Please refer to the previous article on using Co-integration test and Fully Modified Ordinary Least Squares (FMOLS) here.

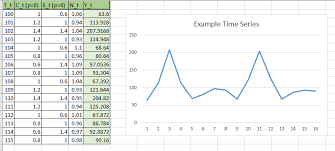

The characteristics of time series data make them not suitable for OLS directly, as such, the variables must be tested for stationarity that is, make their mean and variance equal in case they are not. Usually, a variable that is trending tends to have its mean and variance not equal (non-stationary). As such, the Augmented Dickey-Fuller test (ADF) is used to test for stationarity and make the variables to be stationary.

It is based on the result of the stationarity test, that we will know which method of analysis to go for. The following constitute the methods of analysis based on the stationarity test:

- If all the variables are stationary at level, it means the mean and variance are equal without doing anything to them. In this case, the researcher can proceed to using the normal Ordinary Least Squares (OLS) to estimate the model and the result will be valid.

- If some of the variables are stationary at level I(0) and some are stationary at first difference I(1), then the researcher will have to proceed to using ARDL bounds test to estimate the model.

- If all the variables are stationary at first difference I(1), then Fully Modified Ordinary Least Square (FMOLS) is the appropriate method of analysis. You can download the PDF where FMOLS was explained here.

This article therefore explains the step by step methods of using ARDL bounds test to estimate the model if some of the variables are stationary at level I(0) while some are stationary at first difference I(1).

Testing for Stationarity

The model used for this is one in which Real GDP is a function of Savings Rate (SR), Prime Lending Rate (PLR) and Monetary Policy Rate (MPR). We can as such name is at the “Impact of Interest Rate on Economic Growth”. While SR, PLR and MPR are used as proxy to measure interest rate, real GDP is used as the measure of economic growth.

To test for stationarity;

- Double Click on the variable

- Click on “View” and the illustration below will pop up

- Click on “Unit Root Test” and Check the button of “Trend and Intercept”

- Click on “OK” and the result will show as below:

From the result above, it can be seen that the Null hypothesis states that MPR has a unit root, which means that MPR is non stationary. The Probability value (P-value) of 0.1020 shows that we do not reject the null hypothesis since it is greater than all the levels of significance (1%, 5% and 10%). Since we need to make this stationary, we have to re-estimate MPR at first difference.

- Click on “View” again and then unit root test. From there, click on “first difference” this time around instead of “level”

- The result below will show:

From the result above, it can be seen that when we tested that stationarity of MPR at first difference, the P-value became 0.0000 which is less than all the levels of significance. Here, we can then reject our null hypothesis and say that MPR is stationary at first difference.

Now do the same thing for SR, PLR and RGDP. Before doing the same for RGDP however, you should log it. Two reasons can warrant you to log:

- When the variable is not stationary at level and at first difference.

- When you do not want the coefficients of your results to be large.

The command for logging a variable in E-views is genr lrgdp=log(rgdp). This explains that we are telling E-views to generate a variable named “lrgdp” and it should help us log the variable.

If you therefore do the same process of stationarity to the rest of the variables, you will notice that only PLR is stationary at level while the rest are stationary at first difference.

This will therefore make us estimate our model by making use of the Auto Regressive Distributive Lag (ARDL) bounds test.

Performing ARDL Bounds Test

To perform the bounds test, you should follow the steps below:

- Hold the CTRL key and click on all the variables (let your dependent variable come first). Right click and open as an equation

- The table below will show

- Click on the drop down button that shows LS and click the last method that is ARDL

- The result below will be displayed

- Change the “Constant Level” to “Linear Trend” and click on OK. The result below will be displayed

- You do not need this result. As such, click on View – Coefficient Diagnostics – Bounds Test, as shown below:

- The result below will be displayed

From the result, there are some decision rules to follow before one can know the next method of analysis to follow. They are:

- If the value of the F-statistic is greater than the upper bound (I1 Bound) of the chosen level of significance (in this case 5%), proceed to estimating co-integration and long run form.

- If the value of F-statistics is less than the lower bound (I0 Bound) of the chosen level of significance, proceed to estimating ARDL at first difference. Here, you click on “Estimate” and add D in front of each of the variables [for example: D(LRGDP) D(PLR) D(SR) D(MPR)] and then click OK.

- If the value of the F-statistics is in between the upper and lower bound of the chosen level of significance, then we go back to adjusting our lag to make sure the result is either greater than the upper bound or less than the lower bound.

- In our case, the value of our F-statistics is 10.65974 and this is greater than the upper bound of our chosen level of significance (5.07). therefore, we proceed to estimating the short run and long run result of our model which is the same as the co-integration and long run form.

Based on the characteristics of our variables therefore, the appropriate method of analysis is not OLS, neither is it FMOLS but co-integration and long run form. Therefore, we have to run it.

Estimating the Short Run and Long Run relationship Among the Variables of Study

- From the ARDL bounds test result displayed, click on View- Coefficient Diagnostics- Co-integration and long run form.

- The result below will be displayed:

The first result is the short run result. If you scroll down, you will see the long run result. The long run result shows how the variables will behave in the long run while the short run result shows how the variables will behave when adjusted by 1 year, 2 years and 3 years.

You can therefore interpret accordingly.

Conclusion

As it was explained, using OLS to estimate time series data will give wrong results because the Observational dependency, non- equal mean and variance as well as trending characteristics of the time series variables make them violate the Classical Linear Regression Model (CLRM) assumptions. As such, it is necessary to perform some pre-estimation tests as it is the result of these tests that will determine the appropriate methods of analysis.

Please provide your feedback and questions in the comment section and should you need data backed research for your business and project needs, please send a mail to info@giftedanalysts.com

Hi

Your illustration was explicit and straight to the point. Just what I needed to put me through in an analysis I am currently doing.

However, I noticed you didn’t test for stability of the model. Which stability test is most appropriate for the ardl? Thanks

Hi Kenechukwu,

You can use the Ramsey RESET test for the stability of the model. Just go to coefficient diagnostics just the way we did for the other tests.

The best academic article thus far, literally I did my assignment with you guys, also because your illustrations were perfect.

Thank you for providing practical insights on applying the ARDL Bond Test procedure in EViews.