By Korede Ajogbeje, Oluwatosin Adeniyi, and Festus O. Egwaikhide

Introduction

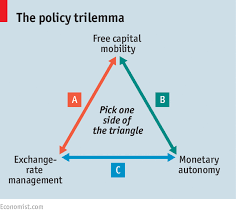

Macroeconomic policies are made in such a way that their implementation will drive home the policy targets. This points to the importance of policy making in economic management, as it serves as a middle ground between goals and targets. A number of countries would want to have it all at their fingertips, i.e., to possess as much power as possible to have an overall policy control so as to drive economic variables. There are three core policy handles in macroeconomics and finance framework – the exchange rate system (ERS), monetary independence (MI) and capital mobility (CM) – all of which have their various impacts on economic variables. However, policy makers typically face a trilemma trade-off whereby they can take full control of only two of these three policies at a given time (Pilbeam, 2006). In light of existing literature, cross country and country specific studies alike have also proved this theory to be right (Prasad et al., 2003, Obsfield et al, 2004, 2010., Hsing, 2012). Thus, there is a trilemma problem as countries are

unable to take full control of these economic policies simultaneously.

The literature on the issue of the trilemma policy has attracted the attention of some economists, and most of the few extant studies are either panel analysis of regional scope or country specific in orientation. Previous studies have also produced divergent results as to the impacts of the trilemma indices on some macroeconomic aggregates (Aizenman et al., 2008; 2009; Hsing, 2012). Most of these studies related the trilemma policies with output volatility, growth and inflation volatility. This study deviates from the convention to study the impacts of these three policies on interest rate, which is an indicator of economic stability and at the same time a key determinant of investments. This falls in line with Hosny et al. (2015)

position that the trilemma policies explain a sizeable proportion of the movement in domestic interest rates.

In the specific case of Nigeria which has in its more recent history been under diverse forms of managed float exchange rate regimes, with her financial borders open and appreciable monetary policy independence, at least two pertinent questions ensue, namely: what has been the effect of these policy combinations on interest rate in Nigeria?; and does external reserve play any intermediate role in complementing Trilemma policies? This study therefore broadly examines the reactions of interest rate in the presence of exchange rate flexibility, monetary independence and capital mobility in Nigeria.

The rest of this study is organised as follows: section 2 presents the review of relevant literature, while the methodology is presented in section 3. Presentation and discussion of the findings are presented in section 4 while in section 5 conclusion is made and some policy implications are given.

Download the full PDF here: Policy Trilemma and Interest Rate Behaviour in Nigeria