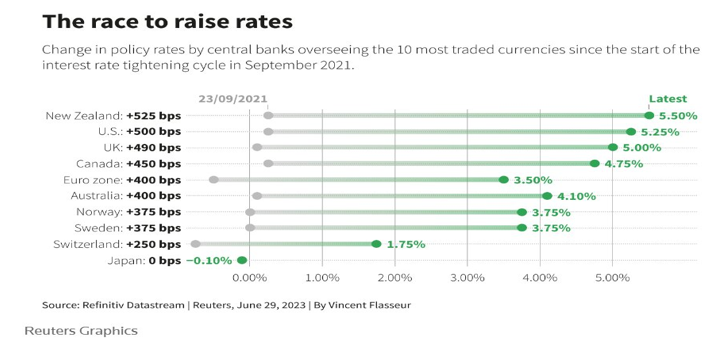

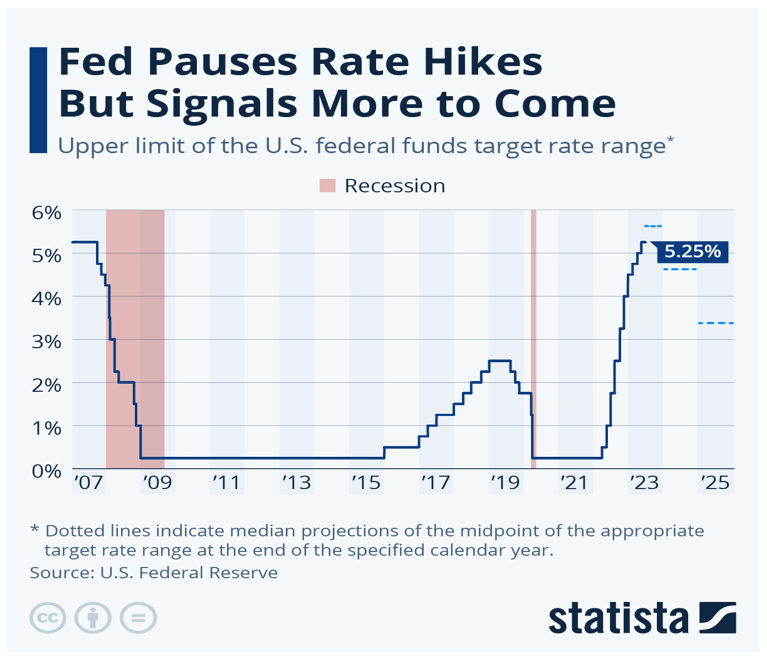

In an attempt to achieve its preferred target inflation rate, the U.S. Fed has pursued a hawkish policy of short-term interest rate increases, bringing the Federal Funds Rate (which is a guide for overnight lending among U.S. banks) from 0.25% in March 2022 to 5.25% as of June 2023. This has increased the cost of capital for all kinds of financial assets and loans and has led to an increase in the demand for dollar-denominated assets such as U.S. Government bonds, thereby reducing the supply of dollars in the U.S. economy and the global economy as a whole.

Scarcity of a foreign currency that is primarily used for global trade and a run to the safety of U.S. Government bonds does not bode well for economic growth in emerging economies that have large foreign-denominated debt, countries that rely on remittances of foreign currency from diaspora communities, or countries with low foreign reserves.

Many low-income developing countries are today either already in or near debt distress. Ghana and Sri Lanka defaulted on their external debt in 2022, two years after Zambia did. Pakistan and Egypt are on the verge of a default. On June 30, Pakistan secured a tentative $3bn funding deal with the International Monetary Fund (IMF), promising it potential, short-term relief. Global public debt levels remain high – at 92 percent of gross domestic product (GDP) at the end of 2022 – despite falling from the record levels seen during the COVID-19 pandemic, when they touched 100 percent of GDP at the end of 2020.

