Overview

As part of its development activities to promote financial inclusion and create new jobs while supporting the Micro, Small and Medium Enterprises (MSMEs) in Nigeria, the Central Bank of Nigeria (CBN) introduces interventions and sustain the existing ones in order to give a helping hand towards economic diversification and sustained development. As such, a total number of six agricultural schemes have been introduced and continued by the CBN since 2015 (some of which have been in existence as far back as 1978 when the Agricultural Credit Guarantee Scheme was introduced) so as to facilitate the flow of agricultural credit to farmers in order to improve the food self sufficiency of the country as well as create jobs and support the MSMEs.

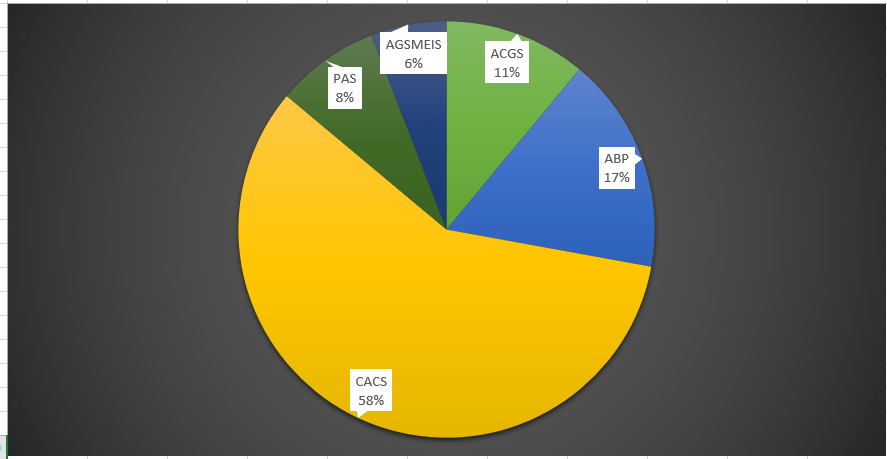

In 2018, a total amount of N320.39 billion was injected into the agricultural sector as part of the CBN intervention to create a diversified economy backed up by sustainable development as well as create employment opportunities. Since the inception of all the agricultural schemes however, a total sum of N1.04 trillion has been injected by the CBN (through 6 agricultural initiatives) into the agricultural sector of which only 42% has been repaid by the beneficiaries since inception valued at N436.66 billion. The aim of this article therefore is to give a break-down of each of the schemes, their respective values and give a brief shortcomings of all the scheme over the periods of study.

The Agricultural Credit Guarantee Scheme (ACGS)

Owned by both the Federal Government of Nigeria (60% ownership) and the CBN (40%) ownership, but fully managed by the CBN in order to stimulate the total agricultural production for both domestic consumption and export, the values of loans under the ACGSF has increased significantly by 1113% from N361.44 million in year 2000 to N4.38 billion in 2018. The general purpose of which is to encourage banks to lend to those engaged in all agricultural value chain activities.

As at December 2018, a total number of 30,612 individuals, co-operatives, and companies were given loans under the ACGS valued at N4.38 billion representing a 25% decrease from N5.85 billion granted to 41,341 beneficiaries in 2017.

Cumulatively and since the inception of the scheme in 1977, a look into the 2018 financial report of the CBN shows that a total number of 1.3 million citizens have benefited from the scheme valued at N114.24 billion from 1977 to 2018. In terms of repayment however, a total amount of N86.94 billion has been repaid from 1977 to 2018 for 889,268 loans.

A further breakdown of the volumes showed that the individuals constitute the largest proportion of the beneficiaries of the loan as N4.26 billion was granted to 29,796 individuals (97.3% of the beneficiaries). The microfinance banks are the largest participants in giving out these loans to the beneficiaries as N4.36 billion to 99.9% of the beneficiaries while the commercial banks gave out N0.02 billion to the remaining 18 beneficiaries.

