The last yuletide and new year festivity were busy for me. I was in the office with my MD sorting out financial statements, P&L, cash flows, financial projections and repayment plan proposals that we were sending to a finance company in the abroad that is loaning us funds for our affordable housing project. By late January, we were done dotting the I’s and crossing the T’s. Though the exchange with the lenders was a bit stressful we were optimistic having done everything required to meet the terms and conditions of the loan, thanks to our lawyers who have done their part too. According to the set timeline, we were on course to get the first tranche of the fund by the end of March but alas! CORONA-VIRUS– it was declared a world pandemic on March 11. Though, the anxiety and uncertainties in the world financial system were existent long before March. Considering the Nigerian economy situation, and the terms of the loan, my MD had to pull the plug after making some consultations. It was a tense situation for us based on expectations and the work we had put in. However, it only seemed the right call to make that time. Looking back now, it would have been a disaster if we had gone ahead to access the fund before the lockdown started. Why?

First– Forex. Though from the onset (before the pandemic), we had planned to hedge a percentage of the loan in dollar against Naira, just in case of a naira free-fall. However, with the present exchange rate, repayment of the loan would have been a problem and hedging wouldn’t have worked looking at the margin of the devaluation of the Naira and also considering the terms of the loan. Secondly, about 60% of the fund to be collected is going into construction which means we won’t have been able to work on-site for one month due to the lockdown, and with growing cases in Nigeria, a second lockdown might be inevitable. Also, a number of equipment were to be shipped from China to Nigeria which definitely wouldn’t have been easy to get and would lag time, consequently bringing about incurring cost. Now how do I think the pandemic will impact the Nigeria Real Estate and Housing sector?

DECLINE IN FDI AND FOREIGN REMITTANCE

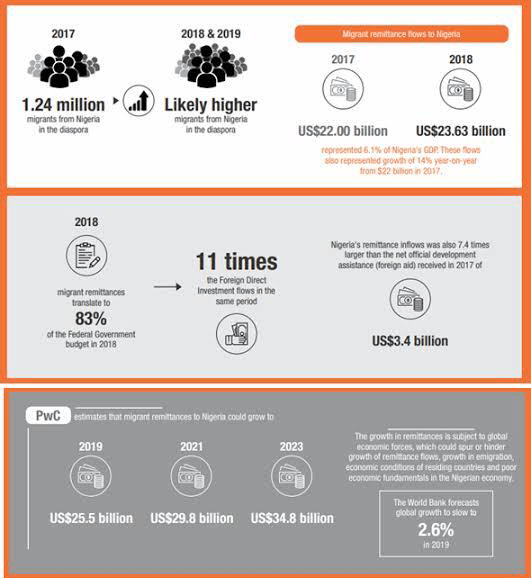

We are living in uncertain times. Nations, Multinational companies and individuals are adjusting to absorb the ongoing effect of the novel Corona Virus. Britain recently merged its Department for International Development (DfID) with the Foreign and Commonwealth office with the aim of managing the way countries are being helped. The effect of this is that the capital inflow into Africa will be limited. On the business side, there has been a significant declination of FDI in Nigeria in recent years. According to UNCTAD (United Nations Conference Trade and Development) 2019 world investment Report, FDI flows to Nigeria totalled USD 1.9billion in 2018 and showed a decline compared to the previous year (USD 3.5billion in 2017). Also, the recently released National Bureau of Statistic shows a decline of 16.72% in FDI in Q1 of this year compared to Q4 of 2019. Other inflows like the migrant remittance inflow which is equivalent to 83% of Nigeria budget in 2018 will also suffer a decline due to the pandemic. The impact of this is that a significant percentage of these inflows goes to the real sector of which construction and real estate have its fair share. SMEs in the construction sector will definitely feel this. Just like every other sector, the pandemic will slow down project financing and housing delivery.