Low foreign reserve balances prevented Sri Lanka from importing foreign products and services, and in May 2022, it was unable to make interest payments on its foreign debt. When foreign currency shortages became a significant issue for Sri Lanka in early 2021, its government attempted to address the problem by prohibiting imports of chemical fertilizers.

The Sri Lankan government instructed producers to use organic fertilizers produced locally. This resulted in extensive crop failures. Sri Lanka had to import additional food supplies from abroad, which exacerbated its foreign currency shortage.

The aggressive monetary policy of the Federal Reserve and other major economic powers has caused significant difficulties for the international economy and nowhere is it more pronounced than in Africa, where the continent has become a causality to the environment of high-interest rates fostered by the Fed.

U.S monetary policy has led to a weakening of the currencies of a lot of African countries, this is as a result on the pressures are more expensive dollar has on imports and trade settlements, Christopher Adam, professor of development economics at the University of Oxford said in a Forbes article that, “The proximate reason for a dollar shortage is the pressure on the balance of payments as a result of the so-called rolling crisis impacting many African economies,”. The crises stem from pandemic-related supply-chain disruptions and the subsequent global recession that resulted in sharply lower prices for Africa’s key exports and a halt in tourism, a key source of dollar inflows, he added.

“The resurgence of global inflation and the resulting tight monetary policy has seen prices for key imports and the cost of foreign borrowing rise sharply,” Adam says. “On top of this, Russia’s invasion of Ukraine saw prices for oil, food and fertilizer spike.”

In Nigeria, for instance, fertilizer and energy price increases crippled the economy. In May 2023, according to data from the Nigerian Bureau of Statistics (NBS), the headline inflation rate increased to 22.41% from May 2022’s headline inflation rate of 17.71%. According to the report for May 2023, food inflation (excluding alcohol) accounted for 11.61 per cent of inflation.

Local importers and non-resident investors typically require hard currencies–mainly U.S. dollars–to respectively pay suppliers or repatriate investment proceeds. In countries with currency controls, the dollars come from central banks, which obtain them from exports, overseas remittances, overseas loans, and tourism.

But several months of dollar outflows from the economies of some of Africa’s top investment destinations like Egypt, Nigeria, and Kenya, with little or no boost to exports have put a strain on central-bank foreign exchange reserves and left local currencies under immense pressure. The Egyptian pound has lost 20% of its value against the dollar this year while Nigeria’s naira is down 39% since June 14, when the central bank removed the peg against the greenback and unified multiple foreign-exchange rates. The rising costs of living as imports become more expensive in local-currency terms has increased operating expenses for companies, slowed economic growth and discouraged fresh investment. Whether a country maintains currency controls or not, the result is much the same.

As a result of the Fed’s decision to increase interest rates on short-term borrowings, dollar-denominated assets have become more attractive, and investors have favored them over other global investment opportunities. As a result, central governments across Africa have been unable to satisfy the funding requirements necessary to stimulate their economies.

An analyst at one of the major financial houses in Nigeria was interviewed in the same Forbes article, and commented on the situation saying, “If local rates at 9% are not attractive to domestic investors given high inflation rate, there is no reason foreign investors should be attracted to it,”, commenting on the relatively low yields of Nigerian bonds compared with what is available in the U.S.

US Treasury bonds, which are considered to be the safest investment in the world by most investors, combined with the current risk-off sentiment and economic uncertainty in the world, as well as some fragile African economies battling high inflation and economic stagnation, have investors demanding higher investment returns for investing in African sovereign debt or shifting capital to dollar-denominated assets that can yield more reliable returns. Yields on some US Treasury bonds are currently have yields up to 5%.

It would seem to the average observer that the economies of Europe’s industrial nations would be able to withstand global economic contraction and rely sufficiently on their export-based economies, but this has not been the case. Inflation in the EU surpassed 10% by the end of 2022, primarily because of the sanctions imposed on Russian oil and gas products because of the special military operation in Ukraine and subsequent high energy bills that plagued companies and households. To restrict the circulation of too much money and achieve equilibrium between supply and demand, the European Central Bank (ECB) has adopted the same aggressive policy as its counterpart across the Atlantic and shifted from negative to high-interest rates policy.

