It is no news about the significant drop in the price of crude oil in the international market, no thanks to Russia and Saudi Arabia fighting for market share as a result of the negative impact of the coronavirus outbreak.

You can read on our previous article here where we explained why the CBN will devalue the Naira in 2020. All have been borne out of the fact that low crude oil price translates to lower revenue as it contributes over 70% of government revenue. It is also borne out of the fact that crude oil revenue is a major component of the external reserve and that Foreign Portfolio Investment is not certain due to the uncertain nature of the foreign investors based on Nigeria’s macroeconomic environment.

However, have you wondered by how much Nigeria will grow if oil price remains at this current rate? What is the impact of oil price of between $30 and $40 per barrel on real GDP growth rate of Nigeria in 2020 and going forward?

This is what this article tends to provide answers to through the use of Time series analysis and forecasting using Eviews.

Test for Stationarity

Unit root test is a pre-estimation test conducted to determine if a time series variable is stationary or not. It aids in ascertaining the order of integration of a variable which means how many times the variable has to be differenced to become stationary. Here, we adopted the Augmented Dickey Fuller test (ADF) to test for unit roots.

| VARIABLES | t-STATISTICS | P VALUE | STATIONARITY | REMARKS |

| RGDP | -1.608740 | 0.7696 | NS | |

| D(RGDP) | -2.759256 | 0.2207 | NS | |

| D(LRGDP) | -4.127058 | 0.0130** | S | I(1) |

| BRENT | -1.285539 | 0.6260 | NS | |

| D(BRENT) | -5.376772 | 0.0001*** | S | I(1) |

Source: Gifted Hands Research using E-views 9.0 (2020)

NS means Not Stationary, S means Stationary.

I (0) means integrated at level and I (1) means integrated of order 1.

Real GDP was not stationary at level and at first difference, hence it was logged. The log was also not stationary at level. And when stationarity was tested at first difference, it was significant. Hence real GDP is referred to as I(1) series. For Brent, the graph showed it is not trending, as such, unit root test was tested at level and intercept but it was not significant. When tested at first difference, it became significant.

The implication of this result is that using the Ordinary Least Square (OLS) method to estimate the parameters will lead to a spurious regression results since the series are non-stationary at level. This necessitated a test of co-integration to check if at all there is a long run relationship among the variables used in the model. A more accurate technique which will control for the non-stationary (at level) nature of those series was employed using Engle-Granger Single Equation Co-integration test for variables that are I (1) series.

Test for Co-Integration

Since at least one of the variables is significant, then the decision rule is that the null hypothesis is rejected. Since the pre-estimation tests show that the variables are non-stationary and are co-integrated, the best method of analysis is the Fully Modified Ordinary Least Squares (FMOLS).

Model Estimation (Co-Integrating Regression)

Interpretation of Results

The estimation shows an R-Square of 98% which explains that 98% of variations in real GDP is measured by the variations in the price of Brent. This explains that the model is a fit one.

Also, it shows that there is a significant positive relationship between the price of Brent and Nigeria’s real GDP. Based on the estimation, a $1 increase in the price of Brent will lead to 0.004558% increase in real GDP. Therefore, real GDP = 0.004558 (Brent)

Assuming price of Brent averages $30 in 2020, then the real GDP growth rate at the end of the year will be 0.004558 multiplied by 30 which is equal to c.0.14%. If non-oil GDP is modelled, then total real GDP growth rate will be the addition of the coefficient of Brent and the coefficient of non-oil GDP.

Below is a table which shows the forecasted real GDP growth rate of Nigeria in 2020 based on different price level of Brent between $30 and $50:

Why does Real GDP Growth Looks Small with Change in Price of Brent?

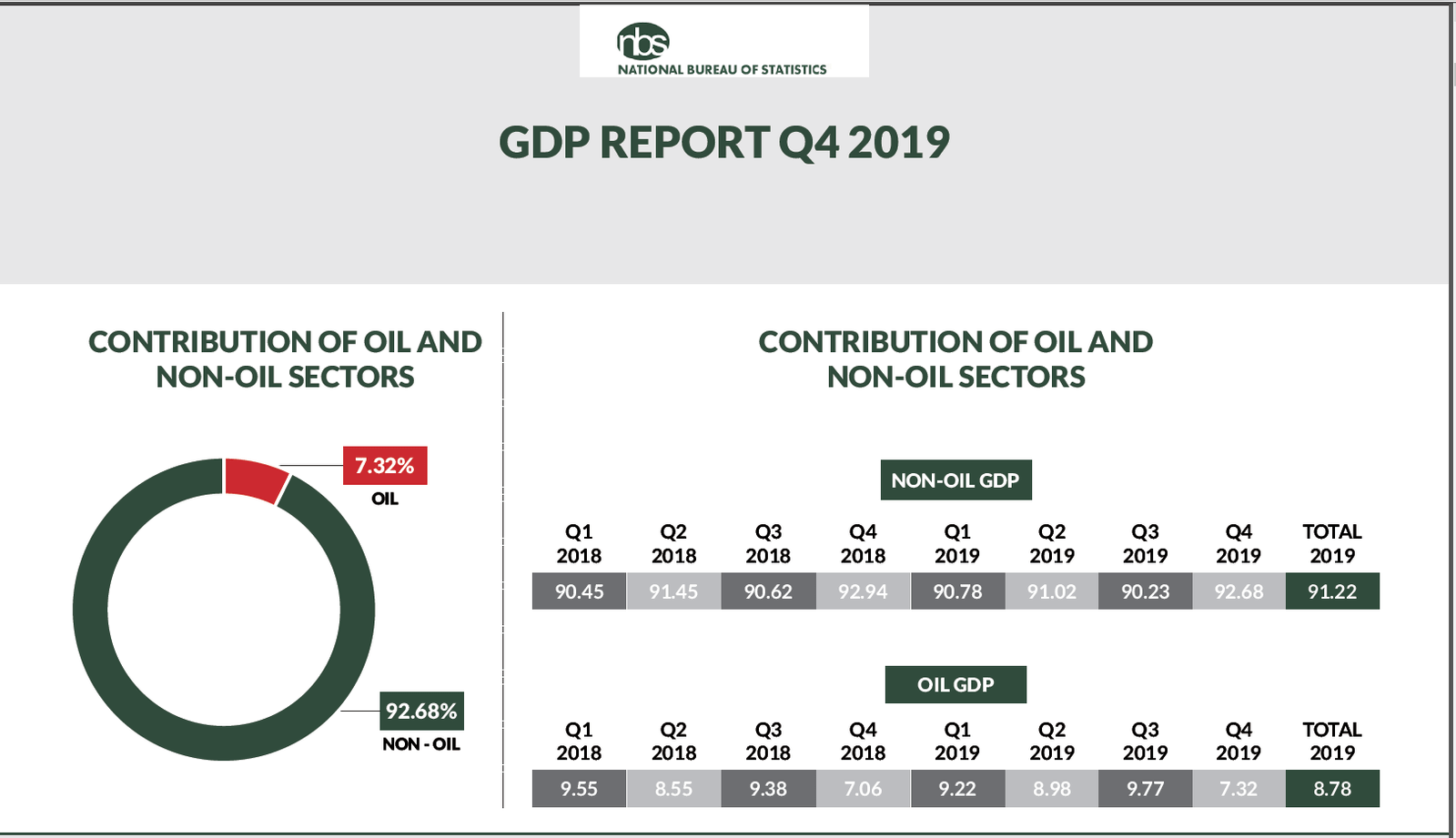

The reason is not far-fetched. Oil as a sector contributes less than 10% to Nigerian economy, while the non-oil sector contributes more than 90% to the GDP. For example, data obtained from the NBS shows that the oil sector contributed 8.78% to real GDP in full year 2019, 7.32% in Q4 2019 and 7.06% in Q4 2018. In Q3 2019, the oil sector contributed 9.77% to the real GDP of the Nigerian economy during the period.

This therefore is a confirmation of the estimation above that the oil sector contributing less than 10% to the economy is not enough to drag the economy backwards whenever there is a significant change in the price of Brent. This therefore explains why the change in the price of Brent by $1 leads to a less than 1% increase in real GDP.

What then Makes the Economy Experience Slow Growth?

To see the economy trend backwards, needs the non-oil sector to experience stagnant growth as it is the sector that contributes most to the economy. It is in the non-oil sector that we have the technology sector, financial services sector, hospitality, manufacturing sector and so on.

The major reason the non-oil sector contracts is due to the fact that it depends on the income generated from oil export to survive. In context, the oil sector contributes over 70% of dollars earned by the country. And since the manufacturing sector, service sector, etc (which are the non-oil sector) require the importation of raw materials used in production, they source for dollar in the foreign exchange market. Citizens also source for the same dollars for consumption. As a result of low revenue caused by low crude oil therefore, too much demand for dollars would be chasing fewer supplies. This leads to pressure on the external reserve and that is when we see the CBN rolling out measures (such as foreign exchange restriction, cap on PTA and BTA, etc). As a result, production and consumption is constrained. This will therefore lead to negative growth rate in the country.

Conclusion

From the foregoing, it can be concluded that the significant impact of crude oil price on Nigeria’s real GDP growth rate is an indirect one because the non-oil sector depends on it to function very well. And this is due to the low level of self sufficiency of the country. If the country is self-sufficient in the production of the basic and necessary goods and services, there will not be pressure to demand for dollars to import raw materials (which could be obtained in the country) or import finished goods (which can also be obtained in the country).

This writer can be contacted on twitter @K2ice_Jr

You can provide your comments in the space provided below. Additionally and should you need data backed research and analysis for your business or research needs, please send a mail to info@giftedanalysts.com