DEVALUATION

One of the long-standing debates I know in investments is comparison of real estate to other asset class like stocks- how one is more beneficial than the other. That’s however not the purpose of this write-up. In a volatile economy like Nigeria where the inflation rate is high and also the continuous free fall of Naira against the dollar over the years, it might seem difficult to make a long term investment like real estate looking at the depreciation and devaluation of properties compared to other asset classes especially when considering liquidity. For instance, a property bought 10years ago in USD (when 1$ ~ #180) in a highbrow area in Lagos will have undergone depreciation within that span to now when (1$ ~#464). Of course, this isn’t only about real estate; it is generally the challenges of investment in our clime. That is, how devaluation, inflation have eaten deep into the economy. While the equity market can be repriced overnight, that can’t be said of real estate. It takes time. The brighter part is that the need and demand for housing in Nigeria is enormous, investors should bet more on affordable housing delivery- where the needs are, and less on the luxury type houses that litters the megacities. Also, strong cash-flow properties like student accommodation and other forms of rental-income investment are good options for investment. Experts should, however, be consulted before making an investment.

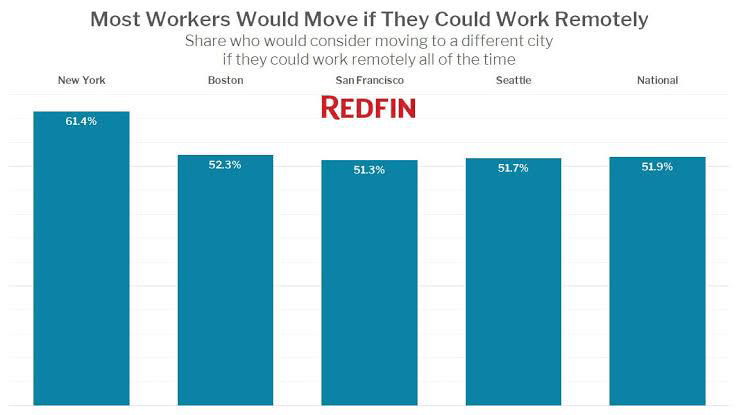

OFFICE SPACE/REMOTE WORKING/WFH – It’s no doubt that the commercial real estate is the hardest hit of all in the property sector during this pandemic. The hotels, retail space, convention centres were all shut down, except for the exempted essential spaces. As the economy begins to open worldwide without a vaccine to cure the virus yet, the impact of Covid-19 has made work-from-home (WFH) more attractive out of necessity. According to a survey conducted by Redfin in the United States, 1 in 4 newly remote employees expect to continue working from home post-COVID 19-which will lead to migration of workers from expensive -large cities to small cities. Tech giant companies like Facebook, Twitter, Google have already implemented WFH policies for their employees.

Bringing this down to the Nigeria context, will this really affect retail/office space? I don’t think so. Even if it will, not in the short term- maybe only some few changes. Why? Infrastructure. Power and Internet are the key tools needed to work from home. Electricity/power is one of the challenges affecting productivity in the country.

The spotlight on remote work as an alternative will gradually sip into the Nigeria work environment, the surge will not be sudden and swift. It’s good to note that some Nigerian companies have already implemented WFH policies for their staff. Red media Africa did, during the lockdown. Most workers now don’t seem to like the traditional office space and the pandemic has equally shown that they also don’t like working at home. This is the more reason co-working spaces will be more relevant- Individuals and companies will pay for what they need per time. Also, future cities will have to configure their infrastructure to optimize the essence of remote working.

Finally, as businesses resume opening around the world, and investors, world leaders, experts and business owners are figuring out what to do and not to do- iterating their way through; the unprecedented impact COVID-19 is having on the world now will forever change how we live, approach businesses and how we work. Just like how the popular Nigeria Artiste Wande Coal put it in his song “Again”. Things are never going to be the same again, never.

For questions, opinions, corrections and contributions, please drop them in the comment section. You can as well contact the writer on Twitter @victorttaiwo

Additionally, should you need data-backed research and analysis for your business or research needs, you can contact us by sending a mail to info@giftedanalysts.com