This has caused significant disruption and precipitated a recession in the European Union. Although inflation in the EU has decreased to 6.1% in May 2023, it is improbable that the ECB will be able achieve their unrealistic goals of ultra-low single-digit inflation due to high energy prices and a change in the dynamics of global supply chains.

The dynamics in the EU are not so dissimilar to what is going on in the U.K economy, inflation is extremely high and peaked above 10% in February 2023; to bring inflation to acceptable levels, the Bank of England (BoE) has also adopted an aggressive high-interest rate policy. This has slowed the economy of the United Kingdom and caused shortages and minimal economic growth. The situation is so dire that a Bank of England economist advised the British to “accept” that they are impoverished. Inflation in the United Kingdom at 8.7% in May 2023 is still well above the preferred target, and further tightening by monetary policymakers will only result in economic contraction and trade disruption.

The painful repercussions of tight monetary policy have not been spared on the U.S. economy. In this article I try to explain the Fed’s actions to combat inflation, but the blowback has not been as easy on the U.S. economy as it may seem.

Due to high short-term interest rates, the United States Government pays record amounts of interest on debt. Things will only get worse. The US Treasury Department paid a record $213 billion in interest on the national debt in the fourth quarter of 2022, an increase of $63 billion from the same period the previous year. Even if the Federal Reserve reduces or stops raising interest rates this year, as many economists anticipate, the cost of borrowing will continue to rise. This is because, as existing debt matures, the government issues new debt at the higher interest rates.

As of June 2023, United States government is now paying $1.3 billion in interest on its debt every day, by 2032, interest payments will rise to over $3 billion daily. According to estimates by the Peter G. Peterson Foundation, a nonpartisan organization that raises awareness of America’s long-term fiscal challenges, the higher interest rates could increase the net interest cost on the national debt to about $9 trillion over the next decade. Interest rates will increase from 2.7 per cent of GDP in the fiscal year 2024 to 3.7 per cent of GDP in the fiscal year 2033.

The high-interest rate environment has also caused financial distress for some U.S. banks because of bank runs spurred on by insufficient liquidity available for customer withdrawals and significant investments in previously issued government bonds that had lost value due to the interest rate increase cycle.

To end the potential contagion and loss of confidence in the U.S. banking system, the Federal Reserve reversed some of the monetary tightening policies it had implemented to combat inflation, increased its asset balances, and provided much-needed liquidity to the banking sector.

This raises the question of whether the Federal Reserve will abandon its current tightening policy and unrealistic monetary objectives the next time the resilience of the U.S. economy and financial systems is seriously threatened.

The last time interest rates were this high was between 2007 and 2009, during the Global Financial Crisis, which caused a severe recession with high unemployment and economic stagnation in the United States. In a post-pandemic world, considering the shift away from a zero-interest rate policy environment and a massive economic stimulus package, a contractionary monetary policy of this magnitude will not produce the intended results and will only harm the global economy.

The damage inflicted by the Fed’s strict monetary policy has reignited efforts to de-dollarize international trade and commerce. Some fiscal and monetary policymakers in the United States recognize that the availability and value of the dollar have made international trade more difficult because of aggressive monetary policy.

In South America, Brazil and Argentina are considering settling vast amounts of trade in a currency other than the U.S. dollar to make trade between them and their neighboring South American countries more seamless. In Africa, discussions regarding the establishment of a common currency to settle intracontinental or subregional trade are gathering momentum. The petrodollar is increasingly under threat as China and a number powerful Middle Eastern oil nation sign agreements to settle oil and gas purchases in Yuan.

Most discussions and actual implementation of the use of other currencies besides the U.S. dollar may not lead to a significant change in the use of the dollar for international trade immediately, but without pragmatic actions by the U.S Fed, it will only encourage de-dollarization policies and diminish the U.S. dollar’s importance as the currency of choice (or circumstance) for foreign exchange reserves and settlement of international trade.

Let there be no misunderstanding about the connection between the Fed’s monetary policy objectives and their impact on the global economy. Pursuing tightening of monetary policy to achieve unrealistic and arbitrary inflation rate objectives in the United States by the U.S. Fed will only add pressure on other central banks across the globe to adopt similar tactics which eventually only leads to more financial instability and adds pressure on international trade and the global economy.

What Should The U.S Fed and Other Central Banks do in a Post-Pandemic World?

The single most important thing the U.S. Federal Reserve can do is acknowledge the inevitable: that decades of Zero-Interest Rate Policy (ZIRP) and Quantitative Easing (QE) have resulted in structural inflation that cannot be totally reversed by hiking interest rates as swiftly as possible. To change its monetary policy strategy, the U.S. Federal Reserve must readjust its inflation objective to a slightly higher range than the 2% to 2.5% inflation rate range, which has proven to be untenable in the post-pandemic era.

Setting a new preferred inflation target by the Fed, along with other central banks from large economies, and with the cooperation of global and regional financial institutions, will lead to a change in monetary policy that will accommodate and sustain economic growth and viability despite a higher inflation tolerance.

A change in monetary policy objective to a higher targeted inflation rate range will reverberate throughout the global financial system and result in the reclassification and revaluation of all financial assets, including sovereign and corporate bonds, stocks, commodities, real estate, and even private equity. This will set in motion an acceptance of the new economic reality of higher inflation, which will lead to the adoption of a higher cost of capital and a higher required rate of return on investments across all asset classes.

One might assume that a high inflation rate environment and a change in investor expectations for returns on capital will result in significant re-rating of financial assets and birth major volatility in financial markets and for financial institutions, but with the current high-interest rate environment over the past two years, monetary policymakers will simply be providing guidance after the fact on how they intend to build and sustain economic prosperity based on the current economic realities.

Most financial assets have begun to stabilize and trade very close to fair value despite much stricter Weighted Average Cost of Capital (WACC), Equity Risk Premiums (ERP) and Risk-free rates.

The above viewpoint can be deduced from a blogpost by Aswath Damodaran a Professor of Finance at the Stern School of Business at New York University, where he teaches corporate finance and equity valuation and is popularly referred to as the Dean of Valuation. He remarked that while it was impressive that the U.S. Federal Reserve was able to reduce inflation to 3% as of June 2023, it would be much more difficult to get it to 2%, describing such efforts as “trench warfare” with the possibility of macroeconomic and inflationary shocks from higher energy prices or regional uncertainties.

In addition, he stated that the U.S. economy may enter a “slow-motion recession” as consumers capitulate to a rising interest rate environment. He stated that he expects interest rates to remain high as long as inflation remains above the Fed’s 2% target range (implying that he does not expect inflation to fall within the Fed’s target range any time soon) and that market participants will have to learn to live (and invest) with higher long-term treasury rates, which appears to be stable between 3.5% and 4%.

He concluded by discussing equity valuations, stating that “stocks look fairly valued, given estimated earnings and cash flows, and assuming that long term rates have found their steady state.”

Changing monetary policy to accommodate a new inflation target range of 3% to 4% for example as some analysts have suggested, will mean that inflation in the United States as of June 2023 is well within the preferred range of the Fed. If the Federal Reserve was to pivot from its existing inflation target rate to a slightly higher new target rate, it will send a signal that a more aggressive monetary policy tightening will not be required in the future to achieve the desired inflation rate target, allowing market participants to adjust their expectations accordingly, in short, there might not be significant depreciation in the valuations of some financial assets.

We must remember that the ultimate goal of monetary policy is to make decisions that will allow for sustainable long-term economic growth in relation to how the money supply is controlled and managed, and most of the time, the sustainability and dependability of the Fed’s decision-making must be such that it does not create a vicious chokehold on economic growth while also reflecting the reality of financial and monetary activities.