The Anchor Borrowers’ Programme (ABP)

Established in 2015, a cumulative amount of N174.48 billion has been disbursed under the programme with 902,518 farmers as the beneficiaries and 935,925 hectares of land being cultivated. According to the CBN, a total number of 11.23 million direct and indirect jobs had been created under the ABP since its inception.

Through 19 participating financial institutions in 2018, a total amount of N118.96 billion was disbursed to 646,313 smallholder farmers in the 36 states of the federation. In terms of cultivation, 640,422 hectares of land were cultivated by the farmers under the scheme in 2018 and the Northern region of the country had the largest beneficiaries (89.9% of the total beneficiaries).

The Commercial Agricultural Credit Scheme (CACS)

The CACS was established in 2009 to provide fund to those engaged in commercial agriculture projects along the value chains of production, processing, marketing, storage and supply of inputs. According to the CBN, the sum of N603.29 had been disbursed to 589 projects under the scheme with cumulative repayments of N328.31 billion for 547 projects, representing steady repayments for 263 projects and full repayments for 284 projects since its inception in 2009.

In 2018, the sum of N79.71 billion was released to 12 banks in respect of 40 projects which comprises of 35 private projects and 5 state government-sponsored projects. This therefore indicates 23.1 and 31.7 per cent decrease in the volume and value of loans disbursed, respectively, when compared with N116.75 billion released to 52 projects in 2017. In terms of value chain activities, the production value chain had 18 projects under the scheme, 16 projects were executed under the processing value chain and valued at N24.74 billion. However, while there was no application for marketing value chain, N9 billion was disbursed to 3 projects under the storage value chain with N10 billion disbursed to 3 projects under the input supplies value chain.

The Paddy Aggregation Scheme (PAS)

In order to increase rice million activities in the country so as to reduce rice production losses, PAS was approved in 2017 as a working capital facility under the CACS. This is majorly for the integrated rice millers in the country as well as to enable medium and large scale rice distributors to purchase locally milled rice from integrated rice millers across the country.

By 2018, the sum of N83.4 billion had been released to 14 integrated rice millers (inclusive of Wacot Rice and Hillcrest Agro Allied Industries) in the country for a tenor of 2 years at 5% rate of interest.

The Agri-Business Small and Medium Enterprises Investment Scheme (AGSMEIS)

The AGSMEIS was established in 2017 to support the efforts of the Federal Government at promoting agricultural businesses in the generation of employment and ensure sustainable economic development. This is being funded from 5% of the Profit After Tax of 41 commercial banks in Nigeria and by 2017, a total amount of N26.8 billion was received from the commercial banks.

By 2018, this amount increased by 26.35% to N33.94 billion which was for on-lending to Micro, Small and Medium Enterprises (MSMEs) in the country.

The Accelerated Agriculture Development Scheme (AADS)

Launched by the CBN in 2017 and with an annual target of engaging at least 370,000 youth farmers across the Nigerian agricultural value chain, the AADS provides credit of 9% per annum with maximum tenor of 5 years, depending on the gestation period of the enterprise. The state government also contribute to the scheme by providing logistics support such as land development, infrastructure, farmer training and extension services.

Conclusion

In attempting to diversify the economy away from crude oil, create jobs and increase the food sufficiency of the country, then intervention in the agricultural sector is required. The CBN sees light in this and has therefore been an active stakeholder in ensuring all economic agents have a role towards the sustainable development and diversification process of the country. The apex financial institution has therefore been rolling out agricultural intervention programmes over the years to support both smallholder and commercial farmers in the country.

However, repayment of loans given to these farmers have been difficult due to the attitudes of most of them towards repayment as well as some of them not able to recoup their investment due to the bad storage facilities and inadequacy of quality road networks. This has therefore resulted in banks and agricultural investors being owed millions of naira by farmers across the country. In some instances, the banks even involve security agencies in debt collection. Therefore, there is the need to educate these farmers on loans and repayment due to the fact that most of them believe it is a national cake that they are entitled to, of which